Strike price is the predetermined price at which an option holder can buy or sell the underlying asset, making it a crucial component in options trading. Understanding how the strike price influences option premiums and potential profitability is essential for making informed investment decisions. Explore the rest of the article to discover how mastering the strike price can enhance your trading strategy.

Table of Comparison

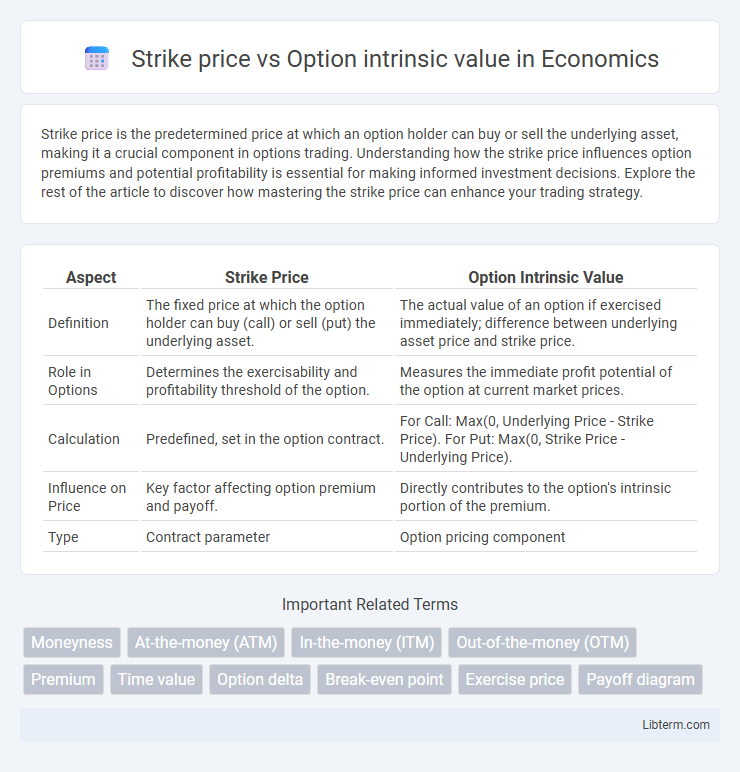

| Aspect | Strike Price | Option Intrinsic Value |

|---|---|---|

| Definition | The fixed price at which the option holder can buy (call) or sell (put) the underlying asset. | The actual value of an option if exercised immediately; difference between underlying asset price and strike price. |

| Role in Options | Determines the exercisability and profitability threshold of the option. | Measures the immediate profit potential of the option at current market prices. |

| Calculation | Predefined, set in the option contract. | For Call: Max(0, Underlying Price - Strike Price). For Put: Max(0, Strike Price - Underlying Price). |

| Influence on Price | Key factor affecting option premium and payoff. | Directly contributes to the option's intrinsic portion of the premium. |

| Type | Contract parameter | Option pricing component |

Understanding Strike Price in Options Trading

The strike price in options trading is the predetermined price at which an option holder can buy or sell the underlying asset, crucial for determining the option's intrinsic value. Intrinsic value is calculated by comparing the strike price to the current market price of the asset, reflecting the real-time profit potential of exercising the option. Accurately understanding the strike price helps traders assess the option's true worth and make informed trading decisions based on potential gains or losses.

What Is Intrinsic Value of an Option?

Intrinsic value of an option is the difference between the current price of the underlying asset and the option's strike price when favorable to the option holder. For a call option, intrinsic value equals the underlying asset price minus the strike price if the asset's market price is above the strike price; otherwise, it is zero. In put options, intrinsic value is calculated as the strike price minus the asset price when the strike price exceeds the current market value; if not, intrinsic value remains zero.

Key Differences: Strike Price vs Intrinsic Value

The strike price is the fixed price at which an option holder can buy or sell the underlying asset, while intrinsic value represents the actual profit potential if the option is exercised immediately. Intrinsic value is calculated as the difference between the current underlying asset price and the strike price for in-the-money options, and zero for out-of-the-money options. Unlike the strike price, intrinsic value fluctuates with market price changes and reflects the real-time worth of the option contract.

Relationship Between Strike Price and Intrinsic Value

The intrinsic value of an option is directly influenced by the strike price relative to the underlying asset's current market price. For a call option, intrinsic value is the positive difference between the asset price and the strike price, while for a put option, it is the difference between the strike price and the asset price when this is favorable. Options with strike prices closer to the underlying asset's market price tend to have higher intrinsic value, reflecting their greater likelihood of profitability at expiration.

How Strike Price Affects Option Premiums

The strike price directly influences option premiums by determining the intrinsic value of the option; options with strike prices closer to the underlying asset's current market price often have higher premiums due to increased likelihood of profitability. In-the-money options, where the strike price is favorable relative to the market price, possess positive intrinsic value, enhancing their premium. Conversely, out-of-the-money options with strike prices less favorable than the market price have lower intrinsic value and typically command lower premiums.

Calculating Intrinsic Value in Call and Put Options

The intrinsic value of a call option is calculated by subtracting the strike price from the current underlying asset price, with values below zero considered zero since the option would not be exercised at a loss. For put options, intrinsic value is determined by subtracting the underlying asset price from the strike price, reflecting the potential profit if the option is exercised when the asset price is below the strike. Accurate calculation of intrinsic value helps investors assess in-the-money options and make informed decisions on exercising options or evaluating their true economic worth.

At the Money, In the Money, and Out of the Money Explained

The strike price is the predetermined price at which an option can be exercised, directly impacting its intrinsic value, which represents the real, tangible profit potential of the option. At the Money (ATM) occurs when the underlying asset's current price equals the strike price, resulting in an intrinsic value of zero. In the Money (ITM) means the option has positive intrinsic value, with call options having a strike price below and put options above the asset's market price, while Out of the Money (OTM) options have no intrinsic value because the strike price is unfavorable compared to the underlying asset's price.

Impact of Market Movements on Intrinsic Value

The strike price determines the baseline at which an option's intrinsic value is calculated, representing the difference between the underlying asset's current market price and the strike price for in-the-money options. Market movements directly influence intrinsic value by increasing it when the asset price moves favorably above the strike price for call options, or below for put options, and reducing it when movements occur in the opposite direction. Volatility and price trends thus play a crucial role in driving the intrinsic value, impacting the option's profitability and exercise potential.

Choosing the Right Strike Price for Higher Intrinsic Value

Selecting the right strike price is crucial for maximizing an option's intrinsic value, which represents the actual profit potential if the option were exercised immediately. In call options, a strike price below the current underlying asset price results in higher intrinsic value, while for put options, a strike price above the asset price increases intrinsic value. Understanding the relationship between the strike price and intrinsic value enables traders to optimize their option positions for greater profitability and risk management.

Practical Examples: Strike Price and Intrinsic Value in Action

A call option with a strike price of $50 and an underlying stock trading at $60 has an intrinsic value of $10, representing the immediate profit if exercised. Conversely, a put option with a strike price of $40 and the stock priced at $35 holds an intrinsic value of $5, reflecting the advantage of selling above the market price. These practical examples illustrate how the strike price determines the intrinsic value, impacting an option's profitability at expiration.

Strike price Infographic

libterm.com

libterm.com