Credit controls regulate the extension of credit to manage financial risk and maintain economic stability. These measures help prevent excessive borrowing and protect both lenders and borrowers from potential defaults. Discover how effective credit control strategies can safeguard Your financial health by reading the rest of the article.

Table of Comparison

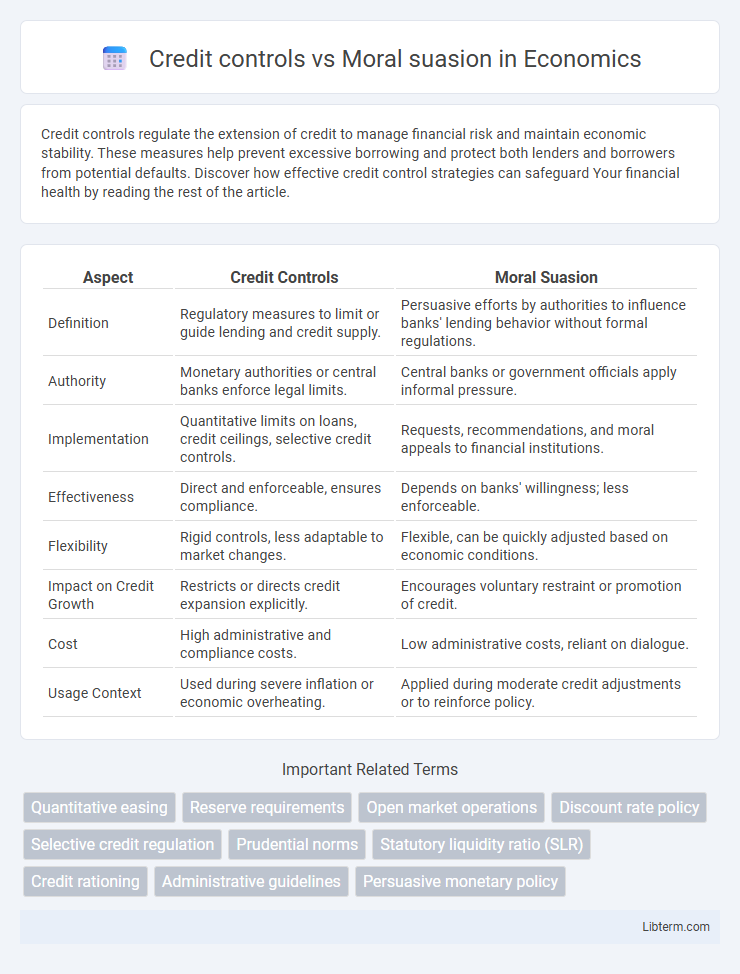

| Aspect | Credit Controls | Moral Suasion |

|---|---|---|

| Definition | Regulatory measures to limit or guide lending and credit supply. | Persuasive efforts by authorities to influence banks' lending behavior without formal regulations. |

| Authority | Monetary authorities or central banks enforce legal limits. | Central banks or government officials apply informal pressure. |

| Implementation | Quantitative limits on loans, credit ceilings, selective credit controls. | Requests, recommendations, and moral appeals to financial institutions. |

| Effectiveness | Direct and enforceable, ensures compliance. | Depends on banks' willingness; less enforceable. |

| Flexibility | Rigid controls, less adaptable to market changes. | Flexible, can be quickly adjusted based on economic conditions. |

| Impact on Credit Growth | Restricts or directs credit expansion explicitly. | Encourages voluntary restraint or promotion of credit. |

| Cost | High administrative and compliance costs. | Low administrative costs, reliant on dialogue. |

| Usage Context | Used during severe inflation or economic overheating. | Applied during moderate credit adjustments or to reinforce policy. |

Introduction to Credit Controls and Moral Suasion

Credit controls refer to regulatory measures implemented by central banks or financial authorities to manage the supply and cost of credit in the economy, aiming to control inflation, stabilize currency, and influence economic growth. Moral suasion involves the use of persuasion and informal pressure by monetary authorities on banks and financial institutions to adhere to policy objectives without formal regulations. Both tools serve as non-quantitative mechanisms to influence lending behavior and monetary conditions without direct compulsory enforcement.

