Monetary targeting focuses on controlling the growth of money supply to achieve economic stability and control inflation. Central banks use this strategy by setting specific money supply targets to influence interest rates and economic activity. Discover how monetary targeting can impact your financial environment by reading the rest of the article.

Table of Comparison

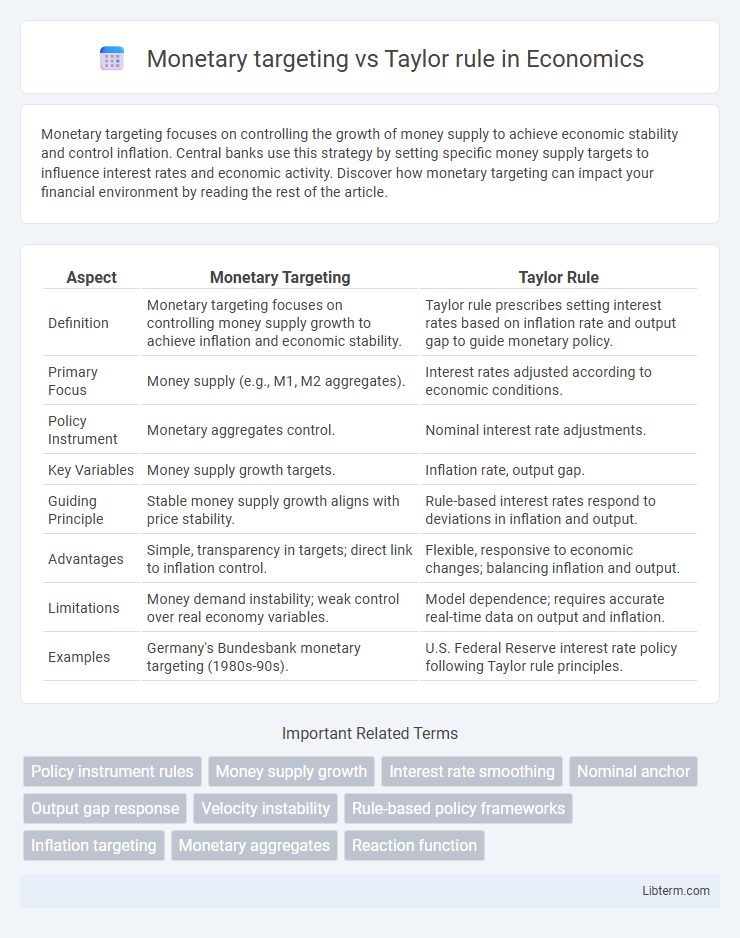

| Aspect | Monetary Targeting | Taylor Rule |

|---|---|---|

| Definition | Monetary targeting focuses on controlling money supply growth to achieve inflation and economic stability. | Taylor rule prescribes setting interest rates based on inflation rate and output gap to guide monetary policy. |

| Primary Focus | Money supply (e.g., M1, M2 aggregates). | Interest rates adjusted according to economic conditions. |

| Policy Instrument | Monetary aggregates control. | Nominal interest rate adjustments. |

| Key Variables | Money supply growth targets. | Inflation rate, output gap. |

| Guiding Principle | Stable money supply growth aligns with price stability. | Rule-based interest rates respond to deviations in inflation and output. |

| Advantages | Simple, transparency in targets; direct link to inflation control. | Flexible, responsive to economic changes; balancing inflation and output. |

| Limitations | Money demand instability; weak control over real economy variables. | Model dependence; requires accurate real-time data on output and inflation. |

| Examples | Germany's Bundesbank monetary targeting (1980s-90s). | U.S. Federal Reserve interest rate policy following Taylor rule principles. |

Introduction to Monetary Policy Frameworks

Monetary targeting emphasizes controlling money supply growth to achieve price stability, relying on predictable relationships between money aggregates and inflation. The Taylor rule prescribes interest rate adjustments based on deviations of inflation and output from their target levels, providing a systematic approach to policy decisions. Both frameworks offer distinct mechanisms for central banks to influence economic activity and stabilize inflation in varying economic contexts.

