Fiduciary money refers to currency that has value primarily because people trust and accept it as a medium of exchange, despite lacking intrinsic worth or backing by physical commodities like gold. This type of money depends on the confidence of the public and the stability of the issuing authority, often governments or central banks. Explore the rest of the article to understand how fiduciary money impacts your daily financial transactions and the broader economy.

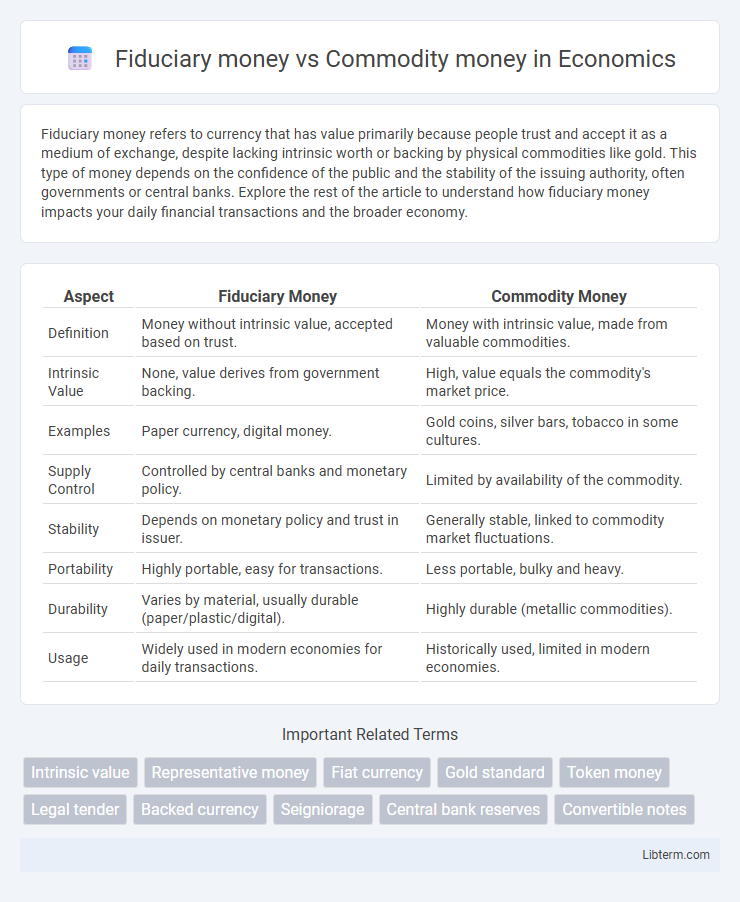

Table of Comparison

| Aspect | Fiduciary Money | Commodity Money |

|---|---|---|

| Definition | Money without intrinsic value, accepted based on trust. | Money with intrinsic value, made from valuable commodities. |

| Intrinsic Value | None, value derives from government backing. | High, value equals the commodity's market price. |

| Examples | Paper currency, digital money. | Gold coins, silver bars, tobacco in some cultures. |

| Supply Control | Controlled by central banks and monetary policy. | Limited by availability of the commodity. |

| Stability | Depends on monetary policy and trust in issuer. | Generally stable, linked to commodity market fluctuations. |

| Portability | Highly portable, easy for transactions. | Less portable, bulky and heavy. |

| Durability | Varies by material, usually durable (paper/plastic/digital). | Highly durable (metallic commodities). |

| Usage | Widely used in modern economies for daily transactions. | Historically used, limited in modern economies. |

Introduction to Fiduciary and Commodity Money

Fiduciary money represents currency that holds value primarily because of trust in the issuing authority rather than intrinsic worth, commonly seen in modern fiat currencies like banknotes. Commodity money derives its value from the material it is made of, such as gold or silver coins, which possess inherent value independent of the issuer. Understanding the distinction between fiduciary and commodity money is essential in analyzing monetary systems and their impact on economic stability.

Definition of Fiduciary Money

Fiduciary money is a type of currency that derives its value from the trust and confidence of the users rather than its intrinsic worth, unlike commodity money, which has inherent value due to the material it is made from, such as gold or silver. This form of money typically includes paper currency or bank deposits issued by a trusted authority, and its acceptance is based on legal framework and public faith in the issuing institution. Fiduciary money facilitates economic transactions by serving as a widely accepted medium of exchange without the need for backing by physical commodities.

Definition of Commodity Money

Commodity money consists of physical goods with intrinsic value, such as gold, silver, or salt, used as a medium of exchange due to their inherent worth. Unlike fiduciary money, which relies on trust and government backing without intrinsic value, commodity money maintains value through its tangible properties and demand. Historically, commodity money served as a stable store of value and unit of account before the widespread adoption of fiat currency systems.

Historical Evolution of Money

Commodity money, characterized by intrinsic value such as gold or silver, dominated early economies due to tangible worth supporting trade and wealth storage. The transition to fiduciary money occurred as governments issued currency backed by trust rather than physical assets, simplifying transactions and expanding economic activity. This historical evolution reflects a shift from value-based mediums to confidence-driven instruments, enabling greater monetary flexibility and modern financial systems.

Key Differences Between Fiduciary and Commodity Money

Fiduciary money derives its value primarily from government regulation or trust rather than intrinsic worth, unlike commodity money, which has value based on the material it is made from, such as gold or silver. Commodity money serves as both a medium of exchange and a store of value due to its inherent physical properties, while fiduciary money depends on legal tender status and collective confidence for acceptance. The key distinction lies in fiduciary money's lack of intrinsic value, making it susceptible to inflation risks, whereas commodity money's value remains more stable due to its tangible assets.

Advantages of Fiduciary Money

Fiduciary money provides greater convenience and portability compared to commodity money by representing value without needing intrinsic worth such as precious metals. It enhances economic efficiency through easy transferability and divisibility, supporting modern digital transactions and credit systems. The flexibility of fiduciary money allows central banks to regulate money supply effectively, stabilizing the economy and controlling inflation.

Advantages of Commodity Money

Commodity money offers intrinsic value, as it is made from materials like gold or silver that hold worth independently of their use as currency. Its stable value reduces the risk of inflation, making it a reliable store of wealth over time. The physical substance and universal acceptance of commodity money enhance trust and facilitate trade across different regions and economic systems.

Challenges and Risks in Each System

Fiduciary money faces challenges related to trust and inflation risks, as its value depends largely on government backing and confidence in issuing institutions. Commodity money, while offering intrinsic value, encounters issues like supply limitations and vulnerability to market fluctuations, which can disrupt economic stability. Both systems risk undermining financial confidence; fiduciary money through potential overissuance and commodity money through scarcity and hoarding.

Modern Examples and Applications

Fiduciary money, such as modern fiat currencies like the US dollar and the euro, relies on government trust and legal frameworks rather than intrinsic value, facilitating efficient digital transactions and monetary policies. Commodity money, exemplified historically by gold and silver coins, holds intrinsic value and serves as a hedge against inflation, though it is less practical for everyday use in contemporary economies. Cryptocurrencies like Bitcoin blur lines by combining features of both, offering digital scarcity akin to commodity money with decentralized trust mechanisms.

Conclusion: The Future of Money

Fiduciary money, backed by trust and government decree, outpaces commodity money due to its flexibility and ease of exchange in modern economies. Digital currencies and central bank digital currencies (CBDCs) are shaping the future by further reducing reliance on physical commodities. The evolution highlights a shift toward more efficient, secure, and scalable monetary systems driven by technological advancements.

Fiduciary money Infographic

libterm.com

libterm.com