A regressive tax imposes a higher relative burden on lower-income individuals, causing them to pay a larger percentage of their income compared to wealthier taxpayers. This tax structure can widen economic inequality by disproportionately impacting those least able to afford it. Explore the article to understand how regressive taxes affect your finances and the economy at large.

Table of Comparison

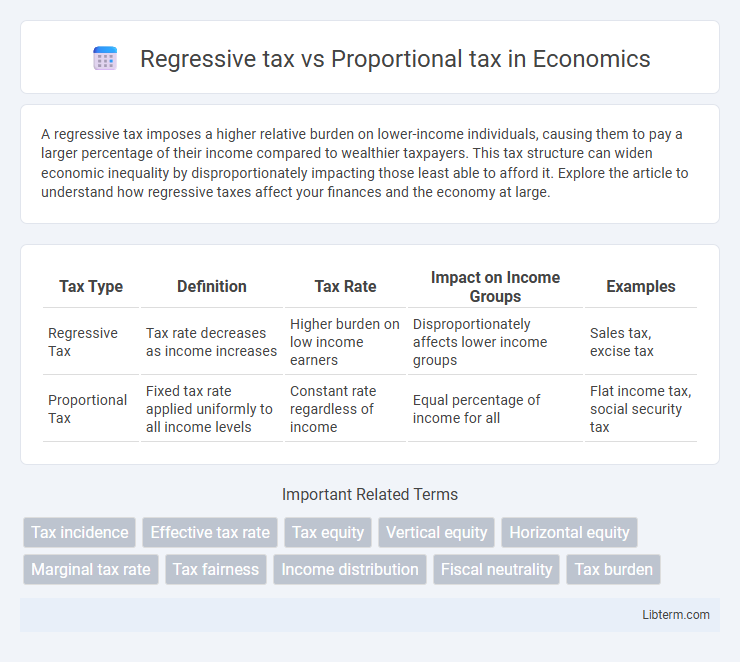

| Tax Type | Definition | Tax Rate | Impact on Income Groups | Examples |

|---|---|---|---|---|

| Regressive Tax | Tax rate decreases as income increases | Higher burden on low income earners | Disproportionately affects lower income groups | Sales tax, excise tax |

| Proportional Tax | Fixed tax rate applied uniformly to all income levels | Constant rate regardless of income | Equal percentage of income for all | Flat income tax, social security tax |

Introduction to Taxation Systems

Regressive tax systems impose a higher burden on lower-income earners by taxing a larger percentage of their income compared to higher earners, often seen in sales taxes and excise duties. Proportional tax systems, also known as flat taxes, apply the same tax rate to all income levels, ensuring uniformity in tax percentage regardless of earnings. Understanding these taxation models is essential for analyzing government revenue strategies and their impact on income inequality.

Defining Regressive Taxes

Regressive taxes impose a higher relative burden on lower-income individuals by taxing a smaller percentage as income rises, making them less equitable. Common examples include sales taxes and excise taxes, which consume a larger portion of income from those with lower earnings. This contrasts with proportional taxes, where the tax rate remains constant regardless of income level.

Understanding Proportional Taxes

Proportional taxes impose a fixed tax rate on all income levels, ensuring equal percentage taxation regardless of earnings, which contrasts with regressive taxes where lower incomes bear a higher relative burden. This tax system simplifies compliance and promotes transparency by applying the same rate across individuals and businesses. Understanding proportional taxes is essential for evaluating their impact on equity, economic behavior, and revenue stability within fiscal policy frameworks.

Key Differences Between Regressive and Proportional Taxes

Regressive taxes impose a higher burden on lower-income earners as the tax rate decreases with increasing income, while proportional taxes maintain a constant tax rate regardless of income level. The effective tax rate in regressive systems decreases as income rises, leading to greater inequality, whereas proportional taxes apply a uniform percentage, ensuring tax equity across all income brackets. Understanding these distinctions is crucial for policymakers targeting tax fairness and economic impact.

Economic Impact of Regressive Taxes

Regressive taxes disproportionately burden lower-income individuals by taking a larger percentage of their income compared to higher earners, leading to increased income inequality and reduced consumer spending power among vulnerable populations. This shift can slow economic growth as lower-income households tend to spend a higher proportion of their income, driving demand in the economy. Moreover, regressive taxes may exacerbate poverty levels and limit access to essential goods and services, intensifying social and economic disparities.

Economic Impact of Proportional Taxes

Proportional taxes, also known as flat taxes, impose a constant tax rate regardless of income level, leading to predictable revenue for governments without discouraging higher earnings. This tax structure tends to maintain spending incentives across all income groups, potentially fostering economic growth through sustained consumer spending and investment. However, proportional taxes may place a relatively heavier burden on low-income households compared to progressive taxes, affecting income distribution and economic equity.

Examples of Regressive Tax Structures

Sales taxes and excise taxes on goods like gasoline, tobacco, and alcohol serve as common examples of regressive tax structures because they take a larger percentage of income from low-income earners than from high-income earners. Social Security payroll taxes in the United States also exhibit regressive characteristics since they apply only up to a wage cap, disproportionately affecting lower and middle-income workers. Property taxes can be considered regressive in certain contexts when assessed uniformly, as lower-income households often pay a higher tax-to-income ratio compared to wealthier homeowners.

Examples of Proportional Tax Structures

Proportional tax structures apply a constant tax rate regardless of income, such as the flat income tax implemented in countries like Estonia and Russia. This tax system ensures that all taxpayers contribute an equal percentage of their earnings, promoting simplicity and transparency in tax collection. Examples also include certain local property taxes and payroll taxes that maintain uniform rates across income brackets, facilitating straightforward revenue estimation for governments.

Social Equity and Fairness Considerations

Regressive taxes disproportionately burden low-income individuals by taking a larger percentage of their income, undermining social equity and fairness. Proportional taxes, or flat taxes, maintain equal rates across all income levels but can still place a relatively heavier financial strain on lower earners, challenging fairness in wealth distribution. Equitable tax policy often requires balancing progressivity to ensure lower-income groups are not overtaxed while maintaining sufficient revenue.

Policy Implications and Future Trends

Regressive taxes disproportionately burden lower-income individuals, potentially increasing income inequality and reducing overall economic mobility. Proportional taxes maintain a constant rate across all income levels, promoting fairness but may generate insufficient revenue for expanding social programs. Future policy trends emphasize hybrid tax models and digital economy considerations to balance equity, efficiency, and fiscal sustainability.

Regressive tax Infographic

libterm.com

libterm.com