Exchange rate targeting is a monetary policy strategy where a country pegs its currency to another currency or a basket of currencies to stabilize exchange rates and control inflation. This approach helps maintain competitiveness in international trade and reduces uncertainty for investors and businesses operating across borders. Explore the rest of the article to understand how exchange rate targeting can impact your economy and financial decisions.

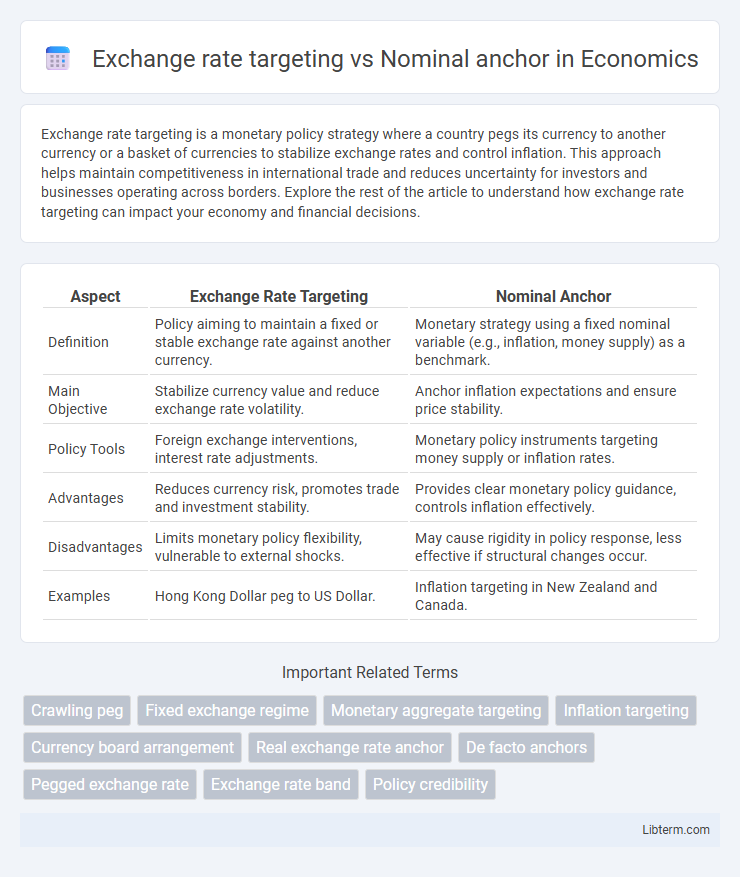

Table of Comparison

| Aspect | Exchange Rate Targeting | Nominal Anchor |

|---|---|---|

| Definition | Policy aiming to maintain a fixed or stable exchange rate against another currency. | Monetary strategy using a fixed nominal variable (e.g., inflation, money supply) as a benchmark. |

| Main Objective | Stabilize currency value and reduce exchange rate volatility. | Anchor inflation expectations and ensure price stability. |

| Policy Tools | Foreign exchange interventions, interest rate adjustments. | Monetary policy instruments targeting money supply or inflation rates. |

| Advantages | Reduces currency risk, promotes trade and investment stability. | Provides clear monetary policy guidance, controls inflation effectively. |

| Disadvantages | Limits monetary policy flexibility, vulnerable to external shocks. | May cause rigidity in policy response, less effective if structural changes occur. |

| Examples | Hong Kong Dollar peg to US Dollar. | Inflation targeting in New Zealand and Canada. |

Introduction to Exchange Rate Targeting and Nominal Anchors

Exchange rate targeting involves stabilizing a country's currency value by pegging it to a foreign currency or a basket to control inflation and enhance trade predictability. Nominal anchors, such as inflation targeting or money supply targets, provide a reference point for monetary policy to anchor expectations and maintain price stability. Both tools are crucial for managing exchange rate volatility and ensuring long-term economic stability in open economies.

Defining Exchange Rate Targeting

Exchange rate targeting involves fixing a country's currency value to a specific foreign currency or basket of currencies to stabilize inflation and control monetary policy. This strategy provides a clear nominal anchor by directly linking domestic prices to an external currency, reducing exchange rate volatility and inflation uncertainty. Unlike broader nominal anchors such as inflation targeting or money supply targets, exchange rate targeting commits the central bank to maintaining exchange rate stability as the primary policy focus.

