The Resource-Based View (RBV) emphasizes that a firm's sustainable competitive advantage stems from its unique resources and capabilities that are valuable, rare, inimitable, and non-substitutable. Understanding how to identify and leverage these strategic assets can significantly enhance your company's long-term performance. Explore the rest of this article to learn how to apply RBV effectively in your business strategy.

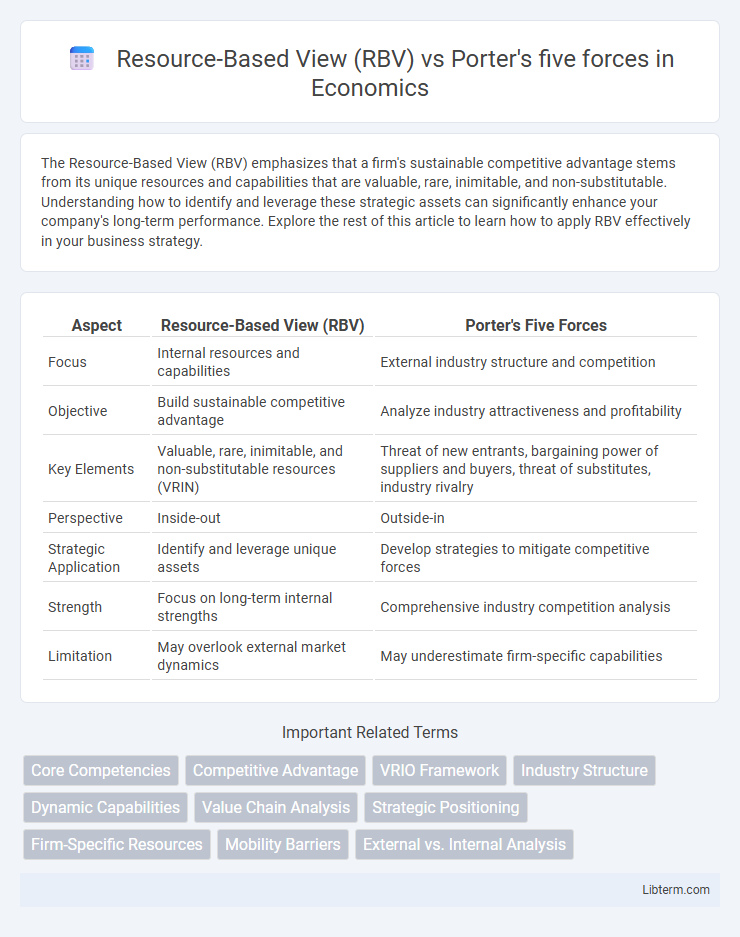

Table of Comparison

| Aspect | Resource-Based View (RBV) | Porter's Five Forces |

|---|---|---|

| Focus | Internal resources and capabilities | External industry structure and competition |

| Objective | Build sustainable competitive advantage | Analyze industry attractiveness and profitability |

| Key Elements | Valuable, rare, inimitable, and non-substitutable resources (VRIN) | Threat of new entrants, bargaining power of suppliers and buyers, threat of substitutes, industry rivalry |

| Perspective | Inside-out | Outside-in |

| Strategic Application | Identify and leverage unique assets | Develop strategies to mitigate competitive forces |

| Strength | Focus on long-term internal strengths | Comprehensive industry competition analysis |

| Limitation | May overlook external market dynamics | May underestimate firm-specific capabilities |

Introduction to Strategic Management Frameworks

Resource-Based View (RBV) emphasizes internal firm resources and capabilities as sources of sustained competitive advantage, highlighting unique assets, skills, and knowledge. Porter's Five Forces analyzes external industry dynamics by assessing competitive rivalry, threat of new entrants, bargaining power of suppliers and buyers, and threat of substitutes. Both frameworks complement strategic management by balancing internal strengths with external market conditions to guide strategic decision-making.

Overview of the Resource-Based View (RBV)

The Resource-Based View (RBV) emphasizes internal firm resources such as tangible assets, intangible assets, and organizational capabilities as key drivers of competitive advantage. Unlike Porter's Five Forces, which analyzes external industry structure and market competition, RBV focuses on leveraging unique, valuable, rare, and inimitable resources within the firm to achieve sustained performance. This perspective highlights how resource heterogeneity and immobility contribute to a firm's distinct strategic positioning and long-term profitability.

