Matching theory explores how individuals or groups pair based on complementary traits, preferences, or resources to maximize mutual benefits. This concept is applied in various fields, including economics, sociology, and psychology, to understand decision-making and relationship formation. Discover insights into how matching theory influences your interactions by reading the rest of the article.

Table of Comparison

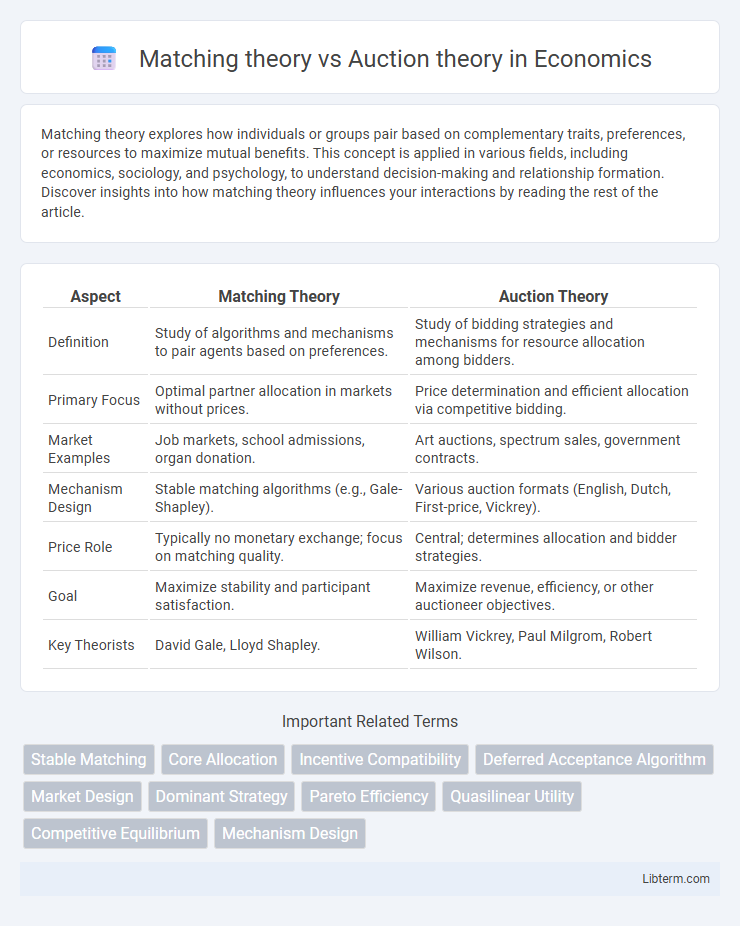

| Aspect | Matching Theory | Auction Theory |

|---|---|---|

| Definition | Study of algorithms and mechanisms to pair agents based on preferences. | Study of bidding strategies and mechanisms for resource allocation among bidders. |

| Primary Focus | Optimal partner allocation in markets without prices. | Price determination and efficient allocation via competitive bidding. |

| Market Examples | Job markets, school admissions, organ donation. | Art auctions, spectrum sales, government contracts. |

| Mechanism Design | Stable matching algorithms (e.g., Gale-Shapley). | Various auction formats (English, Dutch, First-price, Vickrey). |

| Price Role | Typically no monetary exchange; focus on matching quality. | Central; determines allocation and bidder strategies. |

| Goal | Maximize stability and participant satisfaction. | Maximize revenue, efficiency, or other auctioneer objectives. |

| Key Theorists | David Gale, Lloyd Shapley. | William Vickrey, Paul Milgrom, Robert Wilson. |

Introduction to Matching Theory and Auction Theory

Matching theory studies algorithms and preferences to pair agents in markets without prices, emphasizing stable and efficient allocations in settings like job markets or school assignments. Auction theory analyzes bidding strategies and mechanisms to allocate goods or services efficiently, focusing on maximizing revenue and incentivizing truthful bidding in contexts such as spectrum sales or online advertising. Both theories address resource allocation but differ in employing prices versus preference-based mechanisms to achieve optimal outcomes.

