Cost-benefit analysis evaluates the financial advantages and disadvantages of a decision to determine its overall worth. This method helps you weigh potential gains against expenses to make informed choices. Explore the rest of the article to discover how cost-benefit analysis can optimize your decision-making.

Table of Comparison

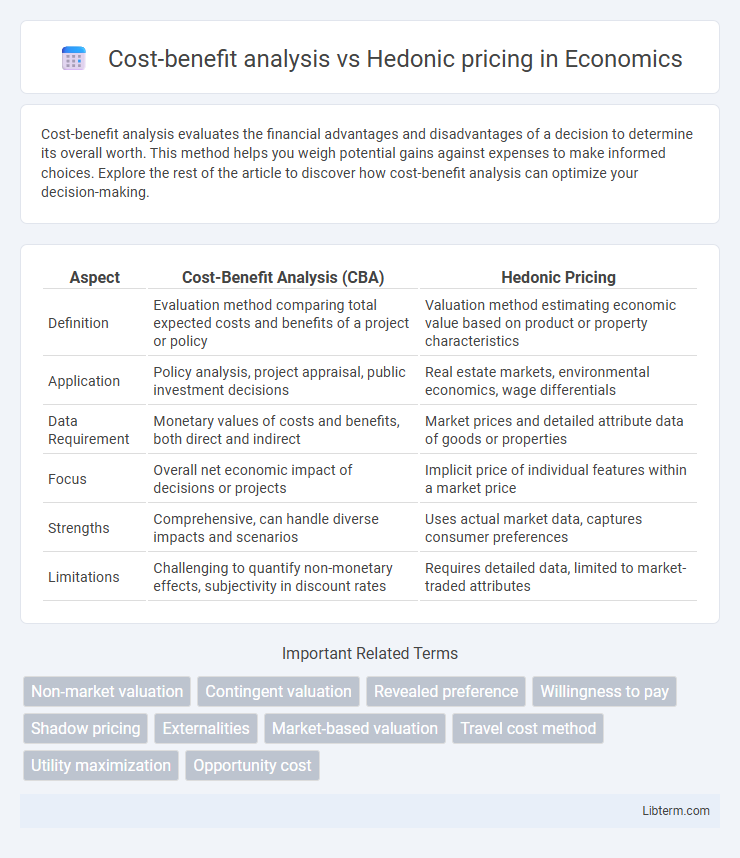

| Aspect | Cost-Benefit Analysis (CBA) | Hedonic Pricing |

|---|---|---|

| Definition | Evaluation method comparing total expected costs and benefits of a project or policy | Valuation method estimating economic value based on product or property characteristics |

| Application | Policy analysis, project appraisal, public investment decisions | Real estate markets, environmental economics, wage differentials |

| Data Requirement | Monetary values of costs and benefits, both direct and indirect | Market prices and detailed attribute data of goods or properties |

| Focus | Overall net economic impact of decisions or projects | Implicit price of individual features within a market price |

| Strengths | Comprehensive, can handle diverse impacts and scenarios | Uses actual market data, captures consumer preferences |

| Limitations | Challenging to quantify non-monetary effects, subjectivity in discount rates | Requires detailed data, limited to market-traded attributes |

Introduction to Cost-Benefit Analysis and Hedonic Pricing

Cost-benefit analysis evaluates the overall economic worth of projects by comparing total expected costs against benefits, facilitating decision-making based on net value. Hedonic pricing estimates the value of environmental or product attributes by analyzing variations in market prices, often applied in real estate or labor markets. Both methods contribute crucial insights for policy evaluation and resource allocation, with cost-benefit analysis offering a comprehensive economic assessment and hedonic pricing providing attribute-specific valuations.

Defining Cost-Benefit Analysis

Cost-benefit analysis (CBA) systematically evaluates the economic pros and cons of projects by quantifying and comparing total expected costs against benefits in monetary terms. Hedonic pricing, in contrast, determines value based on the impact of characteristics on market prices, often applied to real estate or environmental changes. CBA offers a comprehensive framework for decision-making by incorporating direct and indirect effects to assess overall social welfare improvements or losses.

