Solvency II is a regulatory framework designed to ensure insurers maintain adequate capital to cover their risks, promoting financial stability in the European insurance market. It introduces risk-based capital requirements, governance standards, and transparency measures to protect policyholders and foster market confidence. Discover how Solvency II impacts your insurance firm and what you need to know to stay compliant in the full article.

Table of Comparison

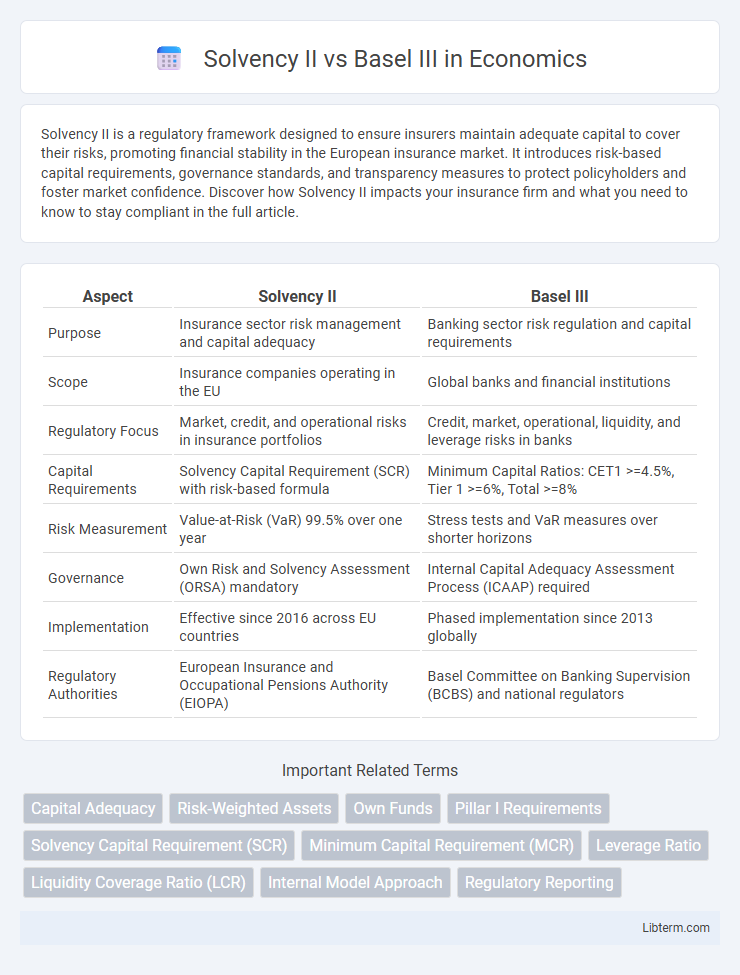

| Aspect | Solvency II | Basel III |

|---|---|---|

| Purpose | Insurance sector risk management and capital adequacy | Banking sector risk regulation and capital requirements |

| Scope | Insurance companies operating in the EU | Global banks and financial institutions |

| Regulatory Focus | Market, credit, and operational risks in insurance portfolios | Credit, market, operational, liquidity, and leverage risks in banks |

| Capital Requirements | Solvency Capital Requirement (SCR) with risk-based formula | Minimum Capital Ratios: CET1 >=4.5%, Tier 1 >=6%, Total >=8% |

| Risk Measurement | Value-at-Risk (VaR) 99.5% over one year | Stress tests and VaR measures over shorter horizons |

| Governance | Own Risk and Solvency Assessment (ORSA) mandatory | Internal Capital Adequacy Assessment Process (ICAAP) required |

| Implementation | Effective since 2016 across EU countries | Phased implementation since 2013 globally |

| Regulatory Authorities | European Insurance and Occupational Pensions Authority (EIOPA) | Basel Committee on Banking Supervision (BCBS) and national regulators |

Introduction to Solvency II and Basel III

Solvency II is a European Union directive that establishes risk-based capital requirements and regulatory standards for insurance companies to ensure financial stability and policyholder protection. Basel III is a global regulatory framework developed by the Basel Committee on Banking Supervision, designed to strengthen bank capital requirements, improve risk management, and increase resilience to financial stress. Both frameworks aim to enhance the stability of their respective sectors--insurance and banking--through rigorous capital adequacy and risk assessment methodologies.

