The Hotelling rule explains how the price of non-renewable resources, like oil or minerals, should increase over time to reflect their scarcity and opportunity cost. This economic principle guides optimal extraction rates to balance current profits with future availability, ensuring sustainable resource management. Explore the rest of this article to understand how the Hotelling rule impacts your resource investment decisions.

Table of Comparison

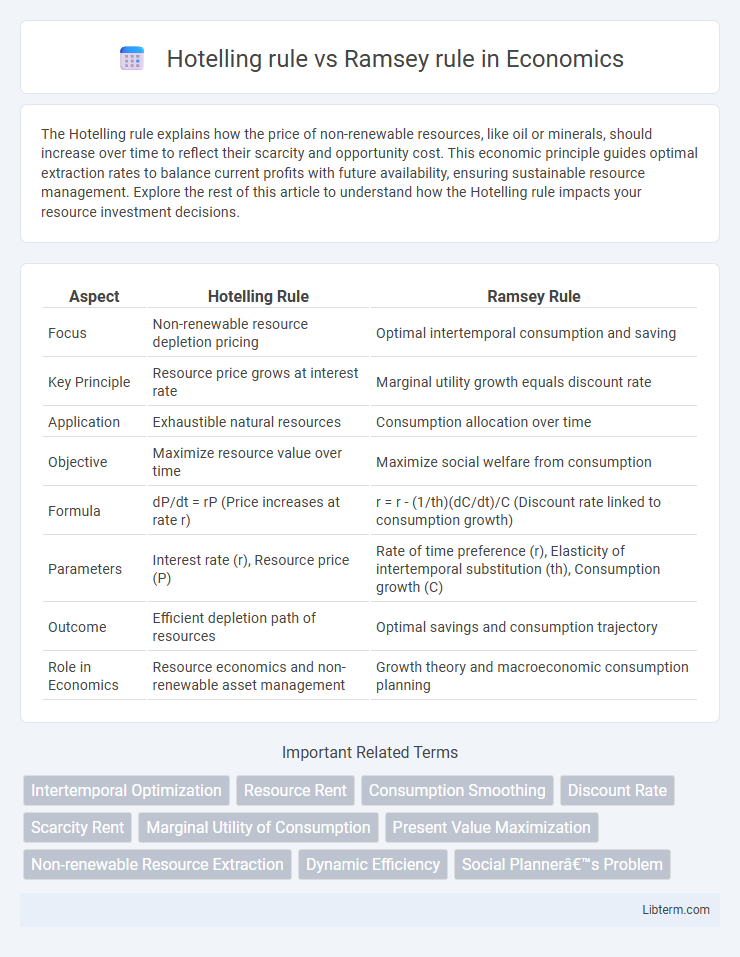

| Aspect | Hotelling Rule | Ramsey Rule |

|---|---|---|

| Focus | Non-renewable resource depletion pricing | Optimal intertemporal consumption and saving |

| Key Principle | Resource price grows at interest rate | Marginal utility growth equals discount rate |

| Application | Exhaustible natural resources | Consumption allocation over time |

| Objective | Maximize resource value over time | Maximize social welfare from consumption |

| Formula | dP/dt = rP (Price increases at rate r) | r = r - (1/th)(dC/dt)/C (Discount rate linked to consumption growth) |

| Parameters | Interest rate (r), Resource price (P) | Rate of time preference (r), Elasticity of intertemporal substitution (th), Consumption growth (C) |

| Outcome | Efficient depletion path of resources | Optimal savings and consumption trajectory |

| Role in Economics | Resource economics and non-renewable asset management | Growth theory and macroeconomic consumption planning |

Introduction to Hotelling and Ramsey Rules

The Hotelling rule governs the optimal extraction path of non-renewable resources by stating that the resource's price should rise at the rate of interest to maximize economic value over time. The Ramsey rule provides a framework for optimal savings and consumption in an economy, setting the rate of consumption growth equal to the difference between the interest rate and the rate of time preference. Both rules link intertemporal decision-making in resource economics and macroeconomic growth through principles of optimal control and discounting future values.

Historical Background of Hotelling Rule

The Hotelling Rule, formulated by Harold Hotelling in 1931, emerged from the study of non-renewable resource economics, highlighting the optimal depletion rate of exhaustible resources. It posits that resource owners will extract and price resources so that the net price rises at the rate of interest, reflecting scarcity over time. This foundational principle contrasts with the Ramsey Rule, which addresses optimal savings and consumption in an intertemporal welfare context, originating from Frank Ramsey's 1928 model on economic growth.

