The wealth effect describes how increases in individuals' perceived wealth, often through rising asset values like stocks or real estate, boost consumer spending and economic activity. When your wealth grows, you're likely to feel more confident about your financial future, prompting higher consumption and investment. Explore the rest of this article to understand how the wealth effect impacts your financial decisions and the broader economy.

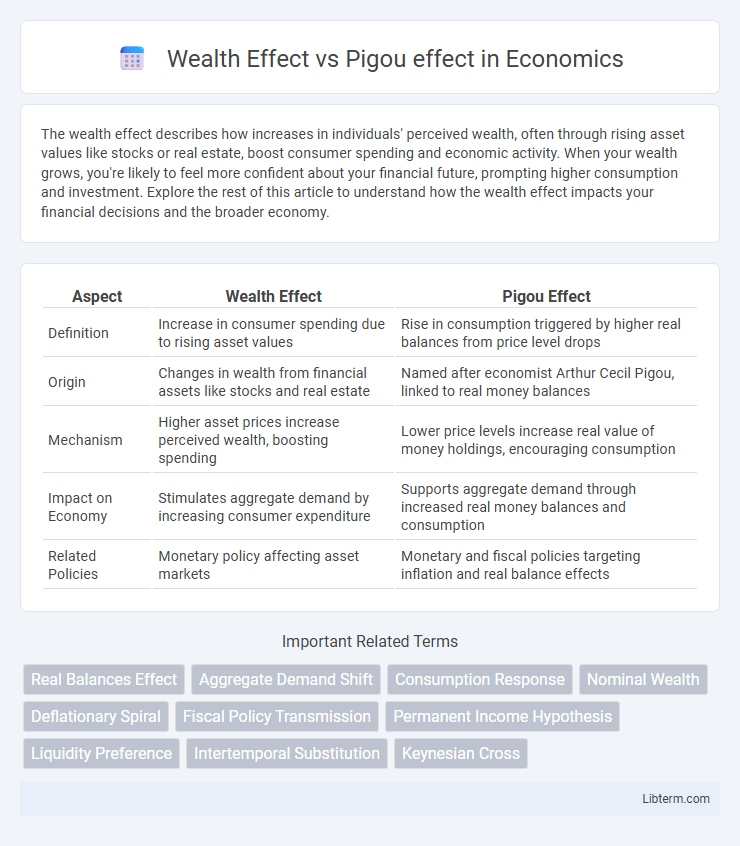

Table of Comparison

| Aspect | Wealth Effect | Pigou Effect |

|---|---|---|

| Definition | Increase in consumer spending due to rising asset values | Rise in consumption triggered by higher real balances from price level drops |

| Origin | Changes in wealth from financial assets like stocks and real estate | Named after economist Arthur Cecil Pigou, linked to real money balances |

| Mechanism | Higher asset prices increase perceived wealth, boosting spending | Lower price levels increase real value of money holdings, encouraging consumption |

| Impact on Economy | Stimulates aggregate demand by increasing consumer expenditure | Supports aggregate demand through increased real money balances and consumption |

| Related Policies | Monetary policy affecting asset markets | Monetary and fiscal policies targeting inflation and real balance effects |

Introduction to Wealth Effect and Pigou Effect

The Wealth Effect refers to the change in consumer spending that results from variations in perceived wealth, often influenced by fluctuations in asset prices such as stocks and real estate. The Pigou Effect, named after economist Arthur Pigou, describes the impact of real balance changes on consumption, where an increase in real money balances boosts purchasing power and thus aggregate demand. Both effects highlight how changes in wealth and real balances can drive shifts in economic activity and consumer behavior.

Defining the Wealth Effect

The Wealth Effect refers to changes in consumer spending resulting from variations in perceived wealth, often driven by fluctuations in asset values such as real estate or stocks. When individuals experience an increase in net worth, they tend to spend more, boosting aggregate demand and stimulating economic growth. This contrasts with the Pigou Effect, which emphasizes real balance effects where lower prices increase real money balances, encouraging higher consumption.

