Structural econometric models provide a powerful framework for understanding complex economic behaviors by explicitly incorporating theoretical relationships and causal mechanisms. These models help identify underlying parameters and simulate policy impacts, making them essential tools for rigorous economic analysis and decision-making. Explore this article to learn how structural econometric models can enhance your insights into economic data and inform effective strategies.

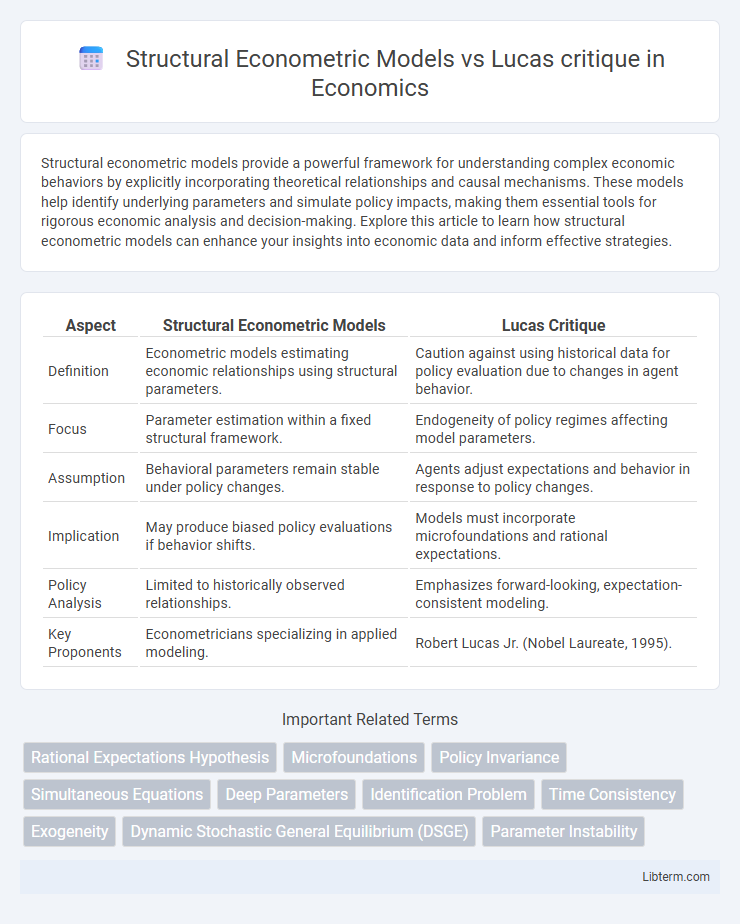

Table of Comparison

| Aspect | Structural Econometric Models | Lucas Critique |

|---|---|---|

| Definition | Econometric models estimating economic relationships using structural parameters. | Caution against using historical data for policy evaluation due to changes in agent behavior. |

| Focus | Parameter estimation within a fixed structural framework. | Endogeneity of policy regimes affecting model parameters. |

| Assumption | Behavioral parameters remain stable under policy changes. | Agents adjust expectations and behavior in response to policy changes. |

| Implication | May produce biased policy evaluations if behavior shifts. | Models must incorporate microfoundations and rational expectations. |

| Policy Analysis | Limited to historically observed relationships. | Emphasizes forward-looking, expectation-consistent modeling. |

| Key Proponents | Econometricians specializing in applied modeling. | Robert Lucas Jr. (Nobel Laureate, 1995). |

Introduction to Structural Econometric Models

Structural econometric models are designed to capture the underlying economic mechanisms by explicitly modeling agents' decision-making processes based on theoretical foundations, allowing for policy simulations and counterfactual analysis. These models differ from reduced-form approaches by incorporating structural parameters that remain invariant to policy changes, addressing concerns raised by the Lucas critique about the instability of empirical relationships under different policy regimes. By integrating microeconomic foundations and rational expectations, structural econometric models provide a robust framework for understanding how economic agents adjust behavior in response to policy shifts.

