Arbitrage Pricing Theory (APT) offers a multifactor approach to asset pricing, identifying multiple macroeconomic factors that influence expected returns beyond a single market index. This model allows investors to assess the sensitivity of an asset's returns to various systematic risks, providing a nuanced understanding of pricing anomalies and market behavior. Discover how APT can enhance Your investment strategies by reading the full article.

Table of Comparison

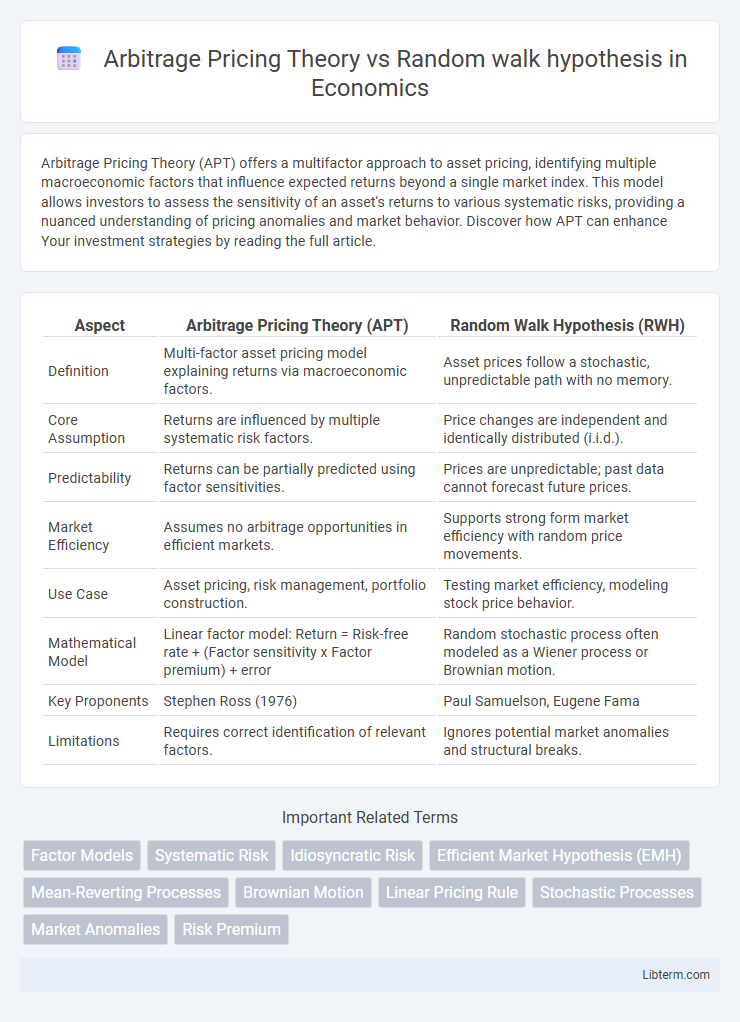

| Aspect | Arbitrage Pricing Theory (APT) | Random Walk Hypothesis (RWH) |

|---|---|---|

| Definition | Multi-factor asset pricing model explaining returns via macroeconomic factors. | Asset prices follow a stochastic, unpredictable path with no memory. |

| Core Assumption | Returns are influenced by multiple systematic risk factors. | Price changes are independent and identically distributed (i.i.d.). |

| Predictability | Returns can be partially predicted using factor sensitivities. | Prices are unpredictable; past data cannot forecast future prices. |

| Market Efficiency | Assumes no arbitrage opportunities in efficient markets. | Supports strong form market efficiency with random price movements. |

| Use Case | Asset pricing, risk management, portfolio construction. | Testing market efficiency, modeling stock price behavior. |

| Mathematical Model | Linear factor model: Return = Risk-free rate + (Factor sensitivity x Factor premium) + error | Random stochastic process often modeled as a Wiener process or Brownian motion. |

| Key Proponents | Stephen Ross (1976) | Paul Samuelson, Eugene Fama |

| Limitations | Requires correct identification of relevant factors. | Ignores potential market anomalies and structural breaks. |

Introduction to Arbitrage Pricing Theory

Arbitrage Pricing Theory (APT) is a multifactor asset pricing model that explains the expected return of a security through various macroeconomic factors, such as inflation rates, interest rates, and market indices. Unlike the Random Walk Hypothesis, which assumes stock prices follow an unpredictable path influenced solely by new information, APT provides a structured framework for identifying pricing inefficiencies based on multiple systematic risk sources. This theory enables investors to exploit arbitrage opportunities by recognizing deviations from predicted returns derived from underlying economic variables.

