Price rigidity occurs when prices remain stable despite changes in supply or demand, affecting market efficiency and consumer behavior. This phenomenon can result from menu costs, long-term contracts, or strategic firm behavior, limiting how quickly markets adjust to new information. Explore the rest of the article to understand how price rigidity impacts your purchasing decisions and the broader economy.

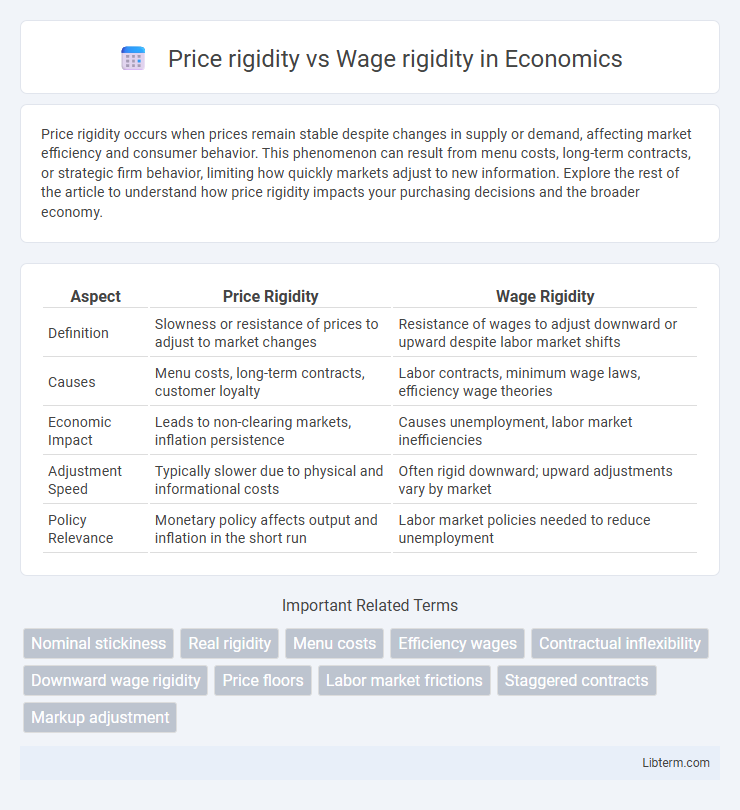

Table of Comparison

| Aspect | Price Rigidity | Wage Rigidity |

|---|---|---|

| Definition | Slowness or resistance of prices to adjust to market changes | Resistance of wages to adjust downward or upward despite labor market shifts |

| Causes | Menu costs, long-term contracts, customer loyalty | Labor contracts, minimum wage laws, efficiency wage theories |

| Economic Impact | Leads to non-clearing markets, inflation persistence | Causes unemployment, labor market inefficiencies |

| Adjustment Speed | Typically slower due to physical and informational costs | Often rigid downward; upward adjustments vary by market |

| Policy Relevance | Monetary policy affects output and inflation in the short run | Labor market policies needed to reduce unemployment |

Introduction to Price Rigidity and Wage Rigidity

Price rigidity refers to the resistance of prices to change despite shifts in supply or demand, often due to menu costs, contracts, or market structure. Wage rigidity occurs when nominal wages are slow to adjust downward, influenced by factors like long-term labor contracts, worker morale, or minimum wage laws. Both rigidities play critical roles in macroeconomic fluctuations by affecting the speed and magnitude of economic adjustments.

Defining Price Rigidity: Concepts and Causes

Price rigidity refers to the resistance of prices to change despite shifts in supply and demand, often caused by menu costs, contracts, and market competition. It contrasts with wage rigidity, where wages remain fixed due to long-term labor contracts, minimum wage laws, and worker morale considerations. Understanding price rigidity is essential for analyzing inflation dynamics and monetary policy effectiveness.

