Exchange rate controls regulate the value of a country's currency by restricting its exchange with foreign currencies, aiming to stabilize the economy and manage inflation. These controls can impact international trade, investment flows, and the availability of foreign currency for businesses and consumers. Explore this article to understand how exchange rate controls affect your finances and global market dynamics.

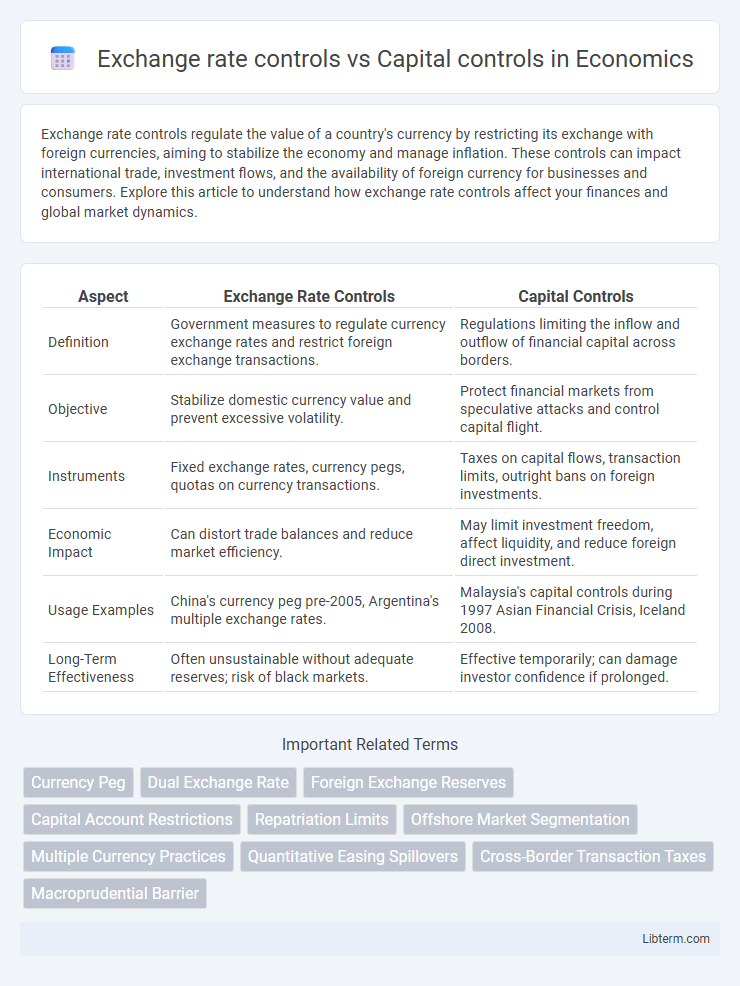

Table of Comparison

| Aspect | Exchange Rate Controls | Capital Controls |

|---|---|---|

| Definition | Government measures to regulate currency exchange rates and restrict foreign exchange transactions. | Regulations limiting the inflow and outflow of financial capital across borders. |

| Objective | Stabilize domestic currency value and prevent excessive volatility. | Protect financial markets from speculative attacks and control capital flight. |

| Instruments | Fixed exchange rates, currency pegs, quotas on currency transactions. | Taxes on capital flows, transaction limits, outright bans on foreign investments. |

| Economic Impact | Can distort trade balances and reduce market efficiency. | May limit investment freedom, affect liquidity, and reduce foreign direct investment. |

| Usage Examples | China's currency peg pre-2005, Argentina's multiple exchange rates. | Malaysia's capital controls during 1997 Asian Financial Crisis, Iceland 2008. |

| Long-Term Effectiveness | Often unsustainable without adequate reserves; risk of black markets. | Effective temporarily; can damage investor confidence if prolonged. |

Introduction to Exchange Rate Controls and Capital Controls

Exchange rate controls are government-imposed restrictions on the buying and selling of foreign currencies to stabilize the national currency and influence international trade balances. Capital controls refer to regulatory measures that limit the flow of foreign capital in and out of a country's economy to prevent excessive volatility and protect financial stability. Both mechanisms serve as tools for managing economic stability, but they target different aspects of currency and capital market movements.