Understanding the Lucas Critique

Structural econometric models rely on estimated relationships that assume policy invariance, but the Lucas critique highlights that these relationships change when policies shift, rendering traditional models unreliable for policy evaluation. The Lucas critique emphasizes that agents adjust their expectations and behaviors in response to new policies, causing model parameters to shift in ways that undermine static empirical estimates. Understanding the Lucas critique is essential for designing models that incorporate forward-looking behavior and anticipate changes in structural parameters under different policy regimes.

Historical Context and Motivation

Structural econometric models emerged in the mid-20th century to provide empirical tools for policy evaluation by explicitly modeling economic behavior and relationships, aiming to generate reliable predictions under policy changes. The Lucas critique, formulated by Robert Lucas in 1976, challenged these models by arguing that traditional econometric parameters are not invariant to policy shifts due to agents' rational expectations and behavioral adjustments. This critique motivated a shift toward models incorporating microfoundations and expectations, ensuring that structural parameters account for changes in policy regimes and agents' decision-making processes.

Structural Models: Assumptions and Methodology

Structural econometric models rely on explicit economic theory to specify the functional form and parameters, enabling policy evaluation under varying conditions. These models assume stable deep parameters governing agents' behavior, allowing for predictions that are invariant to policy changes. Their methodology involves formulating equations based on economic primitives and estimating them using micro or macro data while addressing endogeneity and identification challenges.

The Lucas Critique: Core Arguments

The Lucas Critique emphasizes that traditional econometric models fail to account for changes in policy regimes because agents adjust their expectations and behavior based on new policies, rendering historical parameter estimates unreliable. Structural econometric models attempt to address this by explicitly incorporating agents' decision rules and expectations, allowing parameters to remain invariant under policy changes. This approach highlights the necessity of modeling microeconomic foundations and endogenous responses to policies to improve predictive accuracy and policy evaluation.

Impact of the Lucas Critique on Macroeconomic Modeling

The Lucas critique fundamentally challenged traditional structural econometric models by emphasizing that policy evaluations are invalid if they ignore changes in agents' expectations and behavior. This insight led to the development of models incorporating rational expectations and microfoundations, ensuring policy shifts alter underlying structural relationships. As a result, modern macroeconomic modeling relies heavily on dynamic stochastic general equilibrium (DSGE) frameworks to capture endogenous responses to policy changes more accurately.

Structural vs. Reduced-Form Models: A Comparison

Structural econometric models incorporate economic theory to specify relationships between variables, enabling policy evaluation by capturing underlying behavioral mechanisms. In contrast, reduced-form models rely solely on observed correlations without explicit theoretical foundations, limiting their predictive power under policy changes highlighted by the Lucas critique. Thus, structural models address the Lucas critique by accounting for shifts in agents' expectations and decision rules, whereas reduced-form models often fail to adapt to such changes.

Policy Evaluation: Structural Models vs. Lucas Critique

Structural econometric models explicitly specify economic relationships using detailed theoretical foundations, enabling policy evaluation by simulating counterfactual scenarios and estimating causal effects under changing policy regimes. In contrast, the Lucas critique highlights that policy changes alter agents' expectations and behavior, rendering traditional reduced-form models unreliable for policy analysis due to parameter instability. Combining structural models with forward-looking expectations addresses the Lucas critique by incorporating endogenous behavioral responses, thus enhancing the credibility and robustness of policy evaluation.

Responses and Adaptations to the Lucas Critique

Structural econometric models often face challenges due to the Lucas critique, which highlights their tendency to produce biased policy evaluations when agents change behavior in response to policy shifts. To address this, researchers incorporate microfoundations and model agents' expectations explicitly, allowing parameters to adapt endogenously to policy changes. This approach improves robustness by aligning structural models with rational expectations, enhancing the credibility of policy simulations under varying economic regimes.

Future Directions in Structural Econometric Modeling

Future directions in structural econometric modeling emphasize developing techniques that explicitly account for Lucas critique by integrating agents' forward-looking behavior and policy regime shifts. Advances in dynamic structural models leverage machine learning and computational power to better identify causal mechanisms under changing policy environments. Researchers prioritize robust model specification strategies that incorporate microeconomic foundations to improve predictive accuracy and policy evaluation.

Structural Econometric Models Infographic

libterm.com

libterm.com