The Life-Cycle Hypothesis explains how individuals plan their consumption and savings behavior over their lifetime to maintain a stable standard of living. It highlights that people save during their working years and dissave during retirement to balance their income fluctuations. Discover how this theory impacts your financial planning by reading the rest of the article.

Table of Comparison

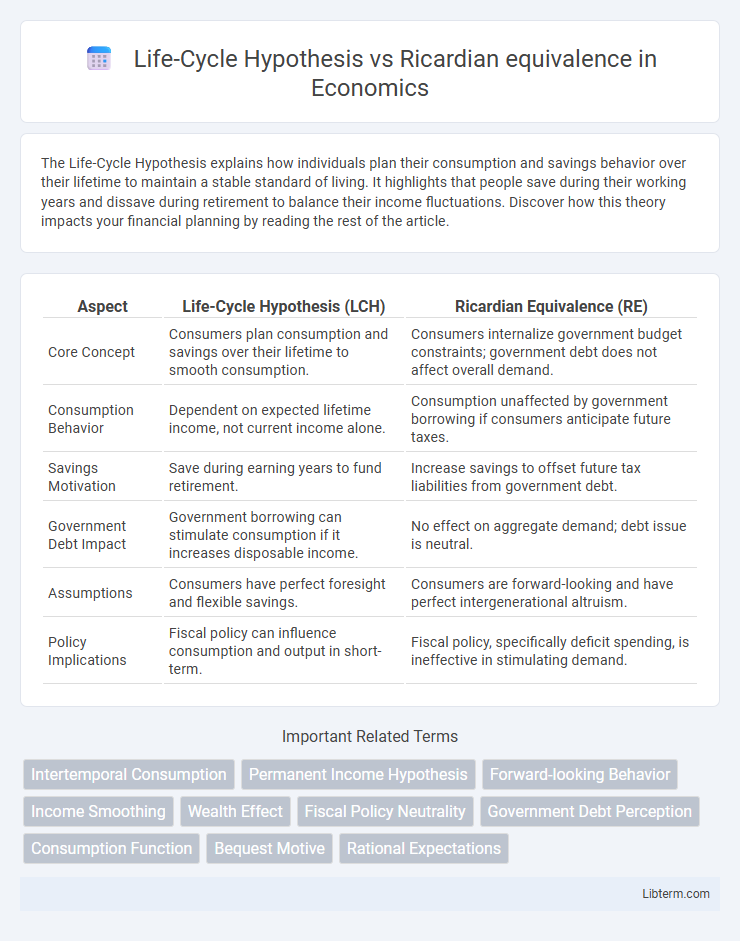

| Aspect | Life-Cycle Hypothesis (LCH) | Ricardian Equivalence (RE) |

|---|---|---|

| Core Concept | Consumers plan consumption and savings over their lifetime to smooth consumption. | Consumers internalize government budget constraints; government debt does not affect overall demand. |

| Consumption Behavior | Dependent on expected lifetime income, not current income alone. | Consumption unaffected by government borrowing if consumers anticipate future taxes. |

| Savings Motivation | Save during earning years to fund retirement. | Increase savings to offset future tax liabilities from government debt. |

| Government Debt Impact | Government borrowing can stimulate consumption if it increases disposable income. | No effect on aggregate demand; debt issue is neutral. |

| Assumptions | Consumers have perfect foresight and flexible savings. | Consumers are forward-looking and have perfect intergenerational altruism. |

| Policy Implications | Fiscal policy can influence consumption and output in short-term. | Fiscal policy, specifically deficit spending, is ineffective in stimulating demand. |

Introduction: Understanding Consumption Theories

The Life-Cycle Hypothesis (LCH) posits that individuals plan their consumption and savings behavior over their lifetime to smooth consumption, factoring in expected income during different life stages. Ricardian equivalence challenges the traditional view by suggesting that government borrowing does not affect overall demand because individuals anticipate future taxes and adjust their savings accordingly. These theories provide critical frameworks for analyzing how consumption responds to fiscal policy and income expectations.

Overview of the Life-Cycle Hypothesis

The Life-Cycle Hypothesis (LCH) posits that individuals plan their consumption and savings behavior over their lifetime to smooth consumption despite varying income levels during different life stages. According to LCH, people accumulate savings during their working years and dissave during retirement to maintain stable consumption patterns. This theory contrasts with Ricardian equivalence, which assumes that consumers fully anticipate government debt financing and adjust their savings accordingly, negating the effect of fiscal policy on aggregate demand.