Defining Exchange Rate Controls

Exchange rate controls are government-imposed restrictions on the buying and selling of foreign currencies to stabilize or influence a nation's currency value and manage inflation. These controls often include fixed exchange rates, limits on currency conversions, and approval requirements for foreign exchange transactions. In contrast, capital controls regulate the flow of capital across borders to prevent financial instability, but exchange rate controls specifically target currency valuation and foreign exchange market activities.

Defining Capital Controls

Capital controls are regulatory measures imposed by governments to limit or regulate the flow of foreign capital in and out of the domestic economy, including restrictions on currency exchange, cross-border transactions, and investment activities. These controls aim to stabilize the national currency, prevent capital flight, and protect the economy from external shocks, differing from exchange rate controls that specifically target the fixed or managed rates of currency exchange. Effective capital controls may include taxes on foreign investments, outright limits on currency conversion, and requirements for governmental approval on large financial transfers.

Objectives of Exchange Rate Controls

Exchange rate controls aim to stabilize a country's currency value by regulating the supply and demand of foreign exchange, preventing excessive volatility in the foreign exchange market. These controls help maintain competitive export prices, reduce inflationary pressures caused by currency fluctuations, and protect foreign currency reserves. Unlike capital controls that restrict cross-border financial flows, exchange rate controls specifically focus on managing currency exchange mechanisms to achieve macroeconomic stability.

Objectives of Capital Controls

Capital controls aim to stabilize the national economy by restricting the flow of foreign capital, preventing excessive currency volatility and shielding domestic markets from speculative attacks. These regulatory measures help maintain financial stability, control inflation, and protect monetary sovereignty by limiting short-term capital movements that can disrupt economic policies. Unlike exchange rate controls that target currency value, capital controls focus on managing cross-border financial flows to support long-term economic growth.

Key Differences Between Exchange Rate and Capital Controls

Exchange rate controls regulate the value of a country's currency by setting fixed exchange rates or limiting currency conversions to stabilize international trade and prevent excessive currency depreciation. Capital controls restrict the flow of money across borders, controlling foreign investments and limiting capital flight to protect the domestic financial system and maintain economic stability. The primary difference lies in their focus: exchange rate controls target currency valuation and trade balance, while capital controls manage cross-border financial transactions and investment flows.

Economic Impacts of Exchange Rate Controls

Exchange rate controls, by fixing or limiting currency values, can stabilize import and export prices but often lead to black markets and reduced foreign investment due to market distortions. In contrast, capital controls restrict cross-border financial flows to preserve currency stability and prevent capital flight without directly altering exchange rates. Exchange rate controls may cause persistent currency overvaluation or undervaluation, hindering economic efficiency and long-term growth by misallocating resources.

Economic Effects of Capital Controls

Capital controls influence economic stability by regulating cross-border financial flows, reducing volatility in exchange rates and limiting the risk of sudden capital flight. By restricting capital movements, these controls can help maintain monetary policy autonomy and prevent external shocks from destabilizing domestic markets. However, excessive capital controls may deter foreign investment, hinder economic growth, and reduce market efficiency.

Case Studies: Countries Using Exchange Rate vs Capital Controls

China's use of exchange rate controls alongside selective capital controls has maintained currency stability while managing foreign investment inflows. Argentina's reliance on strict capital controls during economic crises helped curb capital flight but led to market distortions and reduced investor confidence. Singapore's minimal capital controls combined with a managed float exchange rate system fostered financial openness and resilience amid global economic fluctuations.

Choosing the Right Control Mechanism for Economic Stability

Selecting the appropriate control mechanism--exchange rate controls or capital controls--depends on the country's economic context and policy objectives for stability. Exchange rate controls regulate currency value fluctuations to prevent excessive volatility and inflation, supporting trade balance and investor confidence. Capital controls manage cross-border financial flows, curbing speculative attacks and sudden capital flight that destabilize financial markets and macroeconomic performance.

Exchange rate controls Infographic

libterm.com

libterm.com