Overview of the Ramsey Rule

The Ramsey Rule provides a framework for determining the optimal savings rate by balancing the trade-off between consumption today and consumption in the future, focusing on maximizing intertemporal social welfare. It incorporates factors such as the rate of time preference, the elasticity of marginal utility of consumption, and the economy's growth rate to guide long-term economic policy. Unlike the Hotelling Rule, which applies primarily to non-renewable resource extraction pricing, the Ramsey Rule extends to broader economic growth and optimal capital accumulation decisions.

Mathematical Formulation of Each Rule

The Hotelling rule is mathematically expressed as \(\frac{\dot{P}}{P} = r\), indicating that the rate of increase in the price \(P\) of a non-renewable resource equals the interest rate \(r\) over time. The Ramsey rule formulates optimal savings and consumption with \(\frac{\dot{C}}{C} = \frac{r - \rho}{\theta}\), where \(\dot{C}/C\) is the growth rate of consumption, \(r\) the real interest rate, \(\rho\) the subjective discount rate, and \(\theta\) the intertemporal elasticity of substitution. Both rules optimize resource allocation and intertemporal utility but differ fundamentally in their focus: Hotelling centers on exhaustible resource pricing dynamics, while Ramsey addresses consumption-saving decisions over time.

Economic Assumptions Underlying Both Rules

The Hotelling rule assumes a non-renewable resource with a perfectly competitive market where resource owners maximize profits by equating the marginal net price increase to the interest rate, reflecting scarcity and opportunity cost. The Ramsey rule is based on optimal intertemporal consumption and savings decisions in a representative agent framework, assuming perfect foresight or rational expectations, constant relative risk aversion, and a predetermined social planner's discount rate. Both rules rely on assumptions of efficient markets, no externalities, and constant marginal utility or scarcity rents, but differ in scope, with Hotelling focusing on exhaustible resources and Ramsey on optimal consumption paths considering time preference and productivity growth.

Resource Allocation: Hotelling vs Ramsey

The Hotelling rule focuses on optimal resource extraction over time by equating the marginal net price of a non-renewable resource to the rate of interest, ensuring intertemporal efficiency in depletion. In contrast, the Ramsey rule optimizes resource allocation by maximizing social welfare through equalizing the marginal rate of substitution between consumption across different periods, accounting for utility and discount rates. Resource allocation under Hotelling emphasizes scarcity rent dynamics, while the Ramsey framework integrates consumption preferences and sustainability considerations in economic planning.

Policy Implications for Resource Management

The Hotelling rule emphasizes optimal depletion rates of non-renewable resources, guiding policymakers to set extraction rates that reflect increasing scarcity and rising prices over time. In contrast, the Ramsey rule prioritizes intertemporal consumption smoothing and discounting future utility, influencing resource management by balancing economic growth with consumption preferences. Integrating both rules helps design policies that ensure sustainable resource use while maximizing long-term social welfare and economic efficiency.

Applications in Natural Resource Economics

The Hotelling rule guides the optimal extraction rate of non-renewable resources by equating the marginal net price increase to the discount rate, ensuring resource depletion occurs efficiently over time. The Ramsey rule applies to optimal savings and consumption decisions, including sustainable use of renewable natural resources, by balancing intertemporal utility with resource regeneration rates. Both rules are fundamental in natural resource economics for managing resource depletion and sustainability under scarcity and economic growth conditions.

Criticisms and Limitations of Each Rule

The Hotelling rule faces criticism for its assumption of perfect market conditions and constant extraction costs, which rarely hold true in real-world resource markets, leading to unrealistic price trajectories. The Ramsey rule is limited by its reliance on a fixed social discount rate and assumptions about intertemporal substitution, which may not accurately capture the complexities of sustainable resource management and long-term environmental impacts. Both rules often overlook technological change, market imperfections, and uncertainty, reducing their practical applicability in dynamic resource economics.

Conclusion: Choosing Between Hotelling and Ramsey

The Hotelling rule guides optimal exhaustible resource extraction by equating marginal resource rents with the interest rate, emphasizing scarcity value and intertemporal price dynamics. The Ramsey rule prioritizes welfare maximization through optimal consumption-saving decisions under uncertainty, balancing utility over time with discounting and growth considerations. Choosing between Hotelling and Ramsey depends on policy goals: resource-focused pricing versus holistic economic welfare optimization.

Hotelling rule Infographic

libterm.com

libterm.com