Understanding Wage Rigidity: Key Factors

Wage rigidity occurs when wages remain constant despite changes in labor market conditions, influenced by factors such as long-term contracts, minimum wage laws, and worker morale concerns. Unlike price rigidity, which is often driven by menu costs and market competition, wage rigidity is deeply rooted in institutional settings, including collective bargaining and labor regulations. This persistence of rigid wages can hinder labor market adjustment and contribute to unemployment during economic downturns.

Theoretical Foundations: Keynesian vs Neoclassical Perspectives

Price rigidity in Keynesian theory arises from nominal rigidities and menu costs, causing prices to adjust slowly in response to demand shocks, which contributes to prolonged unemployment. Wage rigidity, emphasized by Keynesians, stems from institutional factors like unions and minimum wage laws that prevent wages from falling to clear the labor market. In contrast, Neoclassical perspectives argue that prices and wages are flexible and adjust quickly to equilibrate supply and demand, leading to market-clearing and full employment under the assumption of perfect competition and rational expectations.

Comparative Analysis: Price Rigidity vs Wage Rigidity

Price rigidity refers to the resistance of prices to change despite shifts in demand or supply, often influenced by menu costs and customer expectations, whereas wage rigidity occurs when wages remain fixed despite labor market fluctuations, impacted by contracts, minimum wage laws, and social norms. Price rigidity typically affects product markets leading to slower market adjustments, while wage rigidity directly influences employment levels and labor market flexibility. Comparative analysis shows that wage rigidity tends to have more profound effects on unemployment rates, whereas price rigidity primarily impacts inflation dynamics and consumer purchasing power.

Macroeconomic Impacts of Price Rigidity

Price rigidity refers to the resistance of prices to change despite shifts in supply or demand, leading to inefficient resource allocation and prolonged market disequilibriums. Wage rigidity, on the other hand, involves inflexible wages that hinder labor market adjustments and can cause unemployment or reduced labor mobility. Price rigidity significantly impacts macroeconomic stability by slowing down the economy's response to shocks, contributing to persistent inflation or deflation, and affecting output levels and employment rates.

Macroeconomic Implications of Wage Rigidity

Wage rigidity refers to the resistance of nominal wages to adjust downward during economic downturns, leading to prolonged unemployment and slower economic recovery. This inflexibility inhibits labor market clearing, resulting in higher structural unemployment and reduced labor mobility. Macroeconomic implications include increased unemployment volatility, diminished effectiveness of monetary policy, and potential wage-price spirals that exacerbate inflation persistence.

Real-World Examples: Evidence from Different Economies

Price rigidity is evident in economies like Japan, where firms often keep prices stable despite fluctuating demand to maintain customer loyalty and avoid menu costs, while wage rigidity is prominent in Germany due to strong labor unions and collective bargaining agreements that prevent quick wage adjustments. In the United States, price flexibility is higher in competitive retail sectors, whereas wage rigidity is observed during recessions as firms hesitate to cut nominal wages to preserve worker morale. Emerging markets such as Brazil experience both price and wage rigidities influenced by government regulations and inflation expectations, impacting their macroeconomic stability.

Policy Responses to Address Rigidity Issues

Policy responses to address price rigidity often involve enhancing market competition through deregulation and promoting flexible pricing mechanisms to allow quicker adjustments to demand shocks. Wage rigidity is mitigated by reforms such as reducing labor market frictions, including lowering minimum wages, easing employment protection legislation, and encouraging wage-setting institutions to adopt more flexible contracts. Central banks use forward guidance and inflation targeting to influence expectations, helping to reduce both price and wage rigidities by fostering adaptive economic behaviors.

Conclusion: Balancing Flexibility for Economic Stability

Price rigidity and wage rigidity each pose distinct challenges to economic stability by limiting market adjustments. Balancing these rigidities requires policies that promote moderate flexibility in prices and wages to enhance responsiveness without causing volatility. Achieving this balance supports steady inflation, employment levels, and overall economic growth.

Price rigidity Infographic

libterm.com

libterm.com