Key Concepts and Assumptions of RBV

The Resource-Based View (RBV) emphasizes the importance of firm-specific resources and capabilities as the primary drivers of competitive advantage and superior performance. It assumes resources must be valuable, rare, inimitable, and non-substitutable (VRIN) to sustain long-term profitability. Unlike Porter's Five Forces, which analyzes external industry forces affecting competition, RBV focuses internally on leveraging unique assets to create and maintain strategic differentiation.

Understanding Porter’s Five Forces Model

Porter's Five Forces model analyzes industry competitiveness by examining five critical factors: the threat of new entrants, bargaining power of suppliers, bargaining power of buyers, threat of substitute products, and industry rivalry. This framework helps businesses assess external pressures shaping profitability and strategic positioning within the market. Understanding these forces enables firms to identify opportunities and threats, guiding decisions to strengthen competitive advantage.

Core Components and Analytical Focus of Porter’s Model

Porter's Five Forces model centers on analyzing industry structure through five core components: competitive rivalry, threat of new entrants, bargaining power of suppliers, bargaining power of buyers, and threat of substitute products or services. The analytical focus lies in evaluating external competitive forces to determine industry attractiveness and potential profitability. This contrasts with the Resource-Based View (RBV), which emphasizes internal firm resources and capabilities as sources of sustainable competitive advantage.

RBV vs Porter’s Five Forces: Fundamental Differences

Resource-Based View (RBV) emphasizes internal capabilities, focusing on unique resources and capabilities as sources of sustained competitive advantage, while Porter's Five Forces analyzes external industry structure and competitive forces to determine profitability. RBV highlights the importance of valuable, rare, inimitable, and non-substitutable (VRIN) resources, contrasting with Porter's framework that assesses supplier power, buyer power, threat of new entrants, threat of substitutes, and competitive rivalry. The fundamental difference lies in RBV's internal, resource-centric perspective compared to Porter's external, market-structure approach to strategy formulation.

Comparative Analysis: Internal vs External Focus

Resource-Based View (RBV) emphasizes internal organizational resources and capabilities as sources of sustained competitive advantage, focusing on unique assets such as proprietary technology, skilled personnel, and brand reputation. In contrast, Porter's Five Forces framework analyzes external industry forces--threat of new entrants, bargaining power of suppliers and buyers, threat of substitutes, and competitive rivalry--to assess market attractiveness and profitability. RBV prioritizes leveraging internal strengths for differentiation, whereas Porter's model concentrates on understanding and responding to external competitive pressures.

Practical Applications in Business Strategy

Resource-Based View (RBV) emphasizes leveraging internal core competencies and unique assets to achieve sustainable competitive advantage, guiding firms in identifying and nurturing valuable, rare, inimitable, and non-substitutable resources. Porter's Five Forces framework assists businesses in analyzing external industry dynamics such as competitive rivalry, supplier power, buyer power, threat of substitution, and threat of new entrants to shape strategies that mitigate competitive pressures. Combining RBV with Five Forces allows firms to align internal resource strengths with external market conditions, enhancing strategic decision-making and long-term profitability.

Advantages and Limitations of Each Framework

The Resource-Based View (RBV) emphasizes internal firm resources and capabilities as sources of competitive advantage, offering a deep understanding of unique assets but may overlook external market dynamics. Porter's Five Forces analyze industry structure and competitive forces, providing insights into market attractiveness and external threats but can neglect firm-specific strengths and adaptability. Combining RBV's internal focus with Porter's external analysis enables a more comprehensive strategic perspective, balancing resource leverage with competitive positioning.

Integrating RBV and Porter’s Five Forces for Comprehensive Strategy

Integrating the Resource-Based View (RBV) with Porter's Five Forces framework enhances strategic analysis by combining internal resource strengths with external industry dynamics. RBV emphasizes firm-specific assets and capabilities that create sustainable competitive advantage, while Porter's Five Forces evaluates competitive pressures shaping industry profitability. A comprehensive strategy leverages RBV to build unique resources that mitigate threats identified through the Five Forces, enabling more resilient positioning in competitive markets.

Resource-Based View (RBV) Infographic

libterm.com

libterm.com