Market share tests analyze a product's or service's percentage of total sales within a specific industry or market, helping companies gauge competitive standing and growth potential. Understanding your market share provides insights into consumer preferences, competitor strategies, and opportunities for expansion. Explore the full article to learn how market share tests can optimize your business decisions.

Table of Comparison

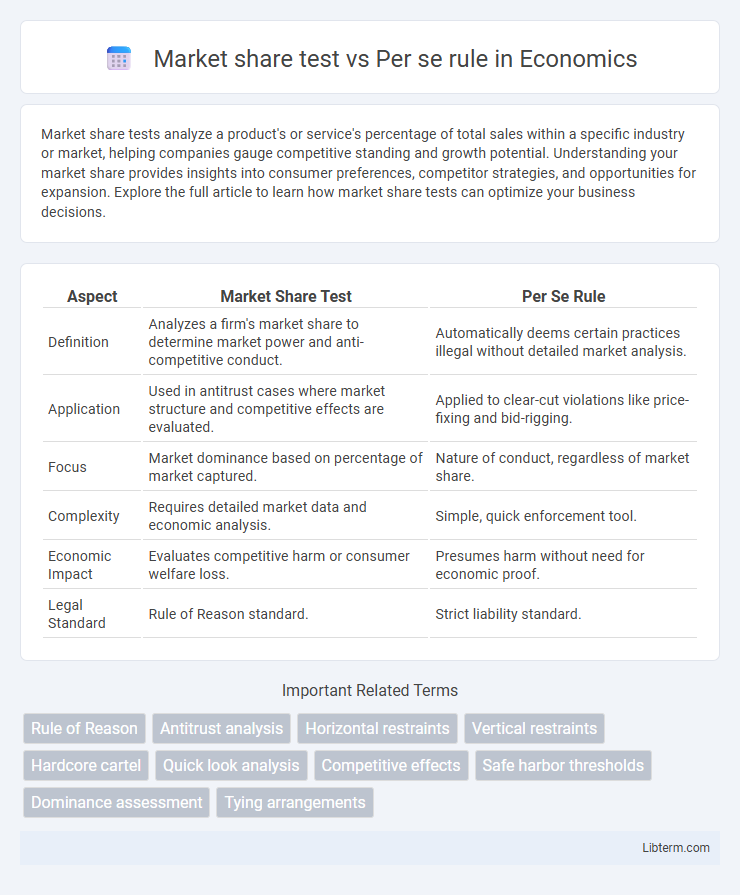

| Aspect | Market Share Test | Per Se Rule |

|---|---|---|

| Definition | Analyzes a firm's market share to determine market power and anti-competitive conduct. | Automatically deems certain practices illegal without detailed market analysis. |

| Application | Used in antitrust cases where market structure and competitive effects are evaluated. | Applied to clear-cut violations like price-fixing and bid-rigging. |

| Focus | Market dominance based on percentage of market captured. | Nature of conduct, regardless of market share. |

| Complexity | Requires detailed market data and economic analysis. | Simple, quick enforcement tool. |

| Economic Impact | Evaluates competitive harm or consumer welfare loss. | Presumes harm without need for economic proof. |

| Legal Standard | Rule of Reason standard. | Strict liability standard. |

Introduction to Antitrust Analysis

Market share test evaluates competitive behavior by assessing the percentage of market control held by a firm to determine potential antitrust violations. Per se rule automatically deems specific actions, such as price-fixing or market division, illegal without detailed market impact analysis. Antitrust analysis uses these approaches to balance efficiency and competition, with market share providing a quantitative basis while the per se rule targets clearly harmful conduct.

Defining the Market Share Test

The Market Share Test defines liability by allocating damages based on each defendant's proportion of the relevant product market, linking responsibility directly to market presence. This approach contrasts with the Per Se Rule, which imposes liability without detailed market analysis when certain anticompetitive conduct is established. The Market Share Test requires precise identification of the product market and quantification of each defendant's share to ensure equitable apportionment of liability.

