The Friedman rule advocates for setting nominal interest rates at zero to achieve optimal monetary policy and minimize inflation costs. This approach can stabilize the economy by aligning money supply growth with real economic output, reducing distortions caused by inflation. Discover how applying the Friedman rule can impact Your financial decisions and economic understanding in the rest of the article.

Table of Comparison

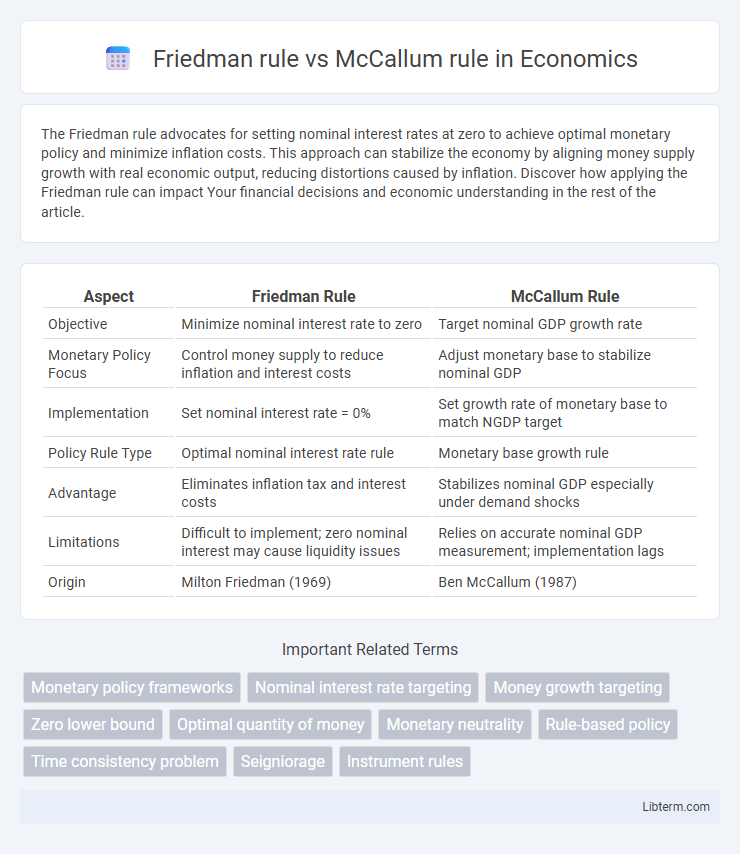

| Aspect | Friedman Rule | McCallum Rule |

|---|---|---|

| Objective | Minimize nominal interest rate to zero | Target nominal GDP growth rate |

| Monetary Policy Focus | Control money supply to reduce inflation and interest costs | Adjust monetary base to stabilize nominal GDP |

| Implementation | Set nominal interest rate = 0% | Set growth rate of monetary base to match NGDP target |

| Policy Rule Type | Optimal nominal interest rate rule | Monetary base growth rule |

| Advantage | Eliminates inflation tax and interest costs | Stabilizes nominal GDP especially under demand shocks |

| Limitations | Difficult to implement; zero nominal interest may cause liquidity issues | Relies on accurate nominal GDP measurement; implementation lags |

| Origin | Milton Friedman (1969) | Ben McCallum (1987) |

Introduction to Monetary Policy Rules

Monetary policy rules like the Friedman rule and the McCallum rule provide systematic frameworks for central banks to adjust the money supply and influence economic stability. The Friedman rule emphasizes maintaining a zero nominal interest rate to minimize inflation costs, advocating for a constant growth rate in the money supply aligned with real output growth. The McCallum rule focuses on targeting the nominal money stock based on a feedback mechanism using observed economic variables, aiming to stabilize nominal GDP by adjusting monetary aggregates.

Overview of the Friedman Rule

The Friedman Rule advocates for a zero nominal interest rate by setting the money growth rate equal to the negative of the real interest rate, minimizing the opportunity cost of holding money and reducing inflation-related distortions. It emphasizes the optimal quantity of money to achieve price stability and maximize welfare without resorting to active monetary policy interventions. This rule contrasts with the McCallum Rule, which prescribes targeting nominal GDP growth to stabilize economic fluctuations through adjusted money supply growth.