Fundamentals of Ricardian Equivalence

Ricardian equivalence posits that consumers anticipate future government debt repayment through higher taxes, leading them to save more and neutralize the impact of fiscal deficits on aggregate demand. Unlike the Life-Cycle Hypothesis, which emphasizes individual consumption smoothing based on lifetime income, Ricardian equivalence assumes perfect foresight and intergenerational altruism, causing government borrowing to have no effect on total consumption. This fundamental concept is rooted in the idea that households internalize government budget constraints, rendering fiscal policy ineffective in changing overall economic output.

Key Assumptions of Both Theories

The Life-Cycle Hypothesis assumes individuals plan consumption and savings over their lifetime to smooth consumption despite income fluctuations, relying on rational expectations and perfect capital markets. Ricardian Equivalence assumes that consumers foresee future taxes to repay government debt, leading them to save rather than increase consumption when government spending rises, under the conditions of intergenerational altruism and perfect capital markets. Both theories depend on rational behavior and perfect capital market conditions but differ in the treatment of government debt and intertemporal budget constraints.

Comparative Analysis: Predictions on Saving and Consumption

The Life-Cycle Hypothesis predicts that individuals smooth consumption over their lifetime by saving during peak earning years and dissaving in retirement, leading to a gradual change in saving rates correlated with age and income expectations. Ricardian equivalence asserts that consumers anticipate future taxes to pay off government debt, therefore increasing government borrowing does not affect aggregate consumption since households adjust their saving to offset fiscal deficits. Empirical studies often find mixed support, with Life-Cycle models better explaining observed age-related saving behaviors, while Ricardian equivalence holds in more theoretical or idealized settings where consumers have perfect foresight and access to credit markets.

Empirical Evidence: Testing the Life-Cycle Hypothesis

Empirical evidence testing the Life-Cycle Hypothesis (LCH) reveals that consumption patterns generally align with the model's prediction of smoothing consumption over a lifetime based on expected income and wealth. Studies using microdata on household consumption and saving behavior find significant support for the LCH, showing that individuals increase savings during working years and decumulate wealth during retirement. Contrarily, evidence also highlights limitations in fully capturing empirical anomalies, prompting comparisons with Ricardian equivalence, which predicts no effect of government borrowing on consumption due to intergenerational transfer expectations.

Empirical Evidence: Evaluating Ricardian Equivalence

Empirical evidence evaluating Ricardian Equivalence reveals mixed results, with many studies finding partial support but significant deviations due to liquidity constraints, myopia, and imperfect capital markets. Data from consumption patterns often align more closely with the Life-Cycle Hypothesis, indicating that individuals do not fully offset government debt through increased savings. Experimental and macroeconomic analyses suggest that Ricardian Equivalence holds under strong assumptions rarely met in real economies, limiting its practical application.

Policy Implications: Fiscal Policy Under Both Theories

Fiscal policy under the Life-Cycle Hypothesis (LCH) suggests that government borrowing can stimulate current consumption by smoothing individuals' lifetime income, as consumers anticipate future taxes but focus on present needs. In contrast, Ricardian Equivalence posits that households internalize government budget constraints, offsetting public borrowing by increasing savings in anticipation of future tax liabilities, rendering fiscal stimulus ineffective. Policymakers relying on LCH should expect multipliers from deficit spending, while those considering Ricardian Equivalence must recognize limited impact of debt-financed fiscal interventions on aggregate demand.

Criticisms and Limitations of Each Approach

The Life-Cycle Hypothesis faces criticism for its assumption of rational foresight and stable preferences, often overlooking uncertainties in income and borrowing constraints that limit realistic consumption smoothing. Ricardian equivalence is challenged for its reliance on perfect capital markets and altruistic intergenerational transfers, which empirical evidence frequently disputes, as taxpayers do not always internalize government debt fully. Both approaches struggle to account for behavioral factors, liquidity constraints, and varying economic conditions that influence saving and consumption patterns beyond their theoretical frameworks.

Conclusion: Relevance in Modern Economic Thought

The Life-Cycle Hypothesis emphasizes the role of individual saving behavior based on anticipated lifetime income, highlighting its influence on consumption patterns and fiscal policy effectiveness. Ricardian equivalence, however, suggests that government borrowing has no impact on overall demand because individuals internalize future tax liabilities, challenging traditional fiscal stimulus assumptions. Modern economic thought integrates both perspectives to better understand saving dynamics and policy implications, recognizing context-dependent validity influenced by factors like liquidity constraints and intergenerational altruism.

Life-Cycle Hypothesis Infographic

libterm.com

libterm.com