The implicit tax rate measures the effective tax burden on an investment or income by comparing the difference between before-tax and after-tax returns. It reflects hidden taxes embedded in subsidies, preferential treatments, or non-transparent tax policies that may reduce your actual profitability. Explore the article to understand how implicit tax rates impact your financial decisions and investment strategies.

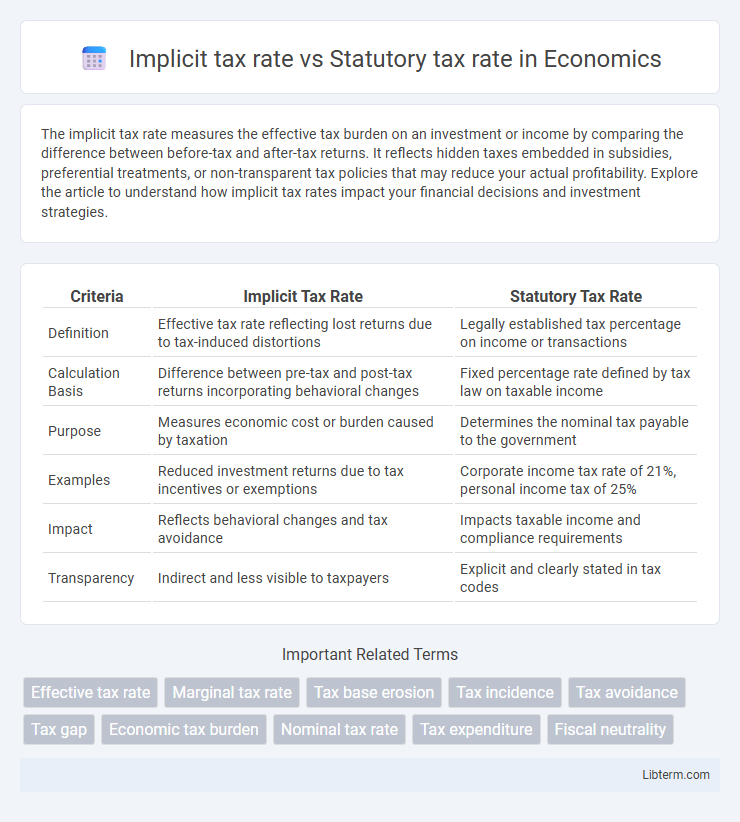

Table of Comparison

| Criteria | Implicit Tax Rate | Statutory Tax Rate |

|---|---|---|

| Definition | Effective tax rate reflecting lost returns due to tax-induced distortions | Legally established tax percentage on income or transactions |

| Calculation Basis | Difference between pre-tax and post-tax returns incorporating behavioral changes | Fixed percentage rate defined by tax law on taxable income |

| Purpose | Measures economic cost or burden caused by taxation | Determines the nominal tax payable to the government |

| Examples | Reduced investment returns due to tax incentives or exemptions | Corporate income tax rate of 21%, personal income tax of 25% |

| Impact | Reflects behavioral changes and tax avoidance | Impacts taxable income and compliance requirements |

| Transparency | Indirect and less visible to taxpayers | Explicit and clearly stated in tax codes |

Introduction to Tax Rates: Implicit vs Statutory

The statutory tax rate represents the legally established percentage a corporation or individual must pay on taxable income, as defined by tax law. In contrast, the implicit tax rate reflects the effective tax burden by accounting for deductions, credits, and other tax provisions, often revealing the true cost of taxation on economic decisions. Understanding the distinction between statutory and implicit tax rates is crucial for assessing the actual impact of taxation on investment and business behavior.

Defining Implicit Tax Rate

The implicit tax rate represents the effective tax burden on an investment by comparing the pre-tax and after-tax returns, reflecting the actual tax impact on economic decisions. Unlike the statutory tax rate, which is the legally prescribed rate set by law, the implicit tax rate accounts for deductions, credits, and other tax provisions that alter the effective tax paid. This rate provides a more accurate measure of the true tax cost on earnings and investment returns within a given jurisdiction.

