The bond's coupon rate determines the fixed annual interest income investors will receive based on the bond's face value, playing a crucial role in assessing investment returns. This rate affects the bond's market price and overall yield, influencing decisions on buying or selling in various interest rate environments. Explore the rest of this article to understand how your investments can benefit from effective coupon rate strategies.

Table of Comparison

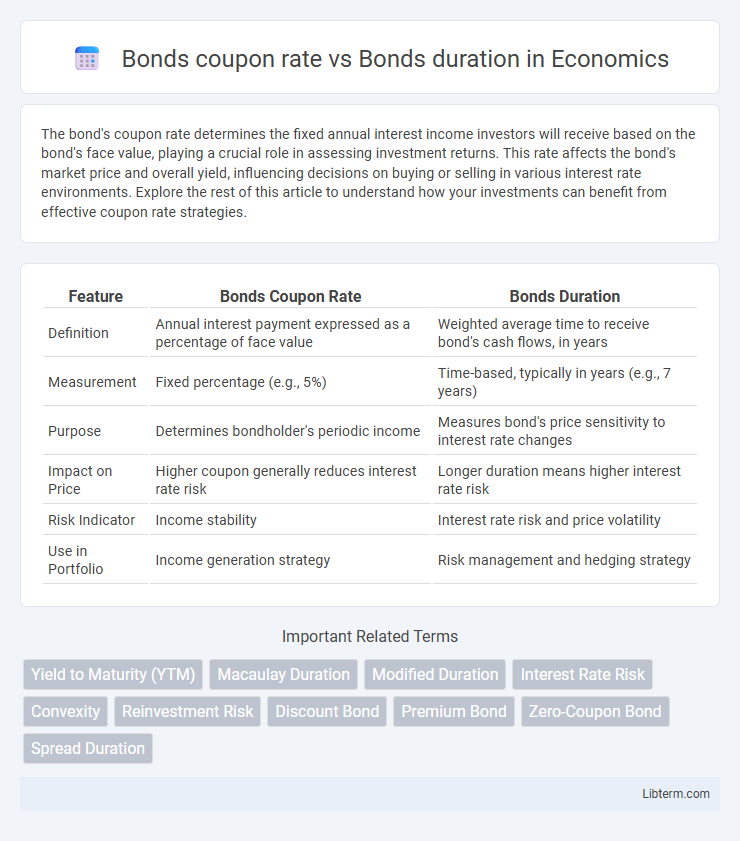

| Feature | Bonds Coupon Rate | Bonds Duration |

|---|---|---|

| Definition | Annual interest payment expressed as a percentage of face value | Weighted average time to receive bond's cash flows, in years |

| Measurement | Fixed percentage (e.g., 5%) | Time-based, typically in years (e.g., 7 years) |

| Purpose | Determines bondholder's periodic income | Measures bond's price sensitivity to interest rate changes |

| Impact on Price | Higher coupon generally reduces interest rate risk | Longer duration means higher interest rate risk |

| Risk Indicator | Income stability | Interest rate risk and price volatility |

| Use in Portfolio | Income generation strategy | Risk management and hedging strategy |

Introduction to Bonds: Coupon Rate and Duration

The coupon rate of a bond represents the annual interest payment expressed as a percentage of the bond's face value, directly influencing investor income. Duration measures the bond's sensitivity to interest rate changes, reflecting the weighted average time to receive the bond's cash flows. Understanding both coupon rate and duration is crucial for assessing a bond's risk and return profile in fixed-income investing.

Understanding Bond Coupon Rates

Bond coupon rates represent the fixed annual interest payments expressed as a percentage of the bond's face value, directly influencing the investor's cash flow. While coupon rates determine periodic income, bond duration measures the bond's sensitivity to interest rate changes, reflecting risk and price volatility over time. Understanding the coupon rate is crucial for assessing income expectations and comparing bonds with different maturities and durations.

What is Bond Duration?

Bond duration measures the sensitivity of a bond's price to changes in interest rates, representing the weighted average time until the bond's cash flows are received. Unlike the bond's coupon rate, which is the fixed annual interest payment expressed as a percentage of the face value, duration provides a more comprehensive risk assessment by incorporating coupon payments, maturity, and yield. Investors use bond duration to estimate potential price volatility and to manage interest rate risk in fixed income portfolios.

Importance of Coupon Rate in Bond Investment

The coupon rate directly influences a bond's periodic interest payments, making it a critical factor for income-focused investors seeking steady cash flow. Higher coupon rates typically reduce a bond's sensitivity to interest rate changes, thereby shortening its effective duration and lowering interest rate risk. Understanding the balance between coupon rate and duration helps investors optimize their portfolios for both income stability and market volatility resilience.

How Duration Measures Interest Rate Risk

Bond duration quantifies the sensitivity of a bond's price to changes in interest rates, expressing the weighted average time until cash flows are received. Unlike the coupon rate, which directly affects periodic interest payments, duration captures the bond's price volatility risk in response to rate fluctuations. Lower coupon rates generally increase duration, indicating higher interest rate risk, as investors wait longer for substantial cash flows.

Relationship Between Coupon Rate and Duration

The coupon rate of a bond inversely affects its duration because bonds with higher coupon rates provide larger periodic cash flows, reducing the sensitivity of the bond's price to interest rate changes. Bonds with lower coupon rates pay smaller interest amounts, resulting in longer durations and greater price volatility. Duration measures the weighted average time to receive bond payments, so as the coupon rate increases, duration typically decreases.

Factors Influencing Both Coupon Rate and Duration

The coupon rate of a bond is primarily influenced by prevailing interest rates, issuer credit quality, and bond maturity, which dictate the periodic interest payments to investors. Duration, measuring the bond's price sensitivity to interest rate changes, depends on the coupon rate, time to maturity, and yield to maturity, with lower coupon rates and longer maturities increasing duration. Market interest rate volatility and inflation expectations also significantly impact both the coupon rate setting and the bond's duration, affecting investor demand and interest rate risk exposure.

Impact of Interest Rate Changes on Bonds

Bonds with higher coupon rates typically exhibit shorter durations, making them less sensitive to interest rate changes, while bonds with lower coupon rates have longer durations and greater price volatility. When interest rates rise, bond prices fall more sharply for long-duration bonds, magnifying losses for holders of low-coupon securities. Investors managing interest rate risk often prefer bonds with higher coupons and shorter durations to reduce exposure to rate fluctuations.

Strategies for Balancing Coupon Rate and Duration

Investors seeking to balance bond coupon rate and duration often adopt laddering strategies, investing in bonds with varying maturities and coupon payments to mitigate interest rate risk while maintaining steady income. High coupon bonds generate more regular cash flow but typically have shorter durations, reducing sensitivity to interest rate fluctuations, whereas low coupon bonds tend to have longer durations, increasing price volatility. Diversifying across different coupon rates and maturities enables portfolio resilience by optimizing yield and managing duration risk effectively.

Conclusion: Choosing Bonds Based on Coupon Rate vs. Duration

Selecting bonds with a higher coupon rate typically provides more immediate income through periodic interest payments, which is beneficial in a rising interest rate environment. Conversely, bonds with longer durations carry greater interest rate risk but may offer higher capital gains potential if rates decline. Investors should balance their preference for steady cash flow against their tolerance for volatility and interest rate fluctuations when choosing between coupon rates and bond durations.

Bonds coupon rate Infographic

libterm.com

libterm.com