Defining Credit Controls: Tools and Mechanisms

Credit controls encompass regulatory tools used by central banks to manage the availability and cost of credit in the economy, including quantitative measures like credit ceilings and qualitative instruments such as margin requirements and selective credit rationing. These mechanisms directly influence lending behaviors by imposing limits on credit expansion or directing credit flows to priority sectors. In contrast, moral suasion relies on persuasive communication by authorities to encourage financial institutions to align lending practices with economic objectives without formal regulatory enforcement.

Understanding Moral Suasion in Monetary Policy

Moral suasion in monetary policy involves the central bank persuading commercial banks to regulate credit growth without enforcing mandatory restrictions, relying on appeals to their sense of responsibility and national interest. Unlike credit controls, which impose direct quantitative limits on lending, moral suasion encourages voluntary compliance through communication and advisory measures. This approach aims to influence banking behavior subtly, leveraging trust and goodwill to achieve monetary stability without disrupting market dynamics.

Key Differences Between Credit Controls and Moral Suasion

Credit controls involve formal regulatory measures imposed by central banks or authorities to restrict or encourage credit flow within the economy, focusing on quantitative and qualitative restrictions like interest rate caps and credit ceilings. In contrast, moral suasion relies on informal persuasion tactics, where authorities appeal to banks' sense of responsibility or national interest to influence lending behavior without enforcing legal constraints. The fundamental difference lies in credit controls being enforceable policies with direct impact, whereas moral suasion depends on voluntary compliance and ethical considerations.

Objectives of Credit Controls in Economic Regulation

Credit controls aim to regulate the availability and cost of credit to stabilize the economy by controlling inflation, curbing excessive borrowing, and ensuring adequate credit flow to priority sectors. These controls help maintain monetary stability and prevent financial imbalances by restricting or guiding lending practices of banks and financial institutions. Unlike moral suasion, which relies on persuasive communication, credit controls use enforceable measures like credit ceilings, interest rate limits, and sector-specific lending quotas to achieve targeted economic outcomes.

The Role of Moral Suasion in Influencing Financial Institutions

Moral suasion plays a critical role in influencing financial institutions by encouraging voluntary compliance with regulatory guidelines through persuasive communication rather than mandatory enforcement. Central banks and regulators use moral suasion to align the behavior of banks with macroeconomic objectives, such as controlling inflation or maintaining financial stability, relying on the institutions' sense of responsibility and reputational considerations. This approach complements formal credit controls by promoting cooperation without strict legal regulations, fostering a collaborative environment for economic policy implementation.

Effectiveness of Credit Controls: Pros and Cons

Credit controls restrict borrowing by setting limits on credit availability, effectively curbing inflation and reducing excessive debt accumulation but may slow economic growth and limit consumer spending. Their structured implementation offers predictable outcomes and enforces fiscal discipline, though rigid controls can lead to credit rationing and reduced financial innovation. While credit controls provide direct regulatory influence, they require careful calibration to avoid unintended economic contractions and ensure balanced market stability.

Case Studies: Credit Controls vs. Moral Suasion in Practice

Case studies on credit controls reveal their effectiveness in regulating money supply and curbing inflation by setting limits on bank lending and interest rates, as seen in India's RBI interventions during high inflation periods. In contrast, moral suasion relies on central banks' persuasive appeals to financial institutions, evident in the US Federal Reserve's informal requests during economic downturns to encourage prudent lending without formal regulations. Evaluations indicate credit controls offer direct enforcement but risk market distortion, whereas moral suasion fosters voluntary compliance, maintaining market flexibility but with less certainty of outcomes.

Challenges and Limitations of Both Approaches

Credit controls often face challenges such as difficulty in precise implementation and risk of distorting credit markets, limiting their effectiveness in controlling excessive borrowing or inflation. Moral suasion can be limited by its reliance on the voluntary cooperation of financial institutions, which may not always align with policy objectives, reducing its practical impact. Both approaches struggle with enforcement issues and may be insufficient as standalone tools for effective monetary policy management.

Conclusion: Choosing the Right Policy Tool

Credit controls provide direct regulation by setting quantitative limits on lending and interest rates, ensuring immediate impact on credit markets, while moral suasion relies on persuasive communication encouraging banks to adopt desired behaviors without legal enforcement. Selecting the appropriate policy tool depends on economic conditions, with credit controls preferred in situations requiring swift intervention and moral suasion favored when fostering cooperative relationships for gradual adjustments. Combining both approaches can enhance effectiveness, balancing regulatory authority with voluntary compliance to stabilize financial systems.

Credit controls Infographic

libterm.com

libterm.com