Fiscal stimulus boosts economic growth by increasing government spending and reducing taxes to encourage consumer and business spending. This approach aims to counteract economic downturns and promote job creation. Explore how fiscal stimulus policies can directly impact Your financial well-being in the full article.

Table of Comparison

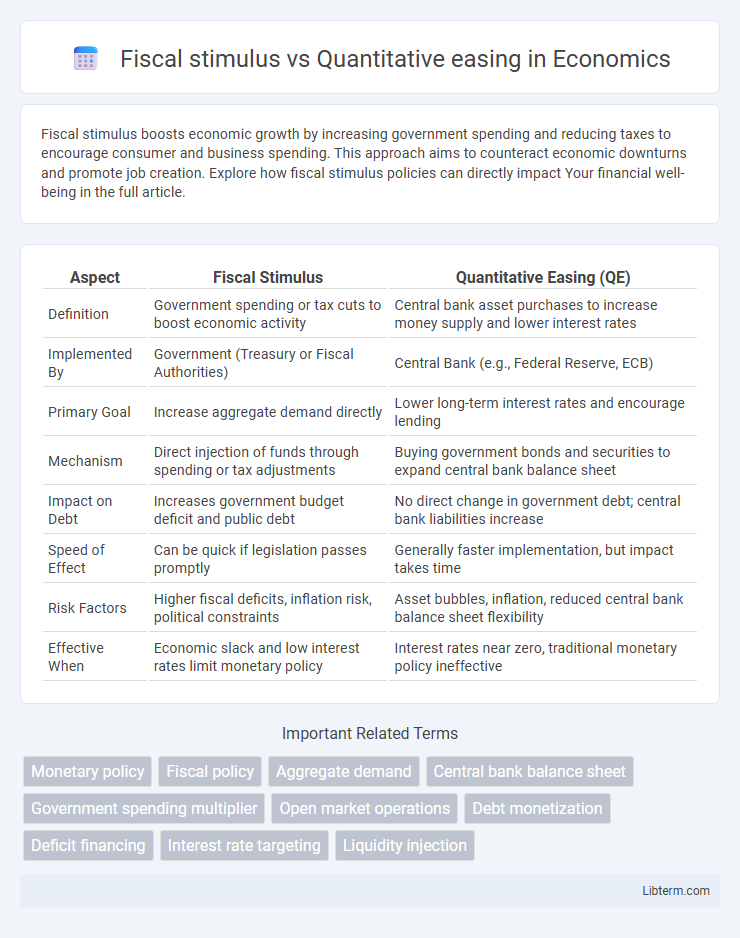

| Aspect | Fiscal Stimulus | Quantitative Easing (QE) |

|---|---|---|

| Definition | Government spending or tax cuts to boost economic activity | Central bank asset purchases to increase money supply and lower interest rates |

| Implemented By | Government (Treasury or Fiscal Authorities) | Central Bank (e.g., Federal Reserve, ECB) |

| Primary Goal | Increase aggregate demand directly | Lower long-term interest rates and encourage lending |

| Mechanism | Direct injection of funds through spending or tax adjustments | Buying government bonds and securities to expand central bank balance sheet |

| Impact on Debt | Increases government budget deficit and public debt | No direct change in government debt; central bank liabilities increase |

| Speed of Effect | Can be quick if legislation passes promptly | Generally faster implementation, but impact takes time |

| Risk Factors | Higher fiscal deficits, inflation risk, political constraints | Asset bubbles, inflation, reduced central bank balance sheet flexibility |

| Effective When | Economic slack and low interest rates limit monetary policy | Interest rates near zero, traditional monetary policy ineffective |

Introduction to Fiscal Stimulus and Quantitative Easing

Fiscal stimulus involves direct government spending or tax cuts aimed at boosting economic activity by increasing aggregate demand. Quantitative easing (QE) is a monetary policy tool whereby central banks purchase financial assets, such as government bonds, to inject liquidity and lower long-term interest rates. Both approaches target economic growth but differ in execution: fiscal stimulus operates through government budgets, while QE functions through central bank balance sheets.

