Perfect competition describes a market structure where numerous small firms sell identical products, ensuring no single seller can influence prices. This environment leads to optimal resource allocation and maximum consumer welfare due to free entry and exit. Explore the rest of the article to understand how perfect competition shapes your market choices and economic outcomes.

Table of Comparison

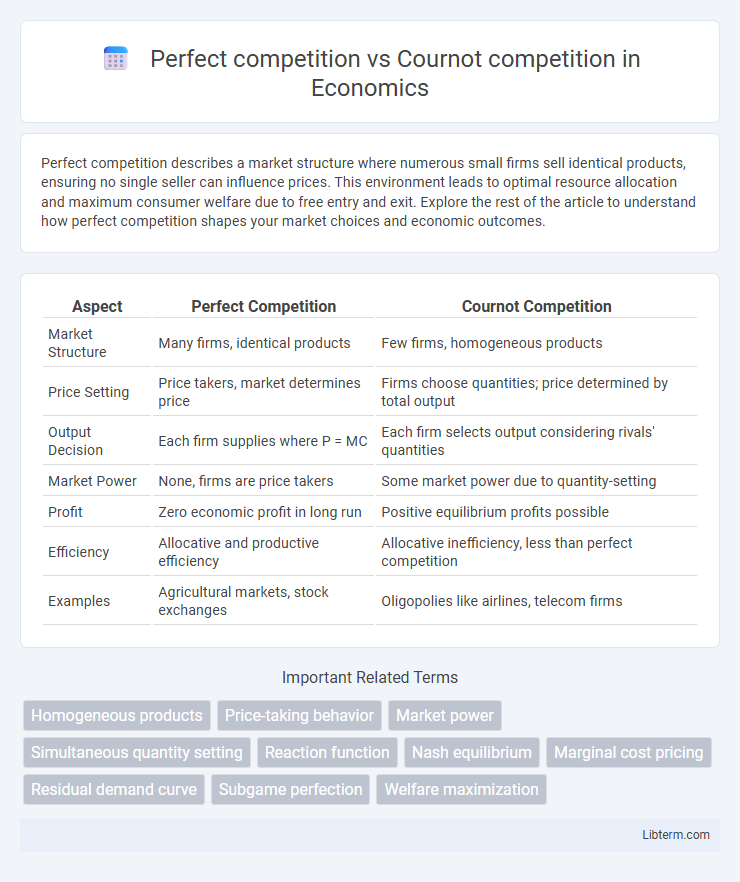

| Aspect | Perfect Competition | Cournot Competition |

|---|---|---|

| Market Structure | Many firms, identical products | Few firms, homogeneous products |

| Price Setting | Price takers, market determines price | Firms choose quantities; price determined by total output |

| Output Decision | Each firm supplies where P = MC | Each firm selects output considering rivals' quantities |

| Market Power | None, firms are price takers | Some market power due to quantity-setting |

| Profit | Zero economic profit in long run | Positive equilibrium profits possible |

| Efficiency | Allocative and productive efficiency | Allocative inefficiency, less than perfect competition |

| Examples | Agricultural markets, stock exchanges | Oligopolies like airlines, telecom firms |

Introduction to Market Structures

Perfect competition features numerous small firms producing homogeneous products, leading to price-taking behavior and maximum market efficiency. Cournot competition involves a limited number of firms choosing quantities strategically, resulting in higher prices and reduced output compared to perfect competition. Market structures differ in firm interdependence, with perfect competition characterized by independent producers and Cournot competition marked by strategic quantity decisions.

Defining Perfect Competition

Perfect competition is a market structure characterized by a large number of small firms, homogeneous products, and perfect information, ensuring no single firm can influence market prices. Firms are price takers, meaning they accept the prevailing market price determined by supply and demand equilibrium. This leads to allocative and productive efficiency, where resources are optimally distributed, and firms produce at the lowest possible cost.

Understanding Cournot Competition

Cournot competition models an oligopoly where firms simultaneously choose quantities to maximize profits, assuming rivals' output remains fixed. Unlike perfect competition, where many firms are price takers producing at marginal cost, Cournot firms strategically interact, leading to equilibrium quantities that reflect mutual interdependence. This results in higher prices and lower total output compared to perfect competition, highlighting the implications of market power and strategic decision-making in oligopolistic markets.

Key Assumptions of Both Models

Perfect competition assumes numerous firms producing homogeneous products with free market entry and exit, ensuring firms are price takers with no market power. Cournot competition involves a limited number of firms simultaneously choosing output quantities, where each firm assumes rivals' outputs as fixed, leading to strategic interdependence and market power. Both models assume profit maximization and identical cost structures but differ in market concentration and firm behavior regarding output decision-making.

Price Determination in Each Market Structure

In perfect competition, price determination is driven by market forces where firms are price takers and prices equal marginal cost, resulting in an efficient allocation of resources. In contrast, Cournot competition involves firms simultaneously choosing output quantities, leading to a market price lower than monopoly but higher than perfect competition equilibrium due to strategic interdependence. The Cournot equilibrium price reflects the balance between firms' output decisions and market demand, causing prices to be above marginal cost and allowing for positive economic profits.

Firm Behavior: Output and Profit Maximization

In perfect competition, firms are price takers producing at the point where marginal cost equals market price to maximize output and profit, resulting in zero economic profit in the long run. Cournot competition involves firms choosing output quantities simultaneously, each considering the other's output to maximize individual profit, leading to higher prices and lower total output compared to perfect competition. The equilibrium output in Cournot models balances firms' strategic interdependence, contrasting with the perfectly competitive firm's output decision based solely on market price.

Market Outcomes: Efficiency and Welfare

Perfect competition leads to allocative and productive efficiency, maximizing total welfare as firms produce at the point where price equals marginal cost, resulting in no deadweight loss. Cournot competition, characterized by firms choosing quantities simultaneously, generates less output than perfect competition and a higher market price, causing allocative inefficiency and reduced consumer surplus. Consequently, welfare is lower in Cournot markets due to firms possessing market power that restricts output and elevates prices above marginal cost.

Real-World Examples of Both Models

Perfect competition is exemplified by agricultural markets where numerous small farmers sell homogeneous products with no single entity influencing prices, such as wheat or corn markets in the Midwest United States. Cournot competition occurs in industries like the global telecommunications sector, where a few dominant firms, such as AT&T and Verizon, strategically set quantities to maximize profits while considering rivals' output decisions. These contrasting market structures illustrate how product homogeneity and firm count shape competitive strategies and market outcomes.

Advantages and Limitations of Each Structure

Perfect competition offers maximum efficiency with many firms producing identical products, ensuring optimal resource allocation and zero economic profits in the long run. However, its limitation lies in the unrealistic assumption of perfect information and no barriers to entry, which rarely exist in real markets. Cournot competition, involving firms choosing quantities simultaneously, captures strategic interdependence and market power but results in higher prices and lower output compared to perfect competition, reflecting its less efficient but more realistic nature.

Conclusion: Choosing the Right Model

Perfect competition suits markets with numerous small firms producing homogeneous products, leading to price-taking behavior and maximum consumer surplus. Cournot competition models strategic interactions between a few firms with market power making quantity decisions, often resulting in higher prices and lower output than perfect competition. Selecting the appropriate model depends on market structure, firm behavior, and the extent of competitive influence on prices and output levels.

Perfect competition Infographic

libterm.com

libterm.com