A regressive tax imposes a heavier relative burden on lower-income individuals by taxing them at a higher effective rate than wealthier taxpayers. This tax structure often disproportionately affects essential goods and services, reducing disposable income for those with limited financial resources. Explore the article to understand how regressive taxes impact your finances and economic equity.

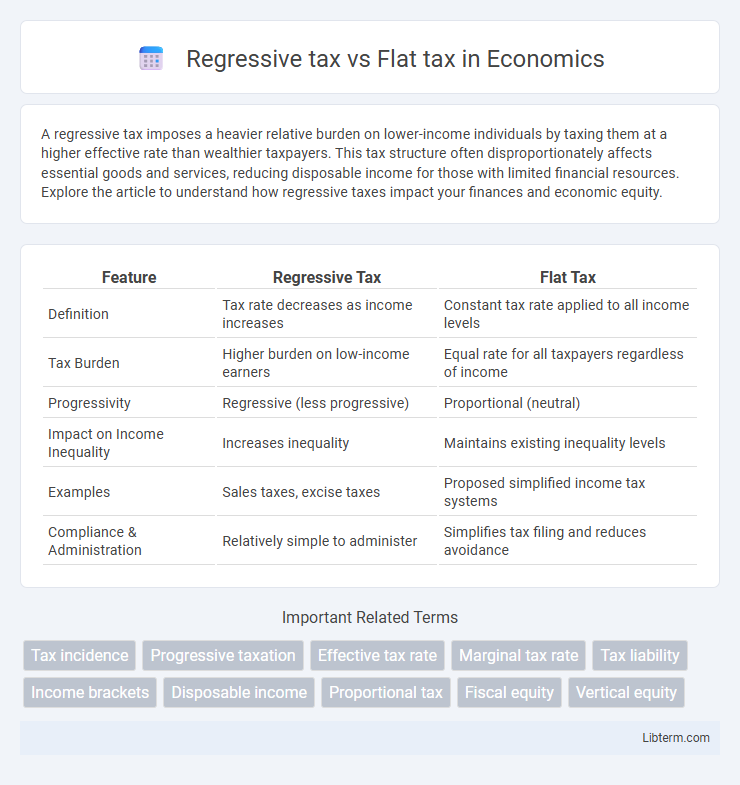

Table of Comparison

| Feature | Regressive Tax | Flat Tax |

|---|---|---|

| Definition | Tax rate decreases as income increases | Constant tax rate applied to all income levels |

| Tax Burden | Higher burden on low-income earners | Equal rate for all taxpayers regardless of income |

| Progressivity | Regressive (less progressive) | Proportional (neutral) |

| Impact on Income Inequality | Increases inequality | Maintains existing inequality levels |

| Examples | Sales taxes, excise taxes | Proposed simplified income tax systems |

| Compliance & Administration | Relatively simple to administer | Simplifies tax filing and reduces avoidance |

Introduction to Taxation Systems

Regressive tax systems impose a higher burden on lower-income earners by taxing them a larger proportion of their income, often through sales taxes on essential goods. Flat tax systems apply a uniform tax rate to all income levels, promoting simplicity but offering less progressivity compared to graduated tax models. Understanding these taxation frameworks is crucial for policymakers aiming to balance revenue generation with economic fairness and efficiency.

What is a Regressive Tax?

A regressive tax imposes a higher relative tax burden on lower-income individuals, meaning the tax rate decreases as income increases. Common examples include sales taxes and excise taxes, which take a larger percentage of income from those with fewer financial resources. This system contrasts with progressive taxation by shifting a disproportionate share of the tax responsibility onto lower earners.

What is a Flat Tax?

A flat tax is a tax system with a constant marginal rate, applying the same percentage to all income levels regardless of earnings. Unlike regressive taxes where lower incomes pay a higher proportion of their income, a flat tax ensures uniform taxation, simplifying compliance and administration. This method aims to promote fairness and economic growth by reducing distortions and incentives to avoid taxes.

Key Differences Between Regressive and Flat Taxes

Regressive taxes levy a higher effective rate on lower-income individuals, making them more burdensome for those with limited financial resources, whereas flat taxes apply a constant rate regardless of income level, treating all taxpayers equally. Regressive tax systems often include sales taxes or excise taxes, which disproportionately impact low-income earners by consuming a larger share of their income, while flat tax systems, such as a single-rate income tax, aim to simplify taxation and reduce rate complexity. The key difference lies in the progression of the tax burden, with regressive taxes increasing the relative strain on poorer populations and flat taxes maintaining uniformity across all income brackets.

Examples of Regressive Taxes

Regressive taxes disproportionately affect lower-income individuals by taking a larger percentage of their income compared to higher earners. Common examples include sales taxes, excise taxes on gasoline and tobacco, and payroll taxes for Social Security, which remain constant regardless of income. These tax structures often exacerbate income inequality, as lower-income households spend a higher share of their earnings on taxed goods and services.

Examples of Flat Tax Structures

Flat tax structures apply a single constant tax rate to all taxpayers regardless of income level, simplifying tax compliance and administration. Examples of flat tax systems include countries such as Estonia, which levies a flat 20% income tax, and Russia, where a 13% flat tax rate is applied. These models contrast with regressive tax systems like sales taxes and excise taxes, which disproportionately affect lower-income individuals by taxing consumption rather than income.

Economic Impacts of Regressive Taxation

Regressive taxation disproportionately burdens low-income households by allocating a higher percentage of their earnings toward taxes compared to wealthier individuals, leading to increased income inequality and reduced consumer spending power. This shift can suppress overall economic growth by limiting access to essential goods and services for lower-income groups, which are critical drivers of demand. Moreover, regressive taxes may exacerbate poverty rates and strain social safety nets, hindering long-term economic stability and mobility.

Social Implications of Flat Taxes

Flat taxes impose a uniform tax rate on all income levels, which can reduce administrative complexity but often place a heavier burden on lower-income individuals, potentially increasing income inequality. Unlike regressive taxes that disproportionately affect low earners or progressive taxes that target higher incomes, flat taxes do not adjust for taxpayers' ability to pay, leading to concerns about fairness and social equity. Critics argue that flat tax systems may limit social mobility and strain public services by reducing the redistributive function essential for supporting vulnerable populations.

Pros and Cons of Each Tax System

Regressive tax systems place a higher relative burden on low-income individuals, leading to increased financial strain and reduced economic equity, but they are simpler to administer and can encourage spending among higher earners. Flat tax systems provide a uniform tax rate on all income levels, promoting fairness and ease of calculation, yet they may disproportionately benefit wealthier taxpayers and reduce progressivity in the tax code. Both systems impact income distribution differently, with regressive taxes potentially increasing inequality, while flat taxes often face criticism for insufficiently addressing the needs of lower-income groups.

Which Tax System is More Equitable?

A regressive tax places a heavier burden on lower-income individuals by taxing a larger proportion of their income, whereas a flat tax applies the same rate to all taxpayers regardless of income level. Flat tax systems promote equity through simplicity and uniformity, preventing disproportionate impacts on vulnerable populations. Evaluating equity requires considering taxpayer ability to pay, with many economists arguing that progressive structures, rather than flat or regressive taxes, more effectively address fairness in taxation.

Regressive tax Infographic

libterm.com

libterm.com