Key Differences Between Fiscal Stimulus and Quantitative Easing

Fiscal stimulus involves government spending and tax policies aimed at boosting economic activity by increasing demand directly, while quantitative easing (QE) is a monetary policy tool where central banks purchase financial assets to inject liquidity and lower interest rates. Fiscal stimulus directly impacts the economy through increased public expenditure or tax cuts, whereas QE influences the economy indirectly by expanding the money supply and encouraging lending. The primary difference lies in their implementation agencies: fiscal stimulus is enacted by the government's fiscal authorities, and quantitative easing is conducted by central banks.

Mechanisms of Fiscal Stimulus

Fiscal stimulus operates by increasing government spending and reducing taxes to directly boost aggregate demand, leading to higher consumption and investment. It injects money into the economy through infrastructure projects, social programs, and tax rebates, creating jobs and increasing disposable income. Unlike quantitative easing, fiscal stimulus impacts the economy through direct transfers and government expenditures rather than manipulating the money supply or interest rates.

How Quantitative Easing Works

Quantitative Easing (QE) operates by the central bank purchasing government securities or other financial assets to inject liquidity directly into the economy, aiming to lower interest rates and increase money supply. This policy encourages lending and investment by making borrowing cheaper, thereby stimulating economic growth during downturns. Unlike fiscal stimulus, which relies on government spending and taxation changes, QE targets financial markets to influence broader economic activity.

Historical Examples of Fiscal Stimulus

The New Deal programs during the 1930s Great Depression exemplify a successful fiscal stimulus through large-scale public works and social welfare initiatives aimed at boosting employment and demand. The 2009 American Recovery and Reinvestment Act deployed over $800 billion in government spending focused on infrastructure, education, and healthcare to counteract the Great Recession's economic contraction. Historical examples of fiscal stimulus demonstrate a direct injection of government funds into the economy to trigger consumption and investment, contrasting with quantitative easing's focus on central bank asset purchases to increase money supply.

Impact of Quantitative Easing on Financial Markets

Quantitative easing influences financial markets primarily by lowering interest rates and increasing liquidity, which stimulates investment and boosts asset prices such as stocks and bonds. It alters market expectations by signaling central banks' commitment to support the economy, thereby reducing risk premiums and enhancing credit availability. This monetary policy tool can lead to inflated asset valuations and increased market volatility over time.

Fiscal Stimulus: Economic Advantages and Drawbacks

Fiscal stimulus involves government spending and tax cuts aimed at boosting economic activity by increasing aggregate demand, which can lead to higher employment and accelerated growth during recessions. It directly injects funds into the economy, supporting sectors like infrastructure, healthcare, and education, but may result in increased public debt and potential inflationary pressures if not managed prudently. The short-term economic advantages often include faster recovery and poverty reduction, while drawbacks encompass budget deficits and long-term fiscal sustainability challenges.

Quantitative Easing: Benefits and Risks

Quantitative easing (QE) involves central banks purchasing government bonds and other financial assets to inject liquidity into the economy, aiming to lower interest rates and stimulate investment and consumption. Benefits of QE include boosting asset prices, supporting financial markets, and preventing deflation during economic downturns. However, risks involve potential inflationary pressures, asset bubbles, and long-term dependency on monetary stimulus, which can reduce central banks' effectiveness in managing future crises.

Policy Effectiveness: Comparing Outcomes

Fiscal stimulus involves direct government spending or tax cuts to boost economic activity, generating immediate demand and employment effects, particularly effective in recessionary periods. Quantitative easing (QE) increases money supply by central banks purchasing financial assets, aiming to lower interest rates and encourage investment, but its impact on real economy growth is often slower and less direct. Studies show fiscal stimulus tends to produce larger short-term GDP growth and job creation compared to QE, which primarily stabilizes financial markets and supports long-term monetary conditions.

Choosing the Right Approach for Economic Recovery

Fiscal stimulus involves direct government spending or tax cuts to boost demand and create jobs, ideal for quickly addressing economic downturns with targeted impact. Quantitative easing, a monetary policy where central banks purchase government bonds to increase money supply and lower interest rates, is effective when traditional policy tools are exhausted and easing financial conditions is crucial. Selecting the right approach depends on the economic context, urgency of recovery, inflation expectations, and coordination between fiscal authorities and central banks to maximize growth while maintaining financial stability.

Fiscal stimulus Infographic

libterm.com

libterm.com