Fundamentals of Monetary Targeting

Monetary targeting involves controlling a specific monetary aggregate, such as M1 or M2, to achieve inflation and economic growth targets based on the stable relationship between money supply and nominal GDP. This approach relies on fundamental principles like the quantity theory of money, which links changes in money supply directly to price levels. Unlike the Taylor rule, which adjusts interest rates based on output gaps and inflation deviations, monetary targeting emphasizes predictable growth rates of money to anchor inflation expectations.

Overview of the Taylor Rule

The Taylor Rule provides a systematic framework for setting interest rates based on deviations of inflation from its target and output from its potential, offering a rule-based monetary policy approach. It incorporates key economic variables such as the inflation gap and output gap to adjust the nominal interest rate, promoting stability and predictable policy responses. Unlike monetary targeting, which focuses on controlling money supply growth, the Taylor Rule directly links interest rate decisions to economic conditions, enhancing responsiveness to inflationary pressures and economic fluctuations.

Key Objectives: Inflation vs. Output Stabilization

Monetary targeting primarily focuses on controlling inflation by regulating money supply growth to achieve price stability, making it a rule-based approach centered on long-term inflation objectives. The Taylor rule emphasizes balancing inflation control and output stabilization by adjusting interest rates in response to deviations of inflation from its target and output from its potential, providing a systematic, data-driven response to economic fluctuations. While monetary targeting aims at maintaining steady inflation rates, the Taylor rule integrates real-time economic conditions to stabilize both inflation and employment levels.

Operational Mechanisms: Money Supply vs. Interest Rates

Monetary targeting focuses on controlling the money supply to influence inflation and economic growth, relying on measures such as M1 or M2 aggregates as operational targets. The Taylor rule adjusts short-term interest rates based on deviations of actual inflation from target inflation and output from potential output, using a formula to guide central bank policy rates. While monetary targeting directly manages liquidity in the economy, the Taylor rule operationalizes policy through interest rate adjustments to stabilize inflation and output.

Historical Performance and Case Studies

Monetary targeting proved effective during the 1980s when central banks aimed to control inflation by setting explicit growth rates for money supply, as seen in countries like the United States and Germany. The Taylor rule, introduced in the 1990s, offered a systematic approach by linking interest rate decisions to inflation and output gaps, with empirical evidence showing improved macroeconomic stability in advanced economies such as the United States and Canada. Case studies highlight the Federal Reserve's transition from monetary targeting under Volcker to a Taylor rule-based framework under Greenspan, correlating with reduced inflation volatility and enhanced economic growth.

Flexibility and Credibility in Policy Implementation

Monetary targeting offers clear, quantifiable goals that enhance policy credibility but often lacks flexibility to respond swiftly to economic shocks or changing financial conditions. The Taylor rule introduces adaptive flexibility by adjusting interest rates based on inflation and output gaps, providing a more responsive framework for monetary policy. While the Taylor rule improves flexibility, its credibility depends on accurate data and consistent implementation, which can be challenged by economic uncertainties and model limitations.

Advantages and Limitations of Monetary Targeting

Monetary targeting provides a clear and transparent framework by focusing on controlling money supply growth to achieve price stability and predict inflation trends. It offers simplicity and straightforward implementation, which can anchor expectations effectively during stable economic conditions. However, its limitations include vulnerability to shifts in money velocity and the evolving financial landscape, reducing its reliability in dynamic or crisis periods compared to the Taylor rule's responsiveness to interest rates and economic fluctuations.

Strengths and Weaknesses of the Taylor Rule

The Taylor Rule provides a systematic framework for setting interest rates based on inflation and output gaps, enhancing transparency and predictability in monetary policy. Its strength lies in effectively stabilizing inflation and economic fluctuations, but it may struggle in times of supply shocks or when economic conditions deviate from historical norms. A key weakness is the reliance on accurate real-time data, as misestimations of output gaps or natural interest rates can lead to inappropriate policy responses.

Future Prospects and Policy Implications

Monetary targeting emphasizes controlling money supply growth to stabilize inflation, proving effective during stable velocity periods but challenged by financial innovation and changing velocity dynamics. The Taylor rule provides a systematic approach to adjusting interest rates based on inflation and output gaps, enhancing transparency and predictability in monetary policy. Future policy implications suggest blending monetary targeting's focus on supply with the Taylor rule's responsiveness to economic conditions to achieve flexible and credible inflation control.

Monetary targeting Infographic

libterm.com

libterm.com