Corporate tax rate impacts your business profitability by determining the portion of earnings paid to the government, directly affecting cash flow and growth potential. Understanding recent changes and comparative rates across regions can help optimize your tax planning strategies. Explore the rest of the article to learn how to navigate corporate tax rates effectively for your enterprise.

Table of Comparison

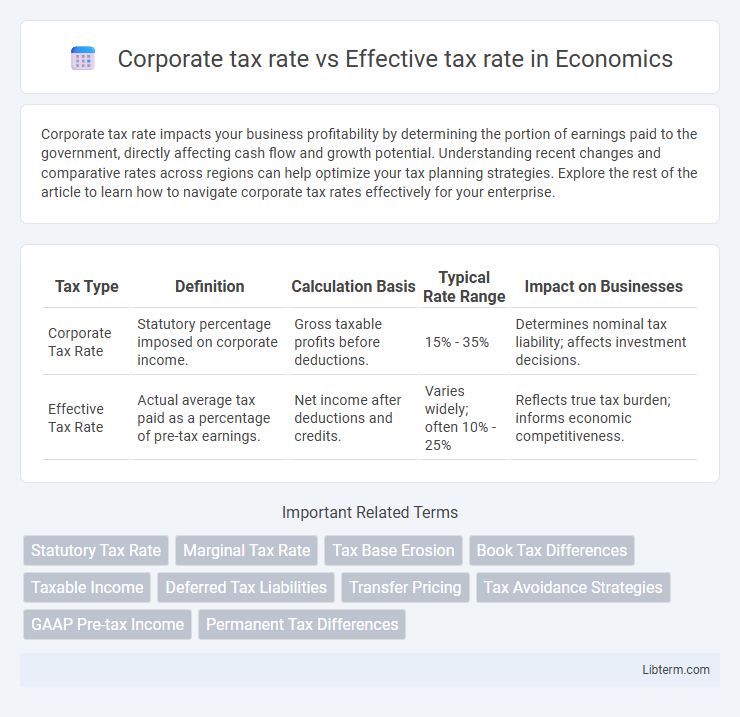

| Tax Type | Definition | Calculation Basis | Typical Rate Range | Impact on Businesses |

|---|---|---|---|---|

| Corporate Tax Rate | Statutory percentage imposed on corporate income. | Gross taxable profits before deductions. | 15% - 35% | Determines nominal tax liability; affects investment decisions. |

| Effective Tax Rate | Actual average tax paid as a percentage of pre-tax earnings. | Net income after deductions and credits. | Varies widely; often 10% - 25% | Reflects true tax burden; informs economic competitiveness. |

Introduction to Corporate Tax Rate vs Effective Tax Rate

The corporate tax rate is the statutory percentage imposed by governments on a corporation's taxable income, serving as the base rate for tax calculations. The effective tax rate reflects the actual percentage of income paid in taxes after deductions, credits, and other adjustments, providing a more accurate measure of a company's tax burden. Differences between the two rates highlight how tax planning strategies and regulatory frameworks impact overall tax expenses for businesses.

Defining Corporate Tax Rate

The corporate tax rate is the statutory percentage imposed by governments on a corporation's taxable income before deductions and credits. It represents the baseline tax liability that businesses must calculate for compliance with tax regulations. Unlike the effective tax rate, which reflects the actual proportion of income paid after adjustments, the corporate tax rate is a fixed legal benchmark used for initial tax computations.

Understanding Effective Tax Rate

The effective tax rate provides a more accurate measure of a company's tax burden by reflecting the actual percentage of income paid in taxes, accounting for deductions, credits, and other adjustments. Unlike the statutory corporate tax rate, which is a fixed rate set by law, the effective tax rate varies based on a company's financial activities and tax planning strategies. Understanding the effective tax rate helps investors and analysts assess a firm's tax efficiency and overall profitability more precisely.

Key Differences between Corporate and Effective Tax Rates

Corporate tax rate is the legally mandated percentage that a corporation must pay on its taxable income set by government law, typically varying by country and jurisdiction. Effective tax rate represents the actual percentage of income a corporation pays in taxes after accounting for deductions, credits, exemptions, and other tax planning strategies, providing a more accurate reflection of a company's real tax burden. Key differences include that the corporate tax rate is a statutory figure used for calculation, while the effective tax rate reflects the true tax impact on net income, influenced by financial decisions and tax compliance measures.

How Corporate Tax Rates Are Set

Corporate tax rates are typically established by national or regional governments based on fiscal policy objectives, economic conditions, and political considerations. These statutory tax rates represent the legal percentage of taxable corporate income that companies must pay, but they do not account for deductions, credits, or loopholes that influence actual tax payments. The effective tax rate, calculated as the ratio of total tax paid to pre-tax earnings, reflects the true tax burden after applying all adjustments, providing a more accurate measure of corporate tax liabilities.

Factors Influencing the Effective Tax Rate

The effective tax rate is shaped by factors such as allowable deductions, tax credits, and differences in income types, which cause it to diverge significantly from the statutory corporate tax rate. Variations in accounting methods, geographic jurisdictions, and the use of tax planning strategies also impact the effective tax rate. These components reflect the actual tax burden a corporation faces, providing a more accurate measure than the nominal corporate tax rate.

Impact of Tax Deductions and Credits

Corporate tax rate represents the statutory percentage imposed on a company's taxable income, whereas the effective tax rate reflects the actual percentage paid after accounting for tax deductions and credits. Tax deductions, such as depreciation and interest expenses, reduce taxable income, while tax credits directly lower tax liability, significantly narrowing the gap between the corporate tax rate and the effective tax rate. The extensive use of deductions and credits allows corporations to substantially decrease their effective tax burdens compared to the nominal corporate tax rate.

Real-World Examples: Corporate vs Effective Tax Rates

Corporate tax rates often represent statutory rates set by governments, such as the 21% federal corporate tax rate in the United States, but effective tax rates reveal the actual percentage of income firms pay after deductions and credits. For example, multinational corporations like Apple reported an effective tax rate close to 15%, significantly lower than the statutory rate, due to tax planning strategies and international tax rules. Real-world disparities between corporate and effective tax rates highlight the impact of tax incentives, loopholes, and varying domestic and global tax regulations on the overall tax burden for businesses.

Implications for Businesses and Investors

Corporate tax rate represents the statutory percentage levied on a company's profits, while the effective tax rate reflects the actual tax paid after deductions and credits, providing a more accurate financial burden measure. Businesses with a lower effective tax rate can reinvest more capital, enhancing growth and competitiveness, whereas investors evaluate effective tax rates to gauge a company's true profitability and potential dividend payouts. Disparities between these rates influence strategic decisions on tax planning, investment allocation, and risk assessment in financial forecasting.

Conclusion: Navigating Corporate and Effective Tax Rates

Corporate tax rate represents the statutory percentage imposed on a company's profits by law, while the effective tax rate reflects the actual average rate a corporation pays after accounting for deductions, credits, and exemptions. Understanding the disparity between these rates is crucial for accurate financial planning, compliance, and strategic decision-making in taxation. Navigating both requires a comprehensive evaluation of tax regulations and corporate financial activities to optimize tax liabilities and maintain fiscal responsibility.

Corporate tax rate Infographic

libterm.com

libterm.com