Intensive margin rent refers to the additional earnings generated from increasing the productivity of a fixed resource, such as land or capital, by intensifying its use rather than expanding its size. This concept plays a crucial role in economics as it helps explain how resource owners can maximize returns through improved efficiency or higher input application. Discover how understanding intensive margin rent can optimize Your resource management and enhance profitability by exploring the rest of the article.

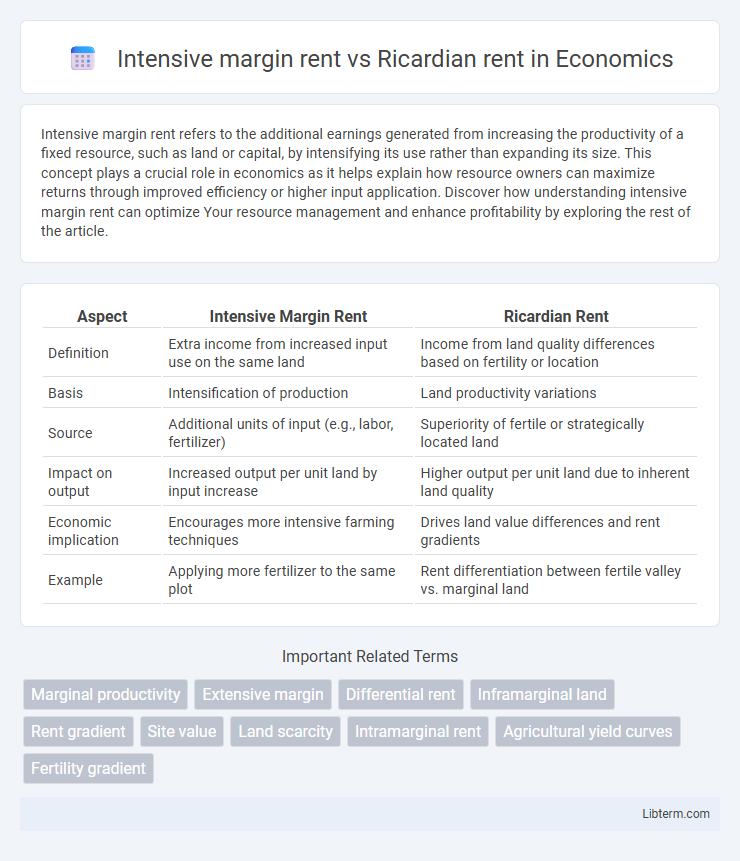

Table of Comparison

| Aspect | Intensive Margin Rent | Ricardian Rent |

|---|---|---|

| Definition | Extra income from increased input use on the same land | Income from land quality differences based on fertility or location |

| Basis | Intensification of production | Land productivity variations |

| Source | Additional units of input (e.g., labor, fertilizer) | Superiority of fertile or strategically located land |

| Impact on output | Increased output per unit land by input increase | Higher output per unit land due to inherent land quality |

| Economic implication | Encourages more intensive farming techniques | Drives land value differences and rent gradients |

| Example | Applying more fertilizer to the same plot | Rent differentiation between fertile valley vs. marginal land |

Understanding Intensive Margin Rent

Intensive margin rent refers to the additional output or profit gained by increasing input use on already cultivated land, highlighting productivity improvements within fixed resources. Unlike Ricardian rent, which arises from differences in land quality and location, intensive margin rent emphasizes the intensification of production techniques or inputs to boost returns. Understanding intensive margin rent is crucial for analyzing how farmers or producers optimize existing land rather than expanding into new territories.

Defining Ricardian Rent

Ricardian rent refers to the economic rent earned from land or resources based on their inherent fertility or productivity differences, as originally described by economist David Ricardo. It arises when more productive land yields higher output without additional input costs, generating a surplus above the opportunity cost. Intensive margin rent, by contrast, is derived from increasing input intensity on the same land, like applying more labor or capital to boost marginal returns.

Key Differences Between Intensive and Ricardian Rent

Intensive margin rent arises from increased productivity on a given land parcel by applying more inputs, reflecting diminishing returns to additional labor or capital. Ricardian rent depends on inherent land fertility or location advantages, representing differential surplus between more and less productive lands. Key differences lie in intensive rent focusing on input variation on fixed land, while Ricardian rent emphasizes land quality differences affecting total productivity and economic surplus.

Economic Theories Behind Land Rent

Intensive margin rent arises from increasing the productivity of land through additional inputs, reflecting the economic principle of diminishing returns in production. Ricardian rent is derived from the differential fertility or location advantages of land, where more productive or better-situated land yields higher economic rent based on classical land rent theory by David Ricardo. These concepts highlight how land's unique characteristics and improvements influence economic rent within land use and resource allocation frameworks.

Intensive Margin Rent: Causes and Examples

Intensive margin rent arises when additional inputs, such as labor or capital, increase the productivity of a fixed factor like land, leading to higher output and returns without expanding the area of use. Causes include diminishing marginal returns on less fertile land and improvements in technology or management practices that enhance yield on existing land. Examples include farmers increasing fertilizer use or irrigation to boost crop yields on the same plot, generating intensive margin rent as opposed to Ricardian rent derived from differences in land fertility across plots.

Origins and Applications of Ricardian Rent

Ricardian rent originates from David Ricardo's theory explaining land value based on differential fertility and location advantages, where rent is the economic return from using more productive land over the least productive land in use. This concept contrasts with intensive margin rent, which arises from additional input use on the same piece of land, reflecting diminishing returns as cultivation intensifies. Ricardian rent is widely applied in agricultural economics to analyze land use efficiency, resource allocation, and property taxation policies.

Factors Influencing Intensive Margin Rent

Intensive margin rent is influenced by factors such as the diminishing returns to additional inputs on a fixed plot of land, technological improvements, and the intensity of land use, which determine the incremental productivity gains. Ricardian rent, by contrast, arises primarily from differences in land fertility and location, reflecting the inherent advantages of more productive or better-situated land. Key determinants of intensive margin rent include input application rates, local agronomic conditions, and investment in land improvement technologies.

Impact of Ricardian Rent on Agriculture

Ricardian rent arises from differences in land fertility and location, creating surplus value for more productive agricultural land. This rent influences land use by encouraging cultivation of higher-quality plots and investment in improvements, which enhances overall agricultural productivity. The presence of Ricardian rent drives efficient resource allocation, shaping farming decisions and impacting crop yields and economic returns across varying land types.

Policy Implications: Intensive vs Ricardian Rent

Intensive margin rent arises from increased productivity on existing land through improved inputs, while Ricardian rent stems from differential land fertility or location advantages. Policy implications demand targeted subsidies and investments to boost efficiency where intensive rent is significant, contrasting with land use regulation and taxation strategies that address Ricardian rent to prevent unproductive land value increases. Effective land policy balances promoting technological enhancements with managing scarcity-driven rents, ensuring equitable resource allocation and sustainable economic growth.

Comparative Analysis: Which Rent Model Prevails?

Intensive margin rent arises from increased input use on existing land, enhancing productivity per unit area, while Ricardian rent stems from inherent differences in land quality and location, generating surplus value due to scarce, superior land. Comparative analysis indicates Ricardian rent often prevails in long-term economic models due to persistent land heterogeneity driving rent disparities, whereas intensive margin rent fluctuates with inputs and technological changes. Empirical evidence from agricultural economics and urban land markets confirms Ricardian rent's dominance in determining land values and rent structures across diverse regions.

Intensive margin rent Infographic

libterm.com

libterm.com