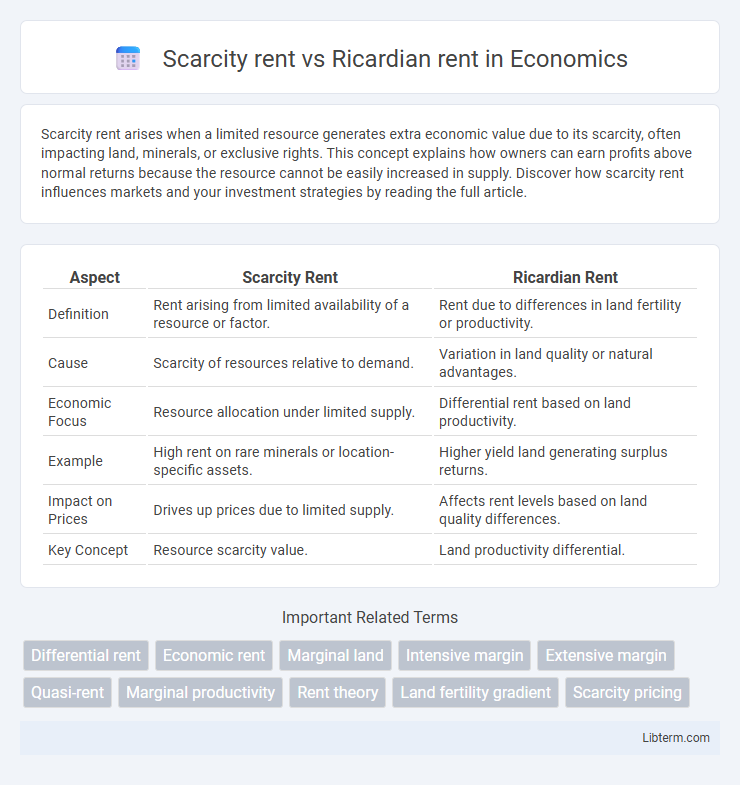

Scarcity rent arises when a limited resource generates extra economic value due to its scarcity, often impacting land, minerals, or exclusive rights. This concept explains how owners can earn profits above normal returns because the resource cannot be easily increased in supply. Discover how scarcity rent influences markets and your investment strategies by reading the full article.

Table of Comparison

| Aspect | Scarcity Rent | Ricardian Rent |

|---|---|---|

| Definition | Rent arising from limited availability of a resource or factor. | Rent due to differences in land fertility or productivity. |

| Cause | Scarcity of resources relative to demand. | Variation in land quality or natural advantages. |

| Economic Focus | Resource allocation under limited supply. | Differential rent based on land productivity. |

| Example | High rent on rare minerals or location-specific assets. | Higher yield land generating surplus returns. |

| Impact on Prices | Drives up prices due to limited supply. | Affects rent levels based on land quality differences. |

| Key Concept | Resource scarcity value. | Land productivity differential. |

Introduction to Economic Rents

Economic rents represent payments to a factor of production exceeding its opportunity cost, with Ricardian rent arising specifically from differential land fertility or location advantages. Scarcity rent emerges when limited availability of a resource or asset drives its price above the cost of production, often affecting natural resources or monopolized goods. Understanding the distinction clarifies the role of supply constraints versus intrinsic factor productivity in determining economic rent.

Defining Scarcity Rent

Scarcity rent refers to the economic rent earned from the limited availability of a resource that is in fixed supply, such as land or mineral deposits, irrespective of its inherent productive quality. In contrast, Ricardian rent arises from differences in the fertility or productivity of land, where more productive land yields higher rent due to its superior attributes. Defining scarcity rent emphasizes the value generated solely by the scarcity and fixed supply of a resource, rather than its inherent productive capacity.

Understanding Ricardian Rent

Ricardian rent arises from differences in land fertility or productivity, where more productive land generates higher returns compared to less productive land, reflecting the surplus income above the cost of production. Scarcity rent, on the other hand, emerges when the supply of land is fixed and demand increases, causing rent to rise due to limited availability rather than productivity differences. Understanding Ricardian rent is essential for analyzing how agricultural output and land value are influenced by inherent land qualities and differential advantages.

Historical Context of Ricardian Theory

Ricardian rent originates from the 19th-century classical economist David Ricardo, who analyzed land rent as a surplus arising from differences in land fertility and location, emphasizing agricultural productivity and land scarcity. Scarcity rent, by contrast, reflects the economic rent generated when the supply of a resource, such as land or minerals, is limited, regardless of its fertility. Ricardo's historical context centered on the Industrial Revolution's impact on land use and productivity, illustrating how rent emerges due to both inherent land qualities and competitive pressures as population and cultivation expand.

Key Differences Between Scarcity and Ricardian Rent

Scarcity rent arises from a fixed supply of a resource or asset, where the limited availability drives up its value, while Ricardian rent is derived from differences in the fertility or productivity of land. Scarcity rent depends on total supply constraints and market demand, whereas Ricardian rent is based on differential advantages in land quality and its ability to produce surplus output. Unlike Ricardian rent, which varies with land characteristics, scarcity rent occurs even when land or resources are homogenous but limited in quantity.

Factors Influencing Scarcity Rent

Scarcity rent arises when the supply of a resource is limited relative to demand, causing its price to exceed the cost of production, whereas Ricardian rent is based on differences in land fertility or resource productivity. Factors influencing scarcity rent include resource availability, technological advancements, and market demand fluctuations. High scarcity rent occurs when resources are fixed in supply, demand is strong, and substitutes are unavailable or costly to develop.

Determinants of Ricardian Rent

Ricardian rent arises from differences in land fertility and location, with determinants including soil quality, climate conditions, and proximity to markets that enhance productivity. Scarcity rent, in contrast, stems from the limited availability of land regardless of quality, reflecting the competitive premium for finite resources. The interplay between these rents influences agricultural output, land use efficiency, and economic rent distribution.

Real-World Examples: Scarcity Rent vs Ricardian Rent

Scarcity rent arises when limited availability of land or resources drives up prices, as seen in urban real estate markets where prime locations command higher rents due to their fixed supply. Ricardian rent, based on differential fertility and productivity, exemplifies agricultural land use where more fertile plots yield surplus profits over less productive land, such as in the varying yields of farmland across regions. Real-world contrasts include city-center commercial properties generating scarcity rent from location scarcity, while diverse crop yields on adjoining farms highlight Ricardian rent differences driven by land quality.

Implications for Resource Allocation

Scarcity rent arises from limited supply of natural resources, influencing resource allocation by signaling firms to use resources efficiently and invest in alternatives. Ricardian rent, derived from differences in land fertility or productivity, leads to allocation favoring more productive lands, optimizing output but potentially causing unequal wealth distribution. Together, these rents shape resource allocation by balancing scarcity-driven pricing and productivity-based incentives, guiding sustainable economic planning.

Conclusion: Economic Significance of Rent Theories

Scarcity rent arises from the limited availability of a resource, while Ricardian rent is derived from differences in land fertility and productivity. Both concepts highlight the impact of resource allocation and differential advantages on income distribution within an economy. Understanding these distinctions is crucial for policymakers to design efficient taxation systems and promote equitable resource use.

Scarcity rent Infographic

libterm.com

libterm.com