Core Principles of Matching Theory

Matching theory centers on stable pairings between agents based on preferences, ensuring no two agents prefer each other over their current matches, known as stability. Unlike auction theory, which focuses on price formation and bidding strategies, matching theory emphasizes preference satisfaction without monetary exchange. Key principles include deferred acceptance algorithms and core stability, which guarantee outcomes where no subset of agents can form a more advantageous match.

Core Principles of Auction Theory

Auction theory centers on the design and analysis of bidding processes where goods or services are allocated based on participants' bids, emphasizing efficiency, revenue maximization, and bidder strategy. Core principles include the concept of private and common values, incentive compatibility, and equilibrium strategies under different auction formats such as English, Dutch, first-price, and second-price auctions. Auction theory contrasts with matching theory by focusing on competitive bidding mechanisms rather than preference-based pairings in markets.

Historical Development and Key Contributors

Matching theory, developed primarily in the 1960s by Lloyd Shapley and David Gale, formalized the stable marriage problem and pioneered algorithms for stable matchings, earning them the 2012 Nobel Prize in Economic Sciences. Auction theory evolved from early 18th-century economic insights by William Vickrey, who introduced the sealed-bid auction model and incentive-compatible mechanisms, later advanced by Paul Milgrom and Robert Wilson with the creation of the spectrum auction design. Both fields significantly influenced market design and game theory, with matching theory emphasizing pairwise stability and auction theory focusing on bidding strategies and revenue optimization.

Mathematical Foundations: Matching vs Auction Models

Matching theory relies on stable matching algorithms and combinatorial optimization principles to pair agents based on preferences while ensuring no blocking pairs. Auction theory employs game-theoretic strategies and mechanism design to analyze bidding behaviors and optimize allocation under strategic interactions. Both theories utilize equilibrium concepts, with matching models focusing on stability and auctions prioritizing incentive compatibility and revenue maximization.

Applications in Real-World Markets

Matching theory excels in assigning agents to resources in markets without prices, such as school choice programs and kidney exchanges, ensuring stable and efficient matches based on preferences. Auction theory is critical in allocating goods and services where prices clear the market, prominently used in spectrum auctions, electricity markets, and online advertising platforms. Both theories underpin market design, with matching theory optimizing preference-based pairings and auction theory driving competitive pricing mechanisms across diverse real-world applications.

Efficiency and Fairness: Comparative Analysis

Matching theory achieves higher efficiency in allocating indivisible goods by directly pairing agents based on preferences, minimizing waste and maximizing mutual satisfaction. Auction theory often emphasizes price discovery and revenue maximization but can result in inefficiencies due to strategic bidding and market power disparities. Fairness in matching theory is enhanced through stable and envy-free matchings, whereas auction outcomes may favor wealthier bidders, challenging equitable access and distribution.

Limitations and Challenges of Each Theory

Matching theory faces limitations in dealing with complex preferences and large-scale markets where stability and efficiency can be difficult to achieve simultaneously. Auction theory struggles with challenges such as strategic bidding, information asymmetry, and designing mechanisms that maximize revenue while maintaining fairness. Both theories require careful consideration of incentive compatibility and computational feasibility to address real-world applications effectively.

Recent Innovations and Research Trends

Recent innovations in Matching Theory emphasize algorithmic stability and efficiency, incorporating machine learning techniques to improve real-time matching in labor markets and online platforms. Auction Theory research trends highlight dynamic pricing models and blockchain integration to enhance transparency and strategy-proof mechanisms in decentralized auctions. Both fields increasingly explore hybrid models, blending matching algorithms with auction designs to optimize resource allocation in complex, multi-agent environments.

Future Directions: Integrating Matching and Auction Theories

Future research in market design increasingly explores the integration of matching theory and auction theory to create hybrid mechanisms that leverage the strengths of both approaches. Combining the stability and preference alignment of matching algorithms with the efficiency and price discovery of auctions offers promising avenues for complex allocation problems in labor markets, school choice, and online platforms. Advances in algorithmic design and computational power will enable more adaptive, incentive-compatible systems that address diverse market constraints and participant behaviors.

Matching theory Infographic

libterm.com

libterm.com