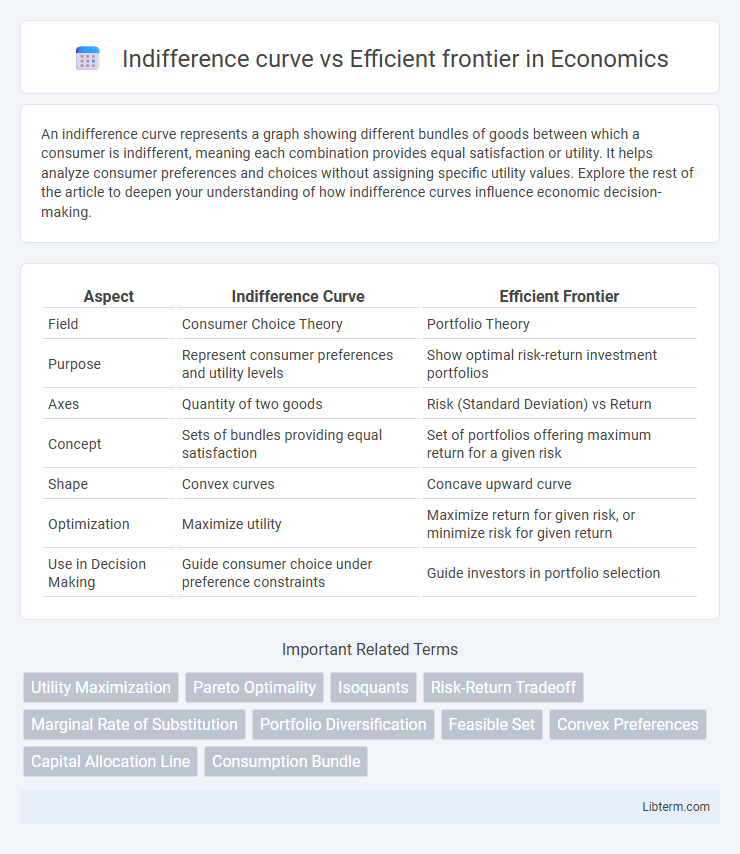

An indifference curve represents a graph showing different bundles of goods between which a consumer is indifferent, meaning each combination provides equal satisfaction or utility. It helps analyze consumer preferences and choices without assigning specific utility values. Explore the rest of the article to deepen your understanding of how indifference curves influence economic decision-making.

Table of Comparison

| Aspect | Indifference Curve | Efficient Frontier |

|---|---|---|

| Field | Consumer Choice Theory | Portfolio Theory |

| Purpose | Represent consumer preferences and utility levels | Show optimal risk-return investment portfolios |

| Axes | Quantity of two goods | Risk (Standard Deviation) vs Return |

| Concept | Sets of bundles providing equal satisfaction | Set of portfolios offering maximum return for a given risk |

| Shape | Convex curves | Concave upward curve |

| Optimization | Maximize utility | Maximize return for given risk, or minimize risk for given return |

| Use in Decision Making | Guide consumer choice under preference constraints | Guide investors in portfolio selection |

Introduction to Indifference Curves and Efficient Frontiers

Indifference curves represent combinations of goods that provide equal satisfaction or utility to a consumer, illustrating consumer preferences and the trade-offs they are willing to make. Efficient frontiers depict the set of optimal investment portfolios offering the highest expected return for a given level of risk or the lowest risk for a given return, central to modern portfolio theory. Both concepts analyze optimal choices under constraints: indifference curves in consumer behavior and efficient frontiers in financial asset allocation.

Fundamental Concepts in Consumer Choice and Investment

Indifference curves represent consumer preferences by illustrating combinations of goods that yield equal satisfaction, enabling analysis of optimal consumption choices based on utility maximization. Efficient frontiers map investment portfolios offering the highest expected return for a given level of risk, guiding optimal asset allocation by balancing risk and return. Both concepts utilize optimization principles--indifference curves optimize consumer utility, while efficient frontiers optimize investment performance under constraints.

