Government spending multiplier measures the impact of public expenditure on overall economic output, showing how each dollar spent can generate additional GDP. Understanding this multiplier helps you evaluate fiscal policies and their effectiveness in stimulating growth during economic downturns. Explore the rest of the article to learn how different factors influence the magnitude of the government spending multiplier.

Table of Comparison

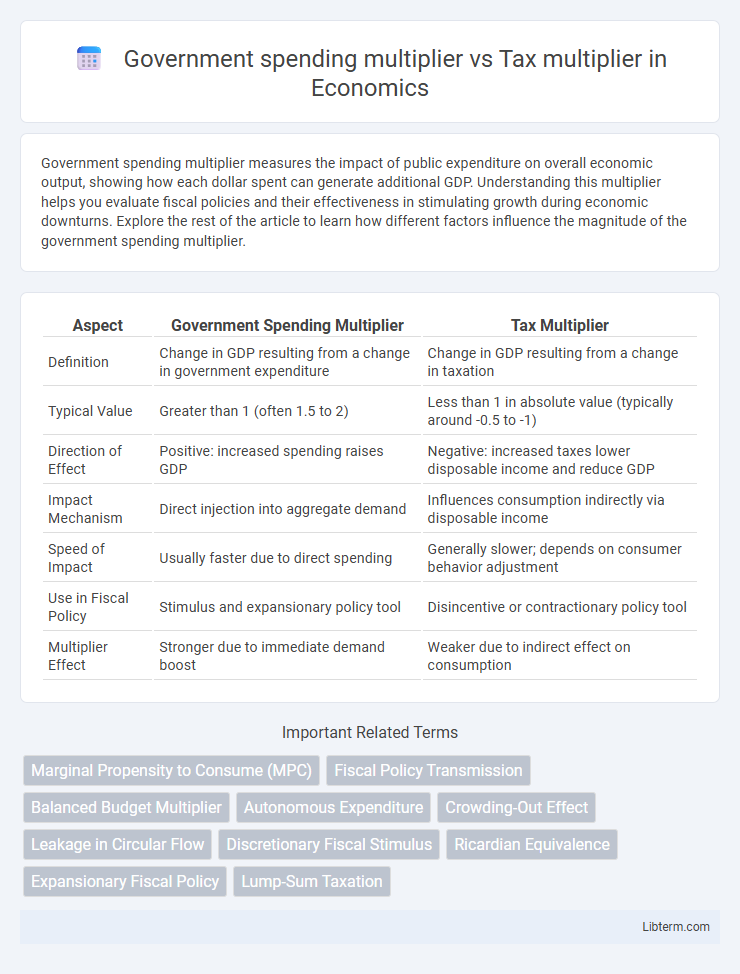

| Aspect | Government Spending Multiplier | Tax Multiplier |

|---|---|---|

| Definition | Change in GDP resulting from a change in government expenditure | Change in GDP resulting from a change in taxation |

| Typical Value | Greater than 1 (often 1.5 to 2) | Less than 1 in absolute value (typically around -0.5 to -1) |

| Direction of Effect | Positive: increased spending raises GDP | Negative: increased taxes lower disposable income and reduce GDP |

| Impact Mechanism | Direct injection into aggregate demand | Influences consumption indirectly via disposable income |

| Speed of Impact | Usually faster due to direct spending | Generally slower; depends on consumer behavior adjustment |

| Use in Fiscal Policy | Stimulus and expansionary policy tool | Disincentive or contractionary policy tool |

| Multiplier Effect | Stronger due to immediate demand boost | Weaker due to indirect effect on consumption |

Introduction to Fiscal Multipliers

Fiscal multipliers measure the impact of fiscal policy on economic output, with the government spending multiplier typically exceeding the tax multiplier. Government spending directly injects demand into the economy, often producing a multiplier effect greater than one, meaning each dollar spent generates more than a dollar in GDP. Tax multipliers are generally smaller because tax cuts increase disposable income but may lead to higher savings instead of immediate consumption.

Understanding the Government Spending Multiplier

The government spending multiplier measures the effect of increased public expenditure on overall economic output, typically resulting in a greater boost to GDP compared to tax multipliers. Unlike tax multipliers, which reflect changes in disposable income and consumer behavior, government spending injects direct demand into the economy, amplifying aggregate demand more immediately. Empirical studies often find the government spending multiplier to be greater than one during economic downturns, indicating that each dollar spent by the government generates more than one dollar in economic output.

