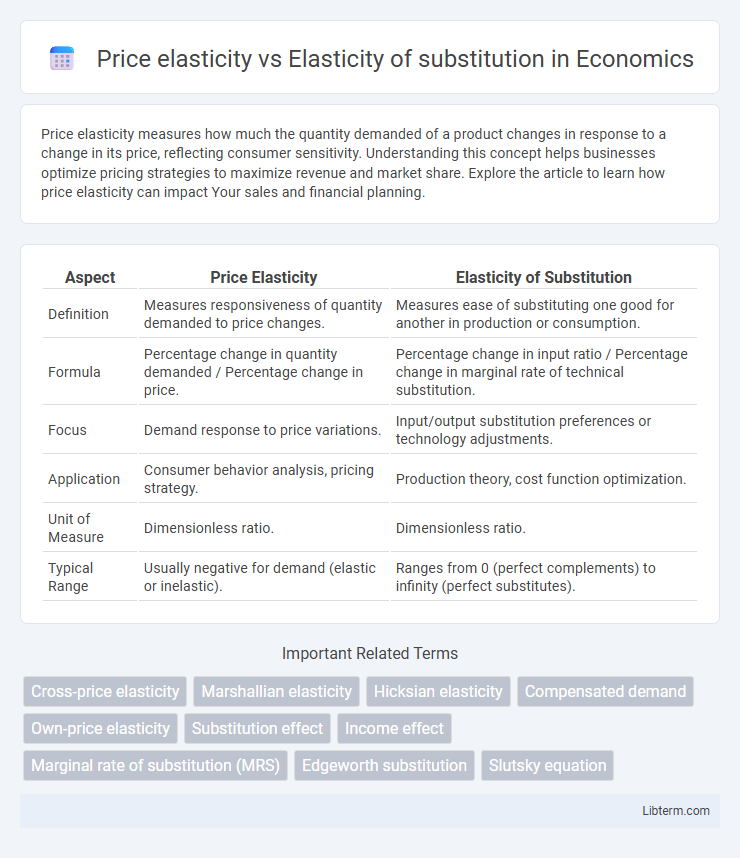

Price elasticity measures how much the quantity demanded of a product changes in response to a change in its price, reflecting consumer sensitivity. Understanding this concept helps businesses optimize pricing strategies to maximize revenue and market share. Explore the article to learn how price elasticity can impact Your sales and financial planning.

Table of Comparison

| Aspect | Price Elasticity | Elasticity of Substitution |

|---|---|---|

| Definition | Measures responsiveness of quantity demanded to price changes. | Measures ease of substituting one good for another in production or consumption. |

| Formula | Percentage change in quantity demanded / Percentage change in price. | Percentage change in input ratio / Percentage change in marginal rate of technical substitution. |

| Focus | Demand response to price variations. | Input/output substitution preferences or technology adjustments. |

| Application | Consumer behavior analysis, pricing strategy. | Production theory, cost function optimization. |

| Unit of Measure | Dimensionless ratio. | Dimensionless ratio. |

| Typical Range | Usually negative for demand (elastic or inelastic). | Ranges from 0 (perfect complements) to infinity (perfect substitutes). |

Introduction to Price Elasticity and Elasticity of Substitution

Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to changes in its price, capturing consumer sensitivity to price fluctuations. Elasticity of substitution quantifies the ease with which consumers or producers can replace one good with another when relative prices change, reflecting substitution patterns between goods. Understanding both concepts is essential for analyzing market behavior, demand shifts, and production decisions in response to price variations and alternative product availability.

Defining Price Elasticity: Concept and Calculation

Price elasticity measures the responsiveness of quantity demanded or supplied to changes in the price of a good, calculated as the percentage change in quantity divided by the percentage change in price. It quantifies how sensitive consumers or producers are to price fluctuations, indicating whether a product is elastic (greater than 1) or inelastic (less than 1). This concept differs from elasticity of substitution, which examines how easily one good can be replaced by another in production or consumption based on relative prices.