Historical Background and Development

Solvency II originated from the European Union's effort to harmonize insurance regulation, implemented in 2016 to enhance risk management and capital adequacy for insurers. Basel III emerged from the Basel Committee on Banking Supervision after the 2008 financial crisis, focusing on strengthening bank capital rules and liquidity requirements globally. Both frameworks have evolved through extensive regulatory consultations to address systemic risks in financial institutions but target different sectors--insurance for Solvency II and banking for Basel III.

Core Objectives and Scope

Solvency II primarily targets the insurance sector, focusing on risk-based capital requirements, governance, and market discipline to ensure insurers' financial stability and policyholder protection. Basel III addresses the banking industry's resilience by enhancing capital adequacy, liquidity, and leverage ratios to mitigate systemic risks and promote financial system stability. Both frameworks aim to strengthen risk management but differ in scope, with Solvency II tailored to insurers and Basel III to banks.

Key Regulatory Requirements

Solvency II mandates insurance companies to maintain risk-based capital reserves aligned with underwriting, market, credit, and operational risks, supported by a three-pillar framework emphasizing quantitative capital requirements, governance, and disclosure. Basel III imposes stringent capital adequacy ratios, leverage ratio, and liquidity coverage ratio on banks to enhance resilience against financial shocks, focusing on credit risk, market risk, and operational risk management. Both frameworks require robust risk management practices but differ in scope, with Solvency II designed for insurers and Basel III targeting banking sector stability.

Capital Adequacy Standards

Solvency II and Basel III establish capital adequacy standards tailored to distinct sectors: Solvency II governs insurance companies by requiring risk-based capital to cover underwriting, market, and operational risks, ensuring policyholder protection. Basel III applies to banks, setting stringent minimum capital requirements, including tier 1 capital ratios, leverage ratios, and buffers to enhance resilience against credit, market, and liquidity risks. Both frameworks emphasize risk sensitivity and promote financial stability by aligning regulatory capital with the underlying risk profiles of institutions.

Risk Management Frameworks

Solvency II and Basel III represent two distinct risk management frameworks designed to enhance the stability of insurance companies and banking institutions, respectively. Solvency II emphasizes comprehensive risk assessment, including underwriting, market, credit, and operational risks, with a focus on maintaining an adequate Solvency Capital Requirement (SCR) to ensure insurer solvency. Basel III concentrates on strengthening bank capital requirements, improving liquidity standards, and introducing leverage ratios to mitigate systemic risk and enhance overall financial system resilience.

Supervisory Review and Reporting

Solvency II and Basel III frameworks emphasize robust supervisory review and reporting to ensure financial stability, with Solvency II focusing on insurance firms and Basel III targeting banks. Solvency II mandates comprehensive Own Risk and Solvency Assessment (ORSA) reports and quarterly regulatory filings to assess insurers' capital adequacy and risk management practices. Basel III requires standardized regulatory reporting, including Pillar 2 Supervisory Review Processes, emphasizing banks' capital planning, risk exposure analysis, and stress testing for enhanced transparency and risk mitigation.

Impact on Financial Institutions

Solvency II and Basel III impose distinct regulatory frameworks that significantly impact financial institutions by enhancing risk management and capital adequacy requirements. Solvency II focuses primarily on insurance companies, requiring them to maintain sufficient capital based on market, credit, and operational risks, thereby promoting financial stability and policyholder protection. Basel III targets banks, enforcing stricter capital buffers, leverage ratios, and liquidity standards to reduce systemic risk and improve the resilience of the banking sector.

Challenges and Criticisms

Solvency II faces challenges related to its complex risk measurement models that can be costly and difficult for insurers to implement effectively, often leading to regulatory arbitrage and inconsistent capital requirements. Basel III, while enhancing bank resilience through stricter capital and liquidity standards, is criticized for potentially constraining lending capacity and increasing compliance burdens for financial institutions. Both frameworks struggle with adequately capturing emerging risks such as cyber threats and climate change, highlighting limitations in their adaptability and risk sensitivity.

Future Outlook for Financial Regulation

Solvency II and Basel III represent cornerstone regulatory frameworks shaping the future of financial stability by emphasizing risk-sensitive capital requirements for insurers and banks respectively. The integration of advanced risk assessment models and digital reporting technologies is expected to enhance transparency and resilience across the financial sector. Emerging regulatory trends indicate increased convergence between insurance and banking oversight, promoting harmonized standards that address systemic risks and cross-sector vulnerabilities.

Solvency II Infographic

libterm.com

libterm.com