Understanding the Per Se Rule

The Per Se Rule in antitrust law automatically deems certain business practices, like price-fixing or market allocation, as illegal without requiring detailed market analysis. Unlike the Market Share Test, which evaluates a company's control over a market to determine monopoly power, the Per Se Rule focuses on the inherent illegality of the conduct itself. This rule simplifies enforcement by categorically prohibiting anti-competitive behaviors considered harmful to market competition.

Key Differences: Market Share Test vs Per Se Rule

The Market Share Test assesses liability based on a defendant's proportion of market sales, distributing responsibility relative to each firm's involvement in the product's market, whereas the Per Se Rule deems specific conduct automatically illegal without requiring detailed market analysis or proof of harm. Market Share Test is typically used in complex product liability and antitrust cases involving multiple manufacturers, while the Per Se Rule applies to clearly defined anticompetitive behaviors such as price-fixing or market division. Key differences include the necessity of market identification and proportional liability under the Market Share Test versus the categorical illegality and presumption of harm under the Per Se Rule.

Legal Foundations and Historical Context

The Market Share Test originated from the landmark case Sindell v. Abbott Laboratories (1980), establishing liability based on a defendant's proportionate share of the market when exact causation is indeterminable. The Per Se Rule, rooted in strict legal principles, asserts automatic liability without requiring proof of negligence or causation, often applied in antitrust and strict liability contexts. Both doctrines reflect evolving judicial approaches to address challenges in attributing liability, with the Market Share Test emphasizing probabilistic causation and the Per Se Rule focusing on clear-cut violations and established prohibitions.

Application in Horizontal and Vertical Agreements

Market share test evaluates the competitive impact of agreements by analyzing the parties' combined market shares, primarily applied in horizontal agreements to determine potential dominance or anti-competitive effects. Per se rule, used mainly in horizontal agreements, condemns certain practices such as price-fixing or market allocation without detailed market analysis due to their inherently anti-competitive nature. In vertical agreements, enforcement typically relies on the rule of reason, as the per se rule is rarely applied, and market share considerations help assess the agreement's potential to harm competition through foreclosure or monopolization.

Advantages and Limitations of the Market Share Test

The Market Share Test offers a quantifiable approach to allocating liability based on a defendant's proportion of the market, simplifying causation in cases involving fungible products such as pharmaceuticals. Its advantages include easing plaintiff's burden of proof when direct causation is difficult to establish and promoting fairness by distributing damages according to market participation. Limitations involve challenges in accurately determining market share, potential unfairness to smaller competitors, and its restricted applicability primarily to cases with interchangeable products and identifiable market boundaries.

Pros and Cons of the Per Se Rule

The Per Se Rule streamlines legal analysis by automatically deeming certain business practices, like price-fixing or market division, illegal without requiring detailed market share or competitive effects examination. This rule enhances legal certainty and deterrence but can lead to overinclusiveness by penalizing agreements that might have pro-competitive justifications in specific contexts. Critics argue that the Per Se Rule may overlook nuanced market realities, unlike the Market Share Test, which assesses the actual competitive impact based on firm dominance and market structure.

Notable Case Studies and Judicial Interpretations

Notable case studies like *SmithKline Corp. v. Eli Lilly & Co.* and *Microsoft Corp. v. United States* demonstrate the market share test's application in antitrust investigations, where courts assess defendants' market shares to establish liability in product liability and monopolization claims. Judicial interpretations reveal the per se rule's rigidity in treating certain conduct, such as price-fixing in *United States v. Socony-Vacuum Oil Co.*, as inherently illegal without detailed market analysis. Courts frequently balance these approaches by applying the market share test in complex indirect evidence scenarios while reserving the per se rule for clear-cut anticompetitive practices.

Choosing the Right Approach in Antitrust Enforcement

Choosing the right approach in antitrust enforcement hinges on balancing the market share test and the per se rule, as the former evaluates competitive impact through quantitative analysis of market dominance while the latter categorically condemns certain anticompetitive practices without detailed market examination. The market share test offers nuanced insights into market power and potential consumer harm, making it suitable for complex and dynamic industries with significant data variability. The per se rule ensures swift legal resolution in cases with clear anticompetitive behavior, such as price-fixing or bid-rigging, protecting market integrity where detailed market analysis may be impractical or unnecessary.

Market share test Infographic

libterm.com

libterm.com