Understanding Elasticity of Substitution: Meaning and Importance

Elasticity of substitution measures the responsiveness in the ratio of two inputs when their relative prices change, reflecting how easily one input can be substituted for another in production. Understanding this elasticity is crucial for optimizing production processes and cost management, especially when input prices fluctuate or technological changes occur. It provides valuable insights for firms to make informed decisions on resource allocation, capital-labor trade-offs, and adapting to market dynamics.

Key Differences Between Price Elasticity and Elasticity of Substitution

Price elasticity measures the responsiveness of quantity demanded or supplied to changes in the price of a specific good, capturing consumer sensitivity to price fluctuations. Elasticity of substitution quantifies how easily consumers or producers can switch between different inputs or goods in response to changes in relative prices, reflecting flexibility in choice between alternatives. The key difference lies in price elasticity focusing on quantity response to a single good's price change, while elasticity of substitution centers on the rate of substitution between two or more goods or inputs.

Factors Affecting Price Elasticity of Demand

Price elasticity of demand measures how the quantity demanded of a good responds to a change in its price, influenced by factors such as availability of substitutes, necessity versus luxury status, and proportion of income spent on the good. The elasticity of substitution reflects the ease with which consumers can replace one input or product with another in production or consumption, often affected by relative prices and technological compatibility. Understanding these distinctions is critical for pricing strategies, as products with high price elasticity require careful consideration of consumer sensitivity and substitution effects.

Determinants of Elasticity of Substitution

Determinants of elasticity of substitution primarily include the degree of similarity between production factors, availability of close substitutes, and the flexibility of technology to switch inputs in production processes. Unlike price elasticity, which measures responsiveness of quantity demanded to price changes, elasticity of substitution quantifies how easily one input can be replaced by another without affecting output levels. Factors such as factor compatibility, input specificity, and the production function's curvature significantly influence the elasticity of substitution in economic models.

Real-World Examples: Price Elasticity vs Elasticity of Substitution

Price elasticity measures how the quantity demanded of a good responds to changes in its price, such as gasoline demand dropping when prices rise sharply. Elasticity of substitution evaluates how easily consumers or producers switch between different inputs or goods when relative prices change, like firms substituting capital for labor in manufacturing. Real-world examples include the high price elasticity of luxury cars, which see demand fluctuations with price shifts, versus the elasticity of substitution between renewable energy sources and fossil fuels as companies adjust their energy mix for cost efficiency.

Economic Implications of Each Elasticity Measure

Price elasticity measures consumer responsiveness to price changes, influencing market demand curves and pricing strategies crucial for revenue optimization. Elasticity of substitution quantifies how easily consumers or producers switch between inputs or goods, affecting production decisions and resource allocation efficiency. Understanding both elasticities aids policymakers in designing effective taxes, subsidies, and competition regulations by predicting market adjustments and welfare impacts.

Applications in Business Strategy and Policy

Price elasticity measures how the quantity demanded of a product responds to price changes, enabling businesses to optimize pricing strategies and forecast revenue. Elasticity of substitution quantifies consumer willingness to replace one good with another when relative prices shift, guiding product differentiation and competitive positioning. Understanding these elasticities informs policymakers and strategists in market regulation, taxation effects, and innovation incentives to enhance market efficiency.

Conclusion: Choosing the Right Elasticity for Analysis

Price elasticity measures the responsiveness of quantity demanded to changes in price, crucial for analyzing consumer behavior and market demand. Elasticity of substitution quantifies the ease with which consumers or producers can replace one good or input with another, essential for understanding production decisions and input flexibility. Selecting the appropriate elasticity depends on the research objective: price elasticity suits demand sensitivity studies, while elasticity of substitution is key for production and input choice analyses.

Price elasticity Infographic

libterm.com

libterm.com