Explaining the Tax Multiplier

The tax multiplier measures the change in aggregate demand resulting from a change in taxes, typically being smaller in absolute value compared to the government spending multiplier because reduced taxes increase disposable income but may not translate entirely into increased consumption. A decrease in taxes raises households' disposable income, leading to higher consumption depending on the marginal propensity to consume (MPC), thus stimulating economic output. Empirical estimates suggest the tax multiplier ranges between -0.5 and -1.5, indicating that a $1 decrease in taxes raises GDP by less than $1, reflecting partial pass-through of tax changes to aggregate demand.

Key Differences Between Spending and Tax Multipliers

Government spending multipliers directly inject funds into the economy, typically producing a larger immediate impact on GDP compared to tax multipliers, which influence disposable income and consumption indirectly. Spending multipliers often exceed one, reflecting the direct increase in aggregate demand, whereas tax multipliers are generally smaller since part of the tax cut might be saved rather than spent. The key difference lies in the transmission mechanism: spending multipliers increase demand through direct government outlays, while tax multipliers rely on households' propensity to consume out of the additional disposable income.

Factors Influencing Multiplier Size

The government spending multiplier and tax multiplier differ primarily in magnitude due to variations in marginal propensities to consume and save. Factors influencing multiplier size include consumer confidence, liquidity constraints, and the state of the economy, with multipliers generally larger during recessions when idle resources exist. Automatic stabilizers and the openness of the economy also affect the effectiveness of fiscal multipliers by altering the extent of induced consumption and leakage through imports.

Marginal Propensity to Consume (MPC) and Its Role

The government spending multiplier generally exceeds the tax multiplier because direct expenditure injects income immediately, amplifying the Marginal Propensity to Consume (MPC) effect more strongly than tax changes, which influence consumption indirectly through disposable income. When MPC is high, each dollar of government spending generates a larger increase in aggregate demand compared to a dollar of tax reduction, as the latter requires households to first adjust their spending decisions. The differential impact hinges on how MPC determines consumption responsiveness, making government spending a more potent fiscal tool in stimulating economic activity.

Real-World Examples and Case Studies

Government spending multipliers typically demonstrate a higher impact on GDP, as seen in the 2009 American Recovery and Reinvestment Act, where direct expenditure boosted economic output by approximately 1.5 times the amount spent. In contrast, tax multipliers often yield smaller effects; for example, during the 2012 European debt crisis, tax cuts produced a multiplier closer to 0.8, reflecting reduced immediate spending stimuli. Case studies from emerging markets like India reveal that government spending on infrastructure projects generates substantial growth, while tax cuts mainly increase disposable income without equivalent GDP expansion.

Short-Run vs Long-Run Effects

Government spending multipliers typically exhibit stronger short-run effects by directly increasing aggregate demand, leading to higher output and employment, whereas tax multipliers tend to be smaller because changes in taxes influence disposable income more indirectly. In the long run, both multipliers diminish as prices adjust and output returns to its natural level, but government spending can crowd out private investment, reducing its effectiveness. Tax multipliers in the long run also depend on how changes in tax rates affect labor supply and capital accumulation, influencing potential GDP growth.

Policy Implications and Effectiveness

Government spending multipliers typically exceed tax multipliers, indicating that direct public expenditure has a stronger immediate impact on aggregate demand and economic growth. Policymakers favor increasing government spending during downturns to stimulate output more efficiently, as tax cuts often lead to partial savings rather than full consumption boosts. Understanding these differences optimizes fiscal policy design for maximizing economic recovery and managing recession fluctuations effectively.

Conclusion: Choosing the Right Fiscal Tool

Government spending multipliers generally have a larger and more immediate impact on aggregate demand compared to tax multipliers, which tend to be smaller and more influenced by household marginal propensity to consume. The effectiveness of each fiscal tool depends on economic conditions; during recessions, direct government expenditure can stimulate demand quickly, while tax cuts may be more effective when aimed at lower-income groups with higher consumption rates. Policymakers should consider the size, timing, and target of fiscal interventions to maximize economic recovery and growth.

Government spending multiplier Infographic

libterm.com

libterm.com