Understanding Hedonic Pricing Method

The Hedonic Pricing method evaluates property values by analyzing how specific attributes such as location, size, and amenities contribute to overall market prices, providing detailed insights into consumer preferences. This approach differs from Cost-Benefit Analysis, which aggregates total costs and benefits for decision-making without isolating individual feature impacts. Understanding Hedonic Pricing enables precise quantification of the economic value of environmental or structural factors affecting real estate markets.

Key Differences Between the Two Approaches

Cost-benefit analysis quantifies overall economic advantages and disadvantages of projects by assigning monetary values to all costs and benefits, providing a comprehensive evaluation of net impact. Hedonic pricing specifically estimates the value of environmental or product attributes by analyzing how these characteristics affect market prices, often used in real estate and labor markets. The key difference lies in cost-benefit analysis addressing broad economic impacts, while hedonic pricing focuses narrowly on attribute-based market valuation.

Application Areas of Cost-Benefit Analysis

Cost-benefit analysis is widely applied in public policy, infrastructure development, healthcare, and environmental impact assessments to evaluate the economic efficiency of projects and regulations. Hedonic pricing, in contrast, primarily focuses on real estate and environmental economics to estimate how various factors like location, amenities, and pollution affect market prices. Cost-benefit analysis systematically quantifies monetary gains and costs over time, guiding decision-makers in resource allocation across diverse sectors such as transportation, education, and energy.

Use Cases for Hedonic Pricing

Hedonic pricing is primarily used to estimate the economic value of environmental attributes and real estate characteristics by analyzing market data, such as housing prices influenced by proximity to parks, schools, or pollution levels. This method is particularly effective in urban planning, environmental economics, and property valuation where market transactions reflect consumer preferences for specific features. Unlike cost-benefit analysis, which aggregates costs and benefits across projects, hedonic pricing decomposes price variations to isolate the value of individual attributes.

Data Requirements and Methodological Challenges

Cost-benefit analysis (CBA) requires comprehensive data on costs and benefits, often encompassing market prices, non-market valuations, and future projections, which can be difficult to quantify accurately, especially for intangible benefits. Hedonic pricing relies on detailed, high-quality market transaction data and attribute-specific variables to isolate the economic value of different property features, but faces challenges in controlling for confounding factors and ensuring data completeness. Both methods struggle with data limitations, potential biases, and the complexity of modeling human preferences and externalities in economic valuations.

Advantages and Limitations of Each Method

Cost-benefit analysis offers a systematic approach to evaluating the overall economic value of a project by comparing total expected costs and benefits, facilitating decision-making in policy and investment. Its advantages include comprehensive assessment and adaptability across sectors, but it is limited by challenges in accurately quantifying intangible benefits and assigning monetary values to environmental or social impacts. Hedonic pricing excels in estimating the economic value of environmental factors reflected in market prices, such as property values, providing detailed insights into how attributes influence prices, yet it is constrained by reliance on available market data and may not capture non-market benefits comprehensively.

Comparative Examples Across Industries

Cost-benefit analysis evaluates the overall economic impact of projects by comparing total expected costs with anticipated benefits, often applied in public infrastructure and healthcare sectors to assess feasibility. Hedonic pricing breaks down market prices into constituent attributes, commonly used in real estate and automotive industries to determine how specific features influence product valuation. For instance, cost-benefit analysis helped justify transportation network expansions by quantifying time savings and accident reductions, while hedonic pricing revealed how proximity to amenities affects housing prices differently across urban and suburban markets.

Choosing the Right Approach for Policy and Decision-Making

Cost-benefit analysis quantifies the overall economic value of a project by comparing total expected costs and benefits, providing a comprehensive framework for policy decision-making. Hedonic pricing isolates the value of specific factors, such as environmental attributes or housing characteristics, by analyzing market prices, offering detailed insights into individual components of value. Choosing between these methods depends on the need for either broad economic evaluation or targeted valuation of asset-specific attributes in environmental, housing, or urban planning policies.

Cost-benefit analysis Infographic

libterm.com

libterm.com