Understanding the Random Walk Hypothesis

The Random Walk Hypothesis posits that stock prices evolve according to a random path, making future price movements unpredictable and independent of past trends. This theory challenges the Arbitrage Pricing Theory, which models asset returns based on multiple systematic risk factors, by emphasizing market efficiency and the impossibility of consistently outperforming the market through analysis. Understanding the Random Walk Hypothesis is essential for investors who rely on the unpredictability of stock prices to justify passive investment strategies.

Historical Background and Development

Arbitrage Pricing Theory (APT), introduced by Stephen Ross in 1976, emerged as a multifactor alternative to the Capital Asset Pricing Model (CAPM), emphasizing multiple macroeconomic factors influencing asset returns. The Random Walk Hypothesis, popularized by Burton Malkiel in the 1970s, roots in earlier Efficient Market Hypothesis work, proposing that stock prices follow a stochastic, unpredictable path due to the instantaneous incorporation of all available information. Both theories significantly shaped modern financial economics by addressing asset price behavior from fundamentally different perspectives--APT through systematic factor models and Random Walk via market efficiency and unpredictability.

Core Assumptions of Arbitrage Pricing Theory

Arbitrage Pricing Theory (APT) assumes that asset returns are driven by multiple macroeconomic factors, with linear sensitivity to these factors and no arbitrage opportunities allowing for risk premiums. It posits that investors are rational, markets are efficient in eliminating arbitrage, and asset returns can be modeled using a multifactor framework. These core assumptions contrast with the Random Walk Hypothesis, which assumes price changes are independent, identically distributed, and unpredictable.

Fundamental Principles of the Random Walk Hypothesis

The Random Walk Hypothesis posits that stock prices evolve according to a random path, making future price movements unpredictable and independent of past trends. This principle challenges traditional forecasting, asserting that market prices fully reflect all available information at any given time, embodying the efficient market paradigm. In contrast to Arbitrage Pricing Theory, which relies on multiple economic factors influencing asset returns, the Random Walk focuses on price unpredictability as a core concept in financial markets.

Key Differences Between APT and Random Walk Hypothesis

Arbitrage Pricing Theory (APT) models asset returns based on multiple macroeconomic factors, emphasizing systematic risk and offering a multifactor explanation for expected returns. The Random Walk Hypothesis asserts that stock prices move unpredictably and follow a stochastic process, implying past price movements do not predict future performance. APT relies on identifiable risk factors for pricing, while the Random Walk Hypothesis supports market efficiency and unpredictability in price changes.

Empirical Evidence and Academic Critiques

Empirical evidence for Arbitrage Pricing Theory (APT) shows mixed results, with some studies confirming its multi-factor model's ability to explain asset returns better than the Capital Asset Pricing Model (CAPM), while others highlight inconsistencies in factor selection. In contrast, the Random Walk Hypothesis (RWH) gains support from empirical tests indicating that stock prices follow a stochastic process, making them unpredictable in the short term. Academic critiques of APT focus on the model's reliance on identifying relevant economic factors, which lacks a standardized approach, whereas critiques of RWH emphasize the presence of market anomalies and behavioral biases that challenge the hypothesis of purely random price movements.

Practical Applications in Financial Markets

Arbitrage Pricing Theory (APT) enables investors to identify mispriced assets by analyzing multiple macroeconomic factors, improving portfolio diversification and risk management strategies in financial markets. The Random Walk Hypothesis suggests that stock prices follow an unpredictable path, reinforcing passive investment approaches such as index fund investing by emphasizing market efficiency. Practical applications of APT include multifactor modeling for asset pricing and risk assessment, while the Random Walk Hypothesis underpins algorithmic trading strategies that rely on price unpredictability for short-term gains.

Limitations and Challenges of Each Theory

Arbitrage Pricing Theory (APT) faces limitations due to its reliance on identifying multiple macroeconomic factors, which can lead to model misspecification and estimation errors affecting asset pricing accuracy. The Random Walk Hypothesis encounters challenges in explaining market anomalies and investor behavior since it assumes price changes are independent and identically distributed, which contradicts empirical evidence of momentum and mean reversion. Both theories struggle with incorporating real-world complexities such as transaction costs, market frictions, and behavioral biases, reducing their practical applicability in financial markets.

Conclusion: Implications for Investors and Researchers

Arbitrage Pricing Theory (APT) provides investors and researchers a multifactor approach to asset pricing, enabling more precise risk assessment and portfolio optimization strategies compared to the Random Walk Hypothesis, which suggests price changes are unpredictable and markets are efficient. APT's explanatory variables allow for identifying systematic risk sources, improving return forecasting and risk management, whereas the Random Walk Hypothesis implies limited potential for consistent outperformance through market timing or skill. Consequently, investors benefit from APT's structured risk decomposition, while researchers gain a framework to explore market anomalies beyond the purely stochastic processes assumed by the Random Walk Hypothesis.

Arbitrage Pricing Theory Infographic

libterm.com

libterm.com