Understanding the Pigou Effect

The Pigou Effect describes the impact of changes in real wealth on consumer spending, where a rise in the price level lowers real money balances, reducing consumption and output. Unlike the Wealth Effect, which emphasizes changes in asset values like housing or stocks, the Pigou Effect specifically highlights the influence of real balances of money on aggregate demand. Understanding this effect is crucial for analyzing how price level fluctuations can stabilize or destabilize the economy by affecting consumers' purchasing power directly.

Historical Background of Both Concepts

The Wealth Effect concept traces back to Keynesian economics in the 1930s, emphasizing changes in consumer spending driven by fluctuations in real wealth, particularly housing and stock market wealth. The Pigou Effect, introduced by economist Arthur Cecil Pigou in the early 20th century, argues that falling prices increase real balances and thus stimulate consumption, countering Keynesian views during deflationary periods. Both effects highlight the role of real wealth or purchasing power in influencing aggregate demand within different macroeconomic frameworks.

Key Differences Between Wealth Effect and Pigou Effect

The Wealth Effect describes how increased consumer wealth, such as rising asset values or savings, boosts consumption and aggregate demand, influencing economic growth. The Pigou Effect specifically relates to real balances of money holdings increasing when price levels fall, leading to higher consumption despite deflationary conditions. Key differences include that the Wealth Effect centers on changes in perceived wealth from asset values, while the Pigou Effect emphasizes the impact of real money balances on consumption in response to price level changes.

Economic Theories Supporting Each Effect

The Wealth Effect is supported by Keynesian economic theory, which emphasizes the role of consumer spending influenced by changes in real wealth, where an increase in asset values like housing or stocks raises consumption and stimulates aggregate demand. The Pigou Effect, rooted in neoclassical economics, argues that lower price levels increase real balances of money, enhancing purchasing power and thereby boosting consumption, which helps restore full employment without needing government intervention. Both theories explain consumption behavior changes but differ in mechanisms: the Wealth Effect focuses on asset appreciation's impact on consumer confidence, while the Pigou Effect centers on the real value of money balances affecting spending.

Real-World Examples and Case Studies

The Wealth Effect is illustrated by the 2000s housing boom in the United States, where rising home values increased consumer spending despite stagnant wages, demonstrating how perceived asset wealth boosts demand. The Pigou Effect was observed during the Great Depression, when falling price levels increased real balances of money, theoretically stimulating consumption, although empirical evidence showed limited recovery without fiscal intervention. Contemporary studies highlight the Wealth Effect's stronger impact on affluent households compared to the Pigou Effect, which often remains constrained by liquidity traps and deflationary expectations.

Implications for Monetary and Fiscal Policy

The Wealth Effect influences consumer spending through changes in asset values, prompting central banks to adjust monetary policy to stabilize demand when asset prices fluctuate. The Pigou Effect emphasizes real balance effects on consumption, suggesting that fiscal policies aimed at increasing real wealth can directly stimulate aggregate demand during deflationary periods. Understanding these effects guides policymakers in balancing interest rate adjustments and government spending to optimize economic growth and stabilize inflation.

Criticisms and Limitations of Each Effect

The Wealth Effect faces criticism for its assumption that increases in asset values directly boost consumer spending, ignoring factors like debt levels and wealth distribution that can dampen this response. The Pigou Effect is limited by its reliance on real balances impacting consumption during deflation, which may not hold in liquidity trap scenarios or when price rigidities exist. Both effects struggle to fully account for complex behavioral responses and macroeconomic variables, limiting their predictive power in real-world economic fluctuations.

Conclusion: Comparing Wealth Effect and Pigou Effect

The wealth effect primarily emphasizes changes in consumer spending driven by variations in real wealth, such as asset prices and household savings, influencing aggregate demand through altered consumption patterns. The Pigou effect highlights the role of real balances, where reductions in price levels increase the real value of money holdings, thereby stimulating consumption and counteracting deflationary pressures. While both effects underscore the impact of real wealth on consumption, the wealth effect focuses on perceived wealth changes, and the Pigou effect stresses real balance adjustments as mechanisms for economic stabilization.

Wealth Effect Infographic

libterm.com

libterm.com