Metallism is an economic theory that emphasizes the importance of precious metals, particularly gold and silver, as the foundation of a nation's currency system. It asserts that a currency's value is derived from the metal content backing it, ensuring intrinsic worth and stability. Explore the rest of the article to understand how metallism influences modern monetary policies and your financial decisions.

Table of Comparison

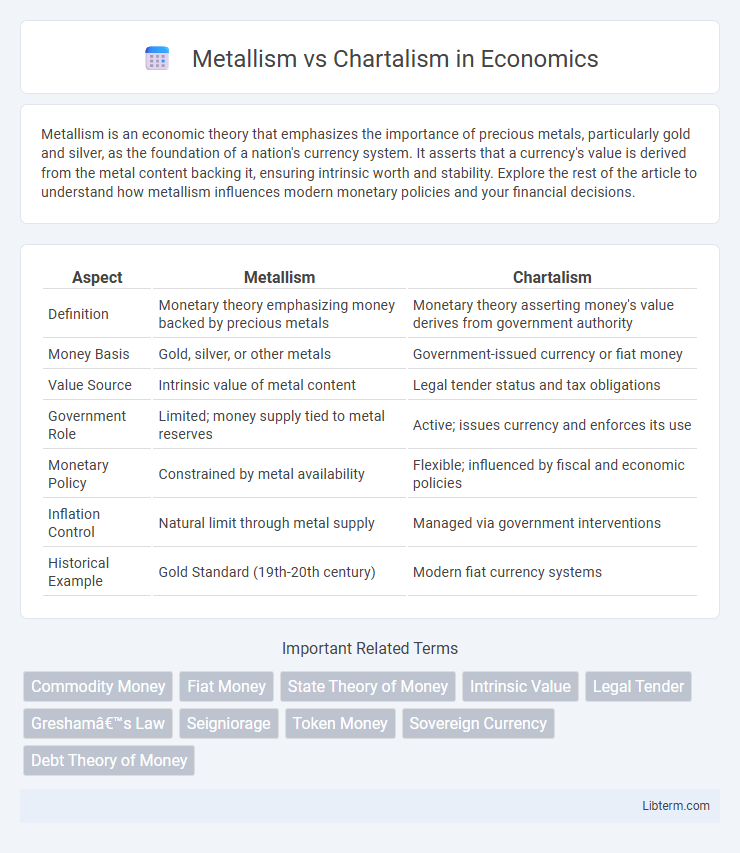

| Aspect | Metallism | Chartalism |

|---|---|---|

| Definition | Monetary theory emphasizing money backed by precious metals | Monetary theory asserting money's value derives from government authority |

| Money Basis | Gold, silver, or other metals | Government-issued currency or fiat money |

| Value Source | Intrinsic value of metal content | Legal tender status and tax obligations |

| Government Role | Limited; money supply tied to metal reserves | Active; issues currency and enforces its use |

| Monetary Policy | Constrained by metal availability | Flexible; influenced by fiscal and economic policies |

| Inflation Control | Natural limit through metal supply | Managed via government interventions |

| Historical Example | Gold Standard (19th-20th century) | Modern fiat currency systems |

Introduction to Metallism and Chartalism

Metallism asserts that money's value derives from the intrinsic worth of the metal, typically gold or silver, used to mint coins, emphasizing commodity-based currency as a foundation for economic stability. Chartalism, in contrast, argues that money's value originates from the state's authority and its ability to impose taxes payable only in that currency, making money a social construct backed by government decree. These contrasting theories highlight the fundamental debate over whether money's value is grounded in physical assets or state power.

Historical Origins of Metallism

Metallism emerged from ancient economies where precious metals like gold and silver were widely accepted as mediums of exchange due to their intrinsic value and scarcity. This monetary theory traces its roots to classical economists such as Adam Smith, who emphasized the role of metal-backed currency in stabilizing economic systems. Historically, metallism became prominent during periods when coinage was directly linked to metal reserves, reinforcing trust and standardization in trade.

Historical Development of Chartalism

Chartalism, rooted in the works of German economist Georg Friedrich Knapp in the early 20th century, emphasizes the state's role in defining money's value through legal frameworks and tax obligations. This historical development contrasts with metallism, which bases money's worth on intrinsic commodity value, often gold or silver, reflecting earlier economic thought. Chartalism's evolution influenced modern monetary theory by highlighting currency as a state-issued tool for economic policy rather than a commodity.

Key Principles of Metallism

Metallism asserts that the value of money is derived from the intrinsic worth of the metal, typically gold or silver, that backs it. This monetary theory emphasizes that currency should be directly convertible into a fixed quantity of precious metal to maintain stability and trust. Metallism contrasts with Chartalism by advocating that money's value stems from its metal content rather than government decree or legal tender laws.

Core Tenets of Chartalism

Chartalism centers on the belief that money's value derives from its acceptance by the state for tax payments, emphasizing the role of government sovereignty in defining currency worth. It asserts that the state creates money through its spending and enforces its use by requiring taxes to be paid in that currency, contrasting with Metallism's reliance on intrinsic value like precious metals. Chartalism highlights fiat money's functionality as a public monopoly and the state's power to regulate and stabilize the monetary system.

Metallism in Practice: Examples and Impacts

Metallism emphasizes money's value derived from the commodity it contains, often gold or silver, as demonstrated by the gold standard used by many countries during the 19th and early 20th centuries. This system stabilizes currency value by linking it to precious metals, facilitating international trade and controlling inflation through limited money supply. However, metallism's rigid reliance on metals can restrict monetary policy flexibility, contributing to economic downturns during periods of metal scarcity or fluctuating commodity prices.

Chartalism in Practice: Modern Applications

Chartalism emphasizes the role of government-issued currency as a tool for economic management, exemplified by modern fiat money systems where states control currency issuance and taxation. Central banks implement monetary policies through interest rate adjustments and quantitative easing to regulate inflation and stimulate growth under chartalist principles. Practical applications include the U.S. Federal Reserve's management of the dollar and Japan's adoption of expansive fiscal measures supported by sovereign currency control to maintain economic stability.

Comparative Analysis: Metallism vs Chartalism

Metallism asserts money's value is intrinsic, backed by precious metals like gold or silver, emphasizing commodity-based currency stability and inflation control. Chartalism, or modern monetary theory, views money as a government-issued token, valuable through legal decree and taxation power, highlighting fiscal policy's role in economic management. The comparative analysis reveals metallism prioritizes tangible asset backing for currency legitimacy, while chartalism centers on sovereign currency's functionality within state monetary systems.

Implications for Monetary Policy

Metallism bases monetary value on a commodity, typically gold or silver, which limits central banks' ability to expand the money supply and imposes strict constraints on monetary policy flexibility. Chartalism asserts that money derives value from government decree and its acceptance for tax payments, granting policymakers greater control over currency issuance and enabling proactive fiscal and monetary interventions. The choice between these frameworks influences inflation control, interest rates, and economic stabilization strategies.

Future Perspectives on Money Theories

Metallism, emphasizing intrinsic value through precious metals, faces challenges adapting to digital currencies and decentralized finance, pushing future monetary theories toward hybrid models incorporating tangible assets and blockchain technology. Chartalism, centered on state-issued fiat money and government authority, gains traction as nations experiment with central bank digital currencies (CBDCs), reinforcing the role of sovereign control in money creation and monetary policy. Emerging perspectives suggest an integrative framework balancing metallist value stability with chartalist flexibility to address economic volatility and innovation.

Metallism Infographic

libterm.com

libterm.com