Liquidity risk refers to the potential difficulty a company or individual may face when trying to quickly convert assets into cash without significant loss in value. This risk can impact your ability to meet short-term financial obligations and maintain smooth operations. Explore the rest of this article to understand how to effectively manage liquidity risk and protect your financial stability.

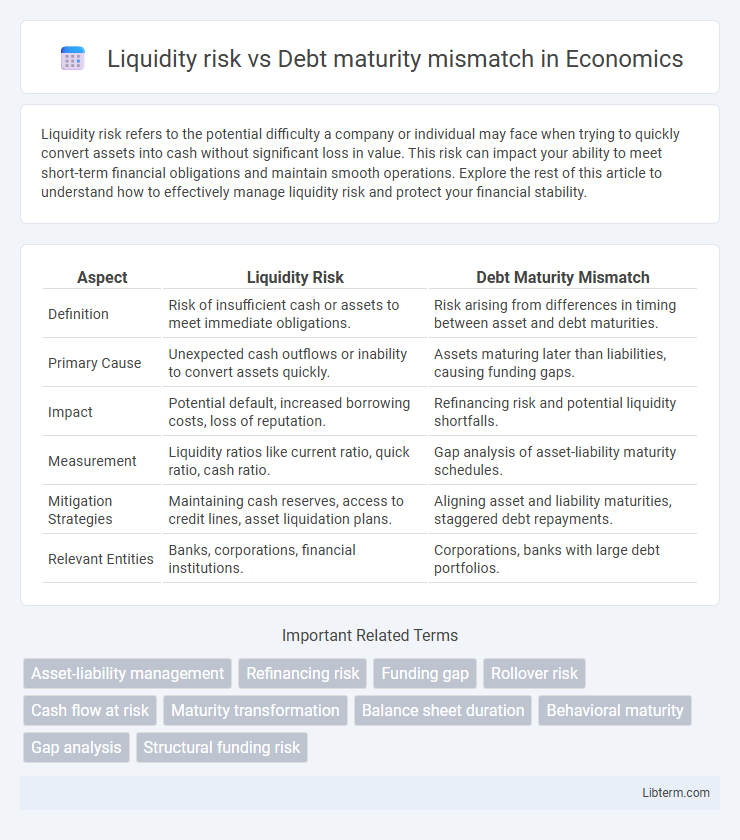

Table of Comparison

| Aspect | Liquidity Risk | Debt Maturity Mismatch |

|---|---|---|

| Definition | Risk of insufficient cash or assets to meet immediate obligations. | Risk arising from differences in timing between asset and debt maturities. |

| Primary Cause | Unexpected cash outflows or inability to convert assets quickly. | Assets maturing later than liabilities, causing funding gaps. |

| Impact | Potential default, increased borrowing costs, loss of reputation. | Refinancing risk and potential liquidity shortfalls. |

| Measurement | Liquidity ratios like current ratio, quick ratio, cash ratio. | Gap analysis of asset-liability maturity schedules. |

| Mitigation Strategies | Maintaining cash reserves, access to credit lines, asset liquidation plans. | Aligning asset and liability maturities, staggered debt repayments. |

| Relevant Entities | Banks, corporations, financial institutions. | Corporations, banks with large debt portfolios. |

Introduction to Liquidity Risk and Debt Maturity Mismatch

Liquidity risk arises when an entity cannot meet its short-term financial obligations due to insufficient cash flow or liquid assets. Debt maturity mismatch occurs when the timing of debt repayments does not align with the company's revenue generation, creating potential liquidity shortfalls. Managing liquidity risk involves analyzing the alignment between debt maturities and cash inflows to ensure solvency under varying market conditions.

Defining Liquidity Risk: Key Concepts

Liquidity risk refers to the potential inability of a firm to meet its short-term financial obligations due to insufficient cash or liquid assets. Debt maturity mismatch occurs when a company's liabilities, particularly debt, have maturities that do not align with the timing of its asset cash flows, leading to elevated liquidity risk. Understanding liquidity risk involves analyzing cash flow timing, asset-liability matching, and the firm's capacity to convert assets into cash without significant loss.