Mathematical Representation of Indifference Curves

Indifference curves are mathematically represented as level curves of a utility function U(x, y) = k, where k is a constant indicating equal utility across combinations of goods x and y. These curves are typically convex to the origin, reflecting diminishing marginal rates of substitution, defined as the negative ratio of marginal utilities, -MUx/MUy. In contrast, the efficient frontier is a locus of optimal portfolios plotted on the risk-return plane, represented by a quadratic optimization problem constrained by return expectations and portfolio weights, distinct from the consumer preference framework of indifference curves.

Construction of the Efficient Frontier in Portfolio Theory

The efficient frontier in portfolio theory is constructed by plotting a set of optimal portfolios that offer the highest expected return for a given level of risk, derived from the combination of different asset weights based on their expected returns, variances, and covariances. Indifference curves represent an investor's risk-return preferences and are superimposed on the efficient frontier to identify the portfolio that maximizes utility. The construction involves solving the mean-variance optimization problem, typically using quadratic programming to minimize portfolio variance for each level of expected return, generating the curved frontier of optimal portfolios.

Key Differences: Indifference Curve vs Efficient Frontier

Indifference curves represent combinations of goods providing equal satisfaction to a consumer, reflecting preferences and utility levels. Efficient frontiers illustrate optimal investment portfolios offering the highest expected return for a given risk, derived from Modern Portfolio Theory. While indifference curves focus on consumer choice and utility maximization, efficient frontiers emphasize risk-return trade-offs in financial asset allocation.

Visualizing Risk, Return, and Preference

Indifference curves represent investor preferences by illustrating combinations of risk and return that provide the same level of utility, enabling visualization of subjective trade-offs between risk tolerance and expected returns. The efficient frontier, derived from portfolio theory, plots optimal portfolios offering the highest expected return for a given level of risk, serving as an objective benchmark for investment decisions. Overlaying indifference curves on the efficient frontier helps identify the optimal portfolio aligning with individual risk preferences and maximizing expected utility.

Applications in Financial Decision-Making

Indifference curves represent investor preferences and risk tolerance by illustrating combinations of risk and return that provide equal utility, guiding personalized portfolio choices. The efficient frontier, derived from Modern Portfolio Theory, identifies portfolios offering the highest expected return for a given risk level, serving as a benchmark for optimal asset allocation. Combining indifference curves with the efficient frontier enables investors to select portfolios that align with their unique risk-return trade-offs, enhancing decision-making in portfolio optimization and risk management.

Limitations and Assumptions of Each Model

Indifference curves assume investors have consistent preferences and risk tolerance, which may not capture real-world behavioral biases, while their reliance on smooth, convex preferences limits application in complex decision scenarios. The efficient frontier model presumes asset returns are normally distributed and markets are efficient, often ignoring factors like transaction costs, liquidity constraints, and changing correlations. Both models simplify investor behavior and market dynamics, restricting their predictive accuracy and practical utility in diverse financial environments.

Real-World Examples and Case Studies

Indifference curves illustrate consumer preferences and trade-offs between goods, such as how an individual might choose between leisure time and income, while the efficient frontier represents optimal investment portfolios maximizing return for a given risk level, as seen in Markowitz's portfolio theory. In real-world cases like pension fund management, the efficient frontier guides asset allocation to balance risk and return, whereas indifference curves help tailor retirement plans according to beneficiary preferences for risk versus stability. Corporate finance decisions also utilize these concepts: firms assess risk-return trade-offs using efficient frontier analysis, while consumer behavior models employ indifference curves to predict market demand patterns under varying economic conditions.

Conclusion: Integrating Preferences and Efficiency

The indifference curve represents consumer preferences by illustrating combinations of goods providing equal satisfaction, while the efficient frontier delineates optimal portfolios offering the highest return for a given risk level. Integrating these concepts enables investors to identify the portfolio that aligns with their risk tolerance and maximizes utility. This synthesis of preferences and efficiency drives optimal decision-making in financial portfolio management.

Indifference curve Infographic

libterm.com

libterm.com