Derivatives contracts are financial instruments whose value is derived from the performance of underlying assets such as stocks, bonds, commodities, or market indexes. These contracts, including options, futures, and swaps, allow investors to hedge risks or speculate on price movements without owning the underlying asset. Explore this article to understand how derivatives can impact your investment strategy and manage financial risk effectively.

Table of Comparison

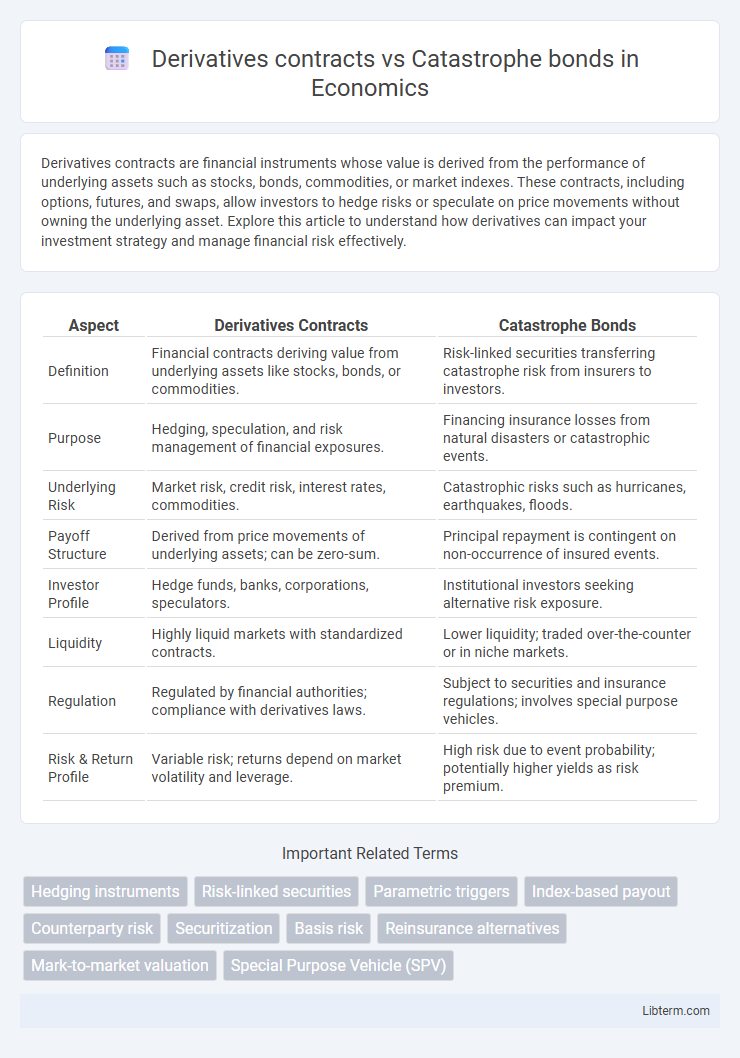

| Aspect | Derivatives Contracts | Catastrophe Bonds |

|---|---|---|

| Definition | Financial contracts deriving value from underlying assets like stocks, bonds, or commodities. | Risk-linked securities transferring catastrophe risk from insurers to investors. |

| Purpose | Hedging, speculation, and risk management of financial exposures. | Financing insurance losses from natural disasters or catastrophic events. |

| Underlying Risk | Market risk, credit risk, interest rates, commodities. | Catastrophic risks such as hurricanes, earthquakes, floods. |

| Payoff Structure | Derived from price movements of underlying assets; can be zero-sum. | Principal repayment is contingent on non-occurrence of insured events. |

| Investor Profile | Hedge funds, banks, corporations, speculators. | Institutional investors seeking alternative risk exposure. |

| Liquidity | Highly liquid markets with standardized contracts. | Lower liquidity; traded over-the-counter or in niche markets. |

| Regulation | Regulated by financial authorities; compliance with derivatives laws. | Subject to securities and insurance regulations; involves special purpose vehicles. |

| Risk & Return Profile | Variable risk; returns depend on market volatility and leverage. | High risk due to event probability; potentially higher yields as risk premium. |

Introduction to Derivatives Contracts and Catastrophe Bonds

Derivatives contracts are financial instruments whose value depends on underlying assets such as stocks, interest rates, or commodities, allowing investors to hedge risks or speculate on price movements. Catastrophe bonds, also known as cat bonds, are specialized risk-linked securities designed to transfer disaster risk from insurers to capital markets, paying high yields if no triggering event such as an earthquake or hurricane occurs. While derivatives provide flexibility in managing a wide range of financial risks, catastrophe bonds specifically address the transfer of natural disaster risks through investment vehicles tied to predefined catastrophe triggers.