Understanding Debt Maturity Mismatch

Debt maturity mismatch occurs when a company's short-term liabilities come due before it can convert its long-term assets into cash, creating cash flow challenges. This mismatch heightens liquidity risk as the firm may struggle to meet obligations without securing additional funding or liquidating assets prematurely. Effective management of debt maturity profiles is crucial to reduce refinancing risk and ensure sustainable liquidity.

How Liquidity Risk Differs from Maturity Mismatch

Liquidity risk refers to the potential inability to meet short-term financial obligations due to insufficient cash or liquid assets, while debt maturity mismatch arises when the timing of a firm's liabilities does not align with its asset maturities, creating funding gaps. Liquidity risk emphasizes immediate cash flow shortages impacting operational stability, whereas maturity mismatch highlights structural imbalances in asset-liability duration that may lead to refinancing risks. Managing liquidity risk requires maintaining adequate cash reserves and access to credit, whereas addressing maturity mismatch involves strategic planning of debt maturities to synchronize with asset cash flows.

Causes of Debt Maturity Mismatch in Financial Institutions

Debt maturity mismatch in financial institutions primarily arises from borrowing short-term funds while lending long-term, exposing them to refinancing risks. This mismatch is caused by reliance on unstable short-term wholesale funding markets and regulatory constraints limiting long-term capital access. Such practices create vulnerability to liquidity shocks when institutions cannot roll over short-term debt amidst market disruptions.

Impact of Liquidity Risk on Financial Stability

Liquidity risk arises when an institution cannot meet short-term obligations due to insufficient cash flow, often exacerbated by debt maturity mismatch where liabilities mature faster than assets. This imbalance can trigger rapid asset fire sales, eroding market confidence and amplifying financial instability. Persistent liquidity shortages undermine the banking sector's ability to function effectively, posing systemic risks to the broader economy.

Interplay Between Liquidity Risk and Debt Maturity Structure

Liquidity risk intensifies when debt maturity mismatch occurs, as short-term liabilities may outpace the availability of liquid assets, leading to potential funding shortfalls. Efficient management of debt maturity structure reduces refinancing risk and ensures sufficient cash flow to meet obligations, thus mitigating liquidity crises. Firms optimize liquidity by staggering debt maturities to align with operational cash flows and maintain buffer reserves for unforeseen liquidity demands.

Real-World Examples of Debt Maturity Mismatch Crises

Debt maturity mismatch occurs when an institution's short-term liabilities outpace its long-term assets, triggering liquidity risk by forcing asset sales at unfavorable terms. The 2008 Lehman Brothers collapse exemplifies this, where heavy reliance on short-term funding amidst long-term asset holdings led to a rapid liquidity crisis and insolvency. Similarly, Argentina's 2018 sovereign debt crisis highlighted maturity mismatches as short-term debt spikes coincided with restricted access to refinancing, escalating default risk.

Strategies to Mitigate Liquidity Risk and Maturity Mismatch

Effective strategies to mitigate liquidity risk and debt maturity mismatch include maintaining a diversified debt portfolio with staggered maturities to avoid large refinancing needs at once. Firms should establish liquidity reserves through cash holdings or committed credit lines to cover short-term obligations. Conducting regular stress testing and cash flow forecasting enhances preparedness for unexpected liquidity shortfalls and optimizes debt management decisions.

Conclusion: Managing Liquidity and Maturity Risks for Sustainable Finance

Managing liquidity risk and debt maturity mismatch is essential for maintaining financial stability and ensuring sustainable finance. Effective strategies include aligning debt maturities with cash flow cycles, maintaining adequate liquid assets, and implementing robust risk assessment frameworks. These practices help prevent solvency issues, reduce refinancing costs, and support long-term financial resilience.

Liquidity risk Infographic

libterm.com

libterm.com