Understanding Nominal Anchors

Nominal anchors are crucial monetary policy tools that help stabilize inflation expectations by tying the price level or inflation rate to a specific target, such as a fixed exchange rate, inflation target, or money supply growth. Exchange rate targeting acts as a nominal anchor by pegging the domestic currency to a foreign currency, providing a clear benchmark for price stability and reducing inflation volatility in open economies. Understanding nominal anchors involves recognizing their role in anchoring inflation expectations, guiding central bank credibility, and influencing long-term economic stability.

Historical Context and Evolution

Exchange rate targeting gained prominence during the 1980s and 1990s as countries sought stable monetary frameworks after episodes of hyperinflation and currency crises, prominently influencing emerging markets in Latin America and Asia. Nominal anchors, including inflation targeting and money supply rules, evolved as central banks adopted more flexible monetary policies to balance exchange rate stability with domestic economic objectives. Historical shifts toward inflation targeting in the late 20th century reflected lessons learned from rigid exchange rate regimes, emphasizing credibility and transparency in monetary policy frameworks.

Key Differences Between Exchange Rate Targeting and Nominal Anchors

Exchange rate targeting involves stabilizing a country's currency value against another currency to control inflation and promote trade stability, while nominal anchors use variables such as inflation rate or money supply as reference points to guide monetary policy. Exchange rate targeting directly links monetary policy to foreign currency fluctuations, which may limit a central bank's flexibility, whereas nominal anchors provide broader control over inflation expectations without fixed exchange commitments. The key difference lies in exchange rate targeting's focus on external currency stability versus the nominal anchor's emphasis on internal price stability.

Advantages of Exchange Rate Targeting

Exchange rate targeting stabilizes inflation by anchoring expectations to a transparent and internationally recognized benchmark, enhancing monetary policy credibility. It facilitates trade and investment by reducing exchange rate volatility, which supports economic integration and growth. This approach can be especially effective for small open economies reliant on stable import prices and external competitiveness.

Pros and Cons of Using Nominal Anchors

Nominal anchors, such as inflation targeting or money supply targets, provide clear benchmarks for monetary policy that help anchor inflation expectations and enhance credibility. They reduce uncertainty by offering a transparent commitment, which can stabilize price levels and economic outcomes over time. However, reliance on fixed nominal anchors may limit policy flexibility during economic shocks and can be less effective if the anchor becomes misaligned with economic fundamentals.

Economic Impacts and Policy Effectiveness

Exchange rate targeting stabilizes currency values and can reduce inflation volatility, but it limits monetary policy autonomy, affecting economic responsiveness to external shocks. Nominal anchors, such as inflation targeting or money supply rules, enhance policy credibility by providing clear expectations, which promotes stable inflation and long-term economic growth. The effectiveness of these approaches depends on country-specific factors, including financial market development, openness to trade, and the ability of institutions to maintain policy discipline.

Case Studies: Country Experiences and Outcomes

Exchange rate targeting as a nominal anchor has shown mixed outcomes in case studies, with countries like Argentina experiencing currency crises due to rigid pegs, while others like Hong Kong have maintained stability through strong commitments. Countries relying on nominal anchors such as inflation targeting, exemplified by New Zealand, have generally achieved more flexible monetary policy and sustainable inflation control. Empirical evidence suggests that exchange rate targeting may pose risks in open economies with volatile capital flows, whereas nominal anchors rooted in domestic price stability tend to foster long-term economic resilience.

Choosing the Optimal Monetary Policy Framework

Choosing the optimal monetary policy framework involves assessing exchange rate targeting and nominal anchor strategies based on economic stability and inflation control objectives. Exchange rate targeting provides external discipline by fixing currency value to a stable foreign counterpart, reducing exchange rate volatility but limiting monetary policy flexibility. Nominal anchors, such as inflation targeting or money supply targets, offer greater policy autonomy to address domestic economic conditions while anchoring inflation expectations and enhancing credibility.

Exchange rate targeting Infographic

libterm.com

libterm.com