Fundamental Concepts: Understanding Derivatives Contracts

Derivatives contracts are financial instruments whose value is derived from underlying assets such as stocks, commodities, or interest rates, enabling investors to hedge risks or speculate on price movements. Unlike catastrophe bonds, which transfer specific disaster risks to investors in exchange for high yields, derivatives can cover a broader range of market risks including credit, currency, and commodity fluctuations. Understanding the fundamental concepts of derivatives involves recognizing key features like contingent payoffs, leverage, and the role of underlying asset prices in determining contract value.

Core Principles of Catastrophe Bonds

Catastrophe bonds are financial instruments designed to transfer specific disaster risks from insurers to capital markets, providing rapid capital relief when predefined catastrophic events occur. Unlike derivative contracts, which often involve speculative or hedging positions based on underlying asset price movements, catastrophe bonds are triggered solely by well-defined event parameters such as earthquake magnitude or hurricane category, enabling transparent and event-driven risk transfer. Core principles of catastrophe bonds include predefined trigger mechanisms, risk securitization, and alignment of investor returns with actual catastrophe losses, fostering efficient risk distribution and liquidity during large-scale disasters.

Risk Transfer Mechanisms Compared

Derivatives contracts and catastrophe bonds are distinct risk transfer mechanisms used by insurers and investors to manage catastrophic risk. Derivatives, such as catastrophe swaps and options, provide financial compensation based on predefined triggers like loss indices, offering flexibility but potentially exposing parties to counterparty risk. Catastrophe bonds transfer risk directly to capital markets, where investors absorb losses in exchange for higher yields, ensuring effective risk dispersion without counterparty credit risk.

Market Participants and Structure

Derivatives contracts, primarily traded by financial institutions and hedge funds, involve agreements based on the price movements of underlying assets, allowing participants to hedge or speculate on risks. Catastrophe bonds, issued mainly by insurance companies and investors, transfer insurance risks from the issuer to bondholders, with payouts triggered by specific catastrophic events such as hurricanes or earthquakes. Structurally, derivatives are standardized or customized contracts settled financially or physically, while catastrophe bonds are securitized debt instruments with predefined triggers linked to real-world disaster variables.

Regulatory and Legal Frameworks

Derivatives contracts operate within well-established regulatory frameworks such as the Dodd-Frank Act, which mandates transparency, reporting, and standardized clearing to mitigate systemic risk in financial markets. Catastrophe bonds fall under securities laws regulated by the SEC, requiring issuance disclosures and investor protections, yet they often benefit from exemptions tailored to insurance-linked securities. The distinct legal structures reflect the differing risk profiles and market functions, with derivatives subject to comprehensive oversight due to their leverage and counterparty risk, while catastrophe bonds integrate insurance principles with capital market regulations.

Pricing and Valuation Differences

Derivatives contracts are typically priced using financial models that incorporate underlying asset volatility, interest rates, and time to maturity, relying heavily on market data and risk-neutral valuation methods. Catastrophe bonds, issued to transfer insurance risk to investors, are valued based on probabilistic catastrophe modeling, expected loss estimates, and recovery rates, reflecting their dependence on actual physical event probabilities rather than purely financial metrics. Unlike derivatives, catastrophe bonds have more complex embedded risk premiums and less liquid secondary markets, influencing their pricing dynamics and valuation methodologies.

Liquidity and Secondary Market Comparison

Derivatives contracts, such as futures and options, generally offer higher liquidity due to standardized terms and active secondary markets that enable frequent trading and price discovery. Catastrophe bonds typically exhibit lower liquidity because their bespoke structures attract a narrower investor base, resulting in less frequent secondary market transactions and wider bid-ask spreads. The limited trading volume of catastrophe bonds contrasts with the robust global derivatives exchanges, making derivatives more suitable for investors requiring rapid entry and exit.

Risk Management Applications

Derivatives contracts enable precise risk transfer by allowing parties to hedge against specific financial exposures, such as interest rates, currency fluctuations, or commodity prices, providing flexible and customizable risk management tools. Catastrophe bonds serve as alternative risk financing instruments that transfer insurance risks, particularly those related to natural disasters like hurricanes or earthquakes, from insurers to capital markets, offering substantial capital relief and risk diversification. Both instruments enhance risk management by distributing potential losses but differ in structure, with derivatives focusing on financial market risks and catastrophe bonds addressing insurance-linked risks.

Key Advantages and Disadvantages

Derivatives contracts offer high liquidity and customizable risk exposure, enabling precise hedging but can introduce counterparty risk and require complex valuation models. Catastrophe bonds provide risk transfer with limited counterparty exposure and the potential for high yields, though they often involve longer maturities and greater complexity in structuring. Both instruments serve risk management but differ significantly in market accessibility, risk profile, and investment horizon.

Derivatives contracts Infographic

libterm.com

libterm.com