Subsidies play a crucial role in supporting various industries by providing financial assistance to reduce costs and encourage growth. They help stabilize markets, promote innovation, and ensure the availability of essential goods and services. Explore this article to understand how subsidies can impact Your economic environment and influence policy decisions.

Table of Comparison

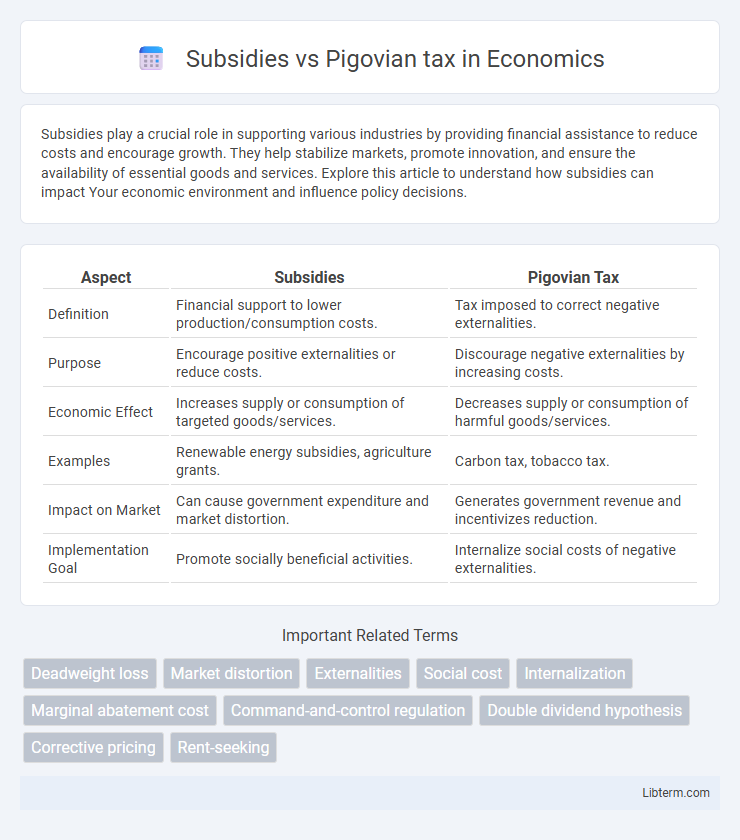

| Aspect | Subsidies | Pigovian Tax |

|---|---|---|

| Definition | Financial support to lower production/consumption costs. | Tax imposed to correct negative externalities. |

| Purpose | Encourage positive externalities or reduce costs. | Discourage negative externalities by increasing costs. |

| Economic Effect | Increases supply or consumption of targeted goods/services. | Decreases supply or consumption of harmful goods/services. |

| Examples | Renewable energy subsidies, agriculture grants. | Carbon tax, tobacco tax. |

| Impact on Market | Can cause government expenditure and market distortion. | Generates government revenue and incentivizes reduction. |

| Implementation Goal | Promote socially beneficial activities. | Internalize social costs of negative externalities. |

Understanding Subsidies and Pigovian Taxes

Subsidies directly reduce the cost of goods or services to encourage positive externalities, such as renewable energy adoption or education investments. Pigovian taxes impose a cost on negative externalities, like pollution, aligning private costs with social costs to discourage harmful activities. Both tools aim to correct market failures but operate through opposite financial incentives--subsidies provide benefits, while Pigovian taxes impose penalties.

Core Principles of Market Intervention

Subsidies and Pigovian taxes represent contrasting core principles of market intervention aimed at correcting externalities. Subsidies incentivize positive externalities by lowering costs for producers or consumers, thereby boosting beneficial activities such as renewable energy adoption. Pigovian taxes impose costs on negative externalities, like pollution, to internalize social costs and discourage harmful behaviors, aligning private incentives with social welfare.

Economic Theories Behind Subsidies

Subsidies function as economic incentives designed to correct market failures by lowering production costs or encouraging consumption of positive externalities, effectively shifting supply or demand curves to achieve socially optimal outcomes. Rooted in welfare economics, subsidies aim to internalize external benefits where private markets under-provide goods or services, such as renewable energy or education. Unlike Pigovian taxes that discourage negative externalities, subsidies enhance positive externalities by increasing market efficiency and promoting equitable resource allocation.

The Rationale for Pigovian Taxes

Pigovian taxes are designed to correct negative externalities by imposing a cost equivalent to the external damage caused by an activity, aligning private incentives with social welfare. These taxes create financial disincentives for harmful behaviors, encouraging producers and consumers to reduce activities that generate social costs, such as pollution or congestion. Unlike subsidies, which lower costs to promote positive externalities, Pigovian taxes internalize external costs, making market outcomes more efficient and socially optimal.

Comparative Effectiveness: Subsidies vs Pigovian Taxes

Subsidies encourage positive externalities by providing direct financial support to producers or consumers, effectively increasing the supply or demand for socially beneficial goods. Pigovian taxes impose costs on negative externalities, aligning private costs with social costs by discouraging harmful activities through price signals. Comparative effectiveness depends on accurate estimation of external costs or benefits, with subsidies often preferred for promoting innovation and Pigovian taxes favored for reducing pollution or consumption of harmful products.

Environmental Impact: Incentives and Outcomes

Subsidies encourage the adoption of environmentally friendly technologies by lowering costs and promoting sustainable practices, leading to increased green investments and reduced pollution levels. Pigovian taxes impose costs on negative externalities, effectively discouraging harmful activities like carbon emissions and incentivizing firms to innovate cleaner alternatives. Both mechanisms influence environmental impact through economic incentives, with subsidies fostering positive behavior and Pigovian taxes penalizing detrimental actions to drive better ecological outcomes.

Fiscal Implications and Government Revenue

Subsidies reduce government revenue by allocating funds to support desired activities, potentially increasing budget deficits if not offset by tax revenues. Pigovian taxes generate direct government revenue by imposing charges on negative externalities, which can be used to fund public goods or compensate for societal costs. The fiscal impact of subsidies may strain public finances, whereas Pigovian taxes offer a revenue-positive approach to internalizing external costs while promoting efficient market outcomes.

Equity and Social Considerations

Subsidies promote equity by providing financial support directly to disadvantaged groups, thereby reducing economic disparities and enhancing social welfare. Pigovian taxes internalize external costs, incentivizing behavior change while generating revenue that can be redistributed to support vulnerable populations. Equity considerations depend on the design and implementation of these tools, as subsidies may create dependency, whereas Pigovian taxes require careful calibration to avoid disproportionately burdening low-income households.

Real-World Examples and Case Studies

Subsidies and Pigovian taxes represent two economic tools used to address externalities, with notable real-world applications such as the U.S. Renewable Energy Subsidies promoting solar and wind energy adoption, reducing greenhouse gas emissions. In contrast, Sweden's carbon tax exemplifies a Pigovian tax effectively incentivizing businesses to lower carbon emissions by internalizing environmental costs. Case studies reveal that subsidies accelerate technology adoption and innovation, while Pigovian taxes drive behavior change through cost signals, both crucial in environmental policy frameworks.

Policy Recommendations and Future Directions

Policy recommendations emphasize careful calibration of subsidies to avoid market distortions while effectively promoting positive externalities such as clean energy adoption and innovation. Pigovian taxes are advised to be dynamically adjusted based on real-time environmental impact data, ensuring precise internalization of external costs like carbon emissions. Future directions involve integrating advanced monitoring technologies and incorporating behavioral economics insights to enhance the efficiency and public acceptance of both subsidies and Pigovian taxes for sustainable economic policies.

Subsidies Infographic

libterm.com

libterm.com