Key Principles of the McCallum Rule

The McCallum Rule targets stable nominal GDP growth by specifying a growth rate for the monetary base, using a feedback mechanism based on past nominal GDP deviations from target levels. Its key principle involves adjusting money supply growth to stabilize nominal GDP rather than focusing solely on inflation targeting like the Friedman Rule. This approach aims to reduce output variability by responding to monetary base changes in real time, emphasizing the role of money supply control in modern monetary policy.

Historical Context and Development

The Friedman rule, formulated by economist Milton Friedman in the 1960s, advocates for a constant, zero nominal interest rate through deflation to minimize the opportunity cost of holding money, rooted in monetarist theories emphasizing stable money supply growth. The McCallum rule, developed by economist Bennett T. McCallum in the late 1980s, proposes a feedback-based monetary targeting rule that adjusts the money supply growth according to deviations in nominal GDP from its target, reflecting advancements in rules-based monetary policy design. Both rules emerged as responses to challenges in controlling inflation and stabilizing economic output, influencing central banking practices and the evolution of monetary policy frameworks.

Mechanisms of Action: Friedman vs. McCallum

The Friedman rule advocates for a constant nominal interest rate set at zero to minimize the opportunity cost of holding money, thereby reducing inflation and stabilizing price levels. In contrast, the McCallum rule adjusts the money supply growth rate based on deviations of nominal GDP from its target level, using a feedback mechanism to stabilize economic fluctuations. While Friedman's approach targets steady money growth to control inflation, McCallum's method relies on active monetary policy interventions responding to real-time economic conditions.

Impact on Inflation and Employment

The Friedman rule aims to minimize nominal interest rates to reduce inflation, promoting price stability but potentially limiting monetary policy flexibility for employment stabilization. In contrast, the McCallum rule targets adjusting the monetary base growth in response to economic conditions, balancing inflation control with employment objectives by allowing more responsive interventions. Empirical studies show the McCallum rule can better accommodate short-term fluctuations in employment without triggering significant inflationary pressures.

Flexibility and Practical Implementation

The Friedman rule advocates for a constant nominal interest rate, effectively zero money growth, promoting price level stability but limiting policy flexibility in response to economic shocks. In contrast, the McCallum rule adjusts the monetary base growth based on deviations of nominal GDP from target levels, offering more adaptability to changing economic conditions. Practical implementation favors the McCallum rule due to its data responsiveness and ability to accommodate real-time economic fluctuations, whereas the Friedman rule's rigidity can hinder timely and effective monetary interventions.

Empirical Evidence and Comparisons

Empirical evidence reveals that the Friedman rule, advocating for a zero nominal interest rate to minimize distortionary costs, often faces practical limitations due to the zero lower bound and real-world frictions. In contrast, the McCallum rule, which targets nominal GDP growth through monetary aggregates, demonstrates more consistent predictability and policy guidance across diverse economic conditions. Comparative studies indicate the McCallum rule provides a more adaptable framework for stabilizing output and inflation, especially when central banks confront imperfect information and changing economic dynamics.

Criticisms and Limitations

The Friedman rule faces criticism for its assumption of zero nominal interest rates, which can be impractical in economies with positive inflation or rigidities. The McCallum rule, while more flexible by targeting monetary aggregates, struggles with delays in data availability and potential instability due to reliance on precise estimates of velocity and output. Both rules face limitations in real-world application, as they may not adequately address financial market imperfections or unexpected economic shocks.

Conclusion: Choosing Between Friedman and McCallum

Choosing between the Friedman rule and the McCallum rule depends on the central bank's priorities regarding inflation control and money supply targeting. The Friedman rule advocates for a zero nominal interest rate to minimize inflation costs, while the McCallum rule emphasizes adjusting the monetary base in response to nominal GDP growth, offering flexibility in dynamic economic conditions. Central banks seeking strict inflation targets may prefer Friedman's approach, whereas those prioritizing responsiveness to economic fluctuations often favor McCallum's framework.

Friedman rule Infographic

libterm.com

libterm.com