Understanding Statutory Tax Rate

The statutory tax rate is the legally established percentage set by tax authorities that applies to taxable income of individuals or corporations. It represents the official tax burden before accounting for deductions, credits, or other tax incentives that can affect the actual taxes paid. Understanding the statutory tax rate is essential for comparing tax policies across jurisdictions and assessing potential tax liabilities.

Key Differences Between Implicit and Statutory Tax Rates

Implicit tax rate measures the effective tax burden on a company's economic income, reflecting actual taxes paid relative to accounting profits, while statutory tax rate is the legally mandated percentage imposed on taxable income by law. The implicit tax rate accounts for deductions, credits, and loopholes affecting the actual tax paid, offering a more realistic view of tax impact, whereas the statutory tax rate represents the nominal rate without adjustments. Understanding these differences is crucial for accurate tax planning and financial analysis, as the implicit tax rate reveals the true cost of taxation beyond the statutory figure.

How Implicit Tax Rate Is Calculated

The implicit tax rate is calculated by dividing the total tax paid by the economic income earned, providing a more accurate reflection of the actual tax burden than the statutory tax rate. Unlike the statutory tax rate, which is the legally mandated percentage on taxable income, the implicit rate accounts for all taxes paid, including effective tax liabilities from deductions, credits, and other adjustments. This measure offers insights into the effective tax cost relative to true earnings, capturing the real impact of tax policies on taxpayers.

Factors Affecting Statutory Tax Rates

Statutory tax rates are influenced by government fiscal policies, economic objectives, and legislative changes aimed at revenue generation and redistribution. Factors such as political climate, public expenditure needs, and international tax competition play critical roles in setting these rates. Implicit tax rates, in contrast, reflect the effective tax burden after deductions, credits, and enforcement, differing from the nominal statutory rates announced by law.

Real-World Examples: Implicit vs Statutory Tax Rate

The implicit tax rate represents the effective average tax a firm pays based on total taxes divided by pre-tax profits, while the statutory tax rate is the official rate set by law. For example, Apple Inc. reports a statutory tax rate of around 21%, but its implicit tax rate often falls below 15% due to tax incentives and international tax planning. In contrast, small businesses in the U.S. typically face stricter alignment between implicit and statutory rates, reflecting fewer opportunities for tax avoidance.

Implications for Taxpayers and Businesses

The implicit tax rate measures the effective tax burden by comparing pre- and post-tax returns, revealing the true cost of taxes beyond nominal statutory rates. Taxpayers often face a higher implicit tax rate when deductions, credits, and loopholes are limited, reducing net returns and increasing overall tax impact. Businesses must consider implicit tax rates in investment decisions, as these rates affect after-tax profitability and influence capital allocation, while statutory rates primarily impact compliance and planning strategies.

Policy Considerations: Why the Difference Matters

The difference between implicit tax rate and statutory tax rate influences policy decisions by highlighting the actual tax burden companies face versus the legally prescribed rates. Implicit tax rate accounts for tax incentives and deductions, informing policymakers about economic distortions and efficiency losses caused by tax policies. Understanding this disparity helps design fairer tax systems that minimize market distortions and promote equitable economic growth.

Conclusion: Choosing the Right Tax Rate for Analysis

Selecting the appropriate tax rate for financial analysis depends on the purpose and context of evaluation; the statutory tax rate reflects the legally mandated percentage on taxable income, while the implicit tax rate incorporates actual taxes paid, including deferred and non-cash impacts. Analysts aiming to assess effective tax burdens and real cash outflows should prioritize the implicit tax rate, as it reveals nuances beyond statutory percentages. For policy comparison or regulatory compliance, the statutory rate provides a standardized benchmark but may underestimate the firm's true tax expense.

Implicit tax rate Infographic

libterm.com

libterm.com