The shadow economy encompasses unreported economic activities that evade government regulation and taxation, impacting official economic data and public revenue. Operating outside formal channels, this sector includes informal labor, undeclared income, and illicit trade, which pose challenges for policymakers and economists. Explore the article to understand how the shadow economy affects your financial environment and the broader economy.

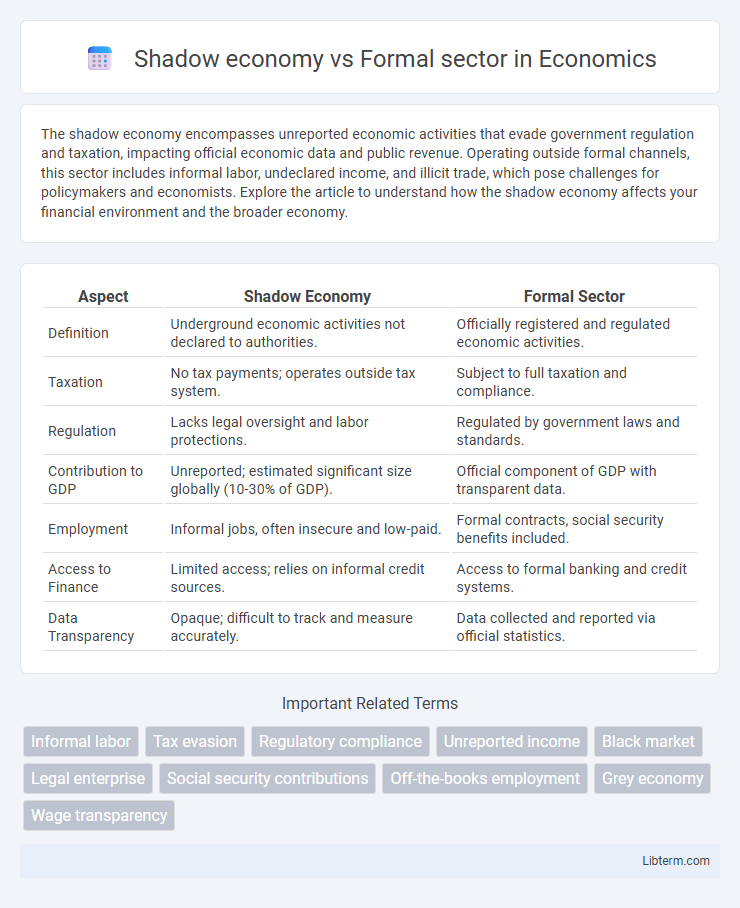

Table of Comparison

| Aspect | Shadow Economy | Formal Sector |

|---|---|---|

| Definition | Underground economic activities not declared to authorities. | Officially registered and regulated economic activities. |

| Taxation | No tax payments; operates outside tax system. | Subject to full taxation and compliance. |

| Regulation | Lacks legal oversight and labor protections. | Regulated by government laws and standards. |

| Contribution to GDP | Unreported; estimated significant size globally (10-30% of GDP). | Official component of GDP with transparent data. |

| Employment | Informal jobs, often insecure and low-paid. | Formal contracts, social security benefits included. |

| Access to Finance | Limited access; relies on informal credit sources. | Access to formal banking and credit systems. |

| Data Transparency | Opaque; difficult to track and measure accurately. | Data collected and reported via official statistics. |

Understanding the Shadow Economy and Formal Sector

The shadow economy consists of unregulated economic activities that evade government oversight, resulting in unreported income and tax evasion, which can distort economic data and reduce public revenues. The formal sector operates within legal frameworks, contributing to official GDP, tax payments, and social security systems, ensuring compliance with labor laws and regulations. Understanding the interplay between these sectors is crucial for policymakers aiming to enhance tax compliance and formalize informal employment to promote sustainable economic growth.

Key Differences Between Shadow and Formal Economies

The shadow economy operates outside government regulation, tax systems, and legal frameworks, while the formal sector consists of officially registered businesses complying with laws and tax obligations. Employment in the shadow economy is often informal, lacking social security benefits and labor protections, in contrast to the formal sector's regulated labor market. Economic output in the shadow economy remains unreported and untaxed, impacting government revenue and policy accuracy, whereas the formal sector contributes transparently to national statistics and public finances.

Factors Driving Informal Economic Activities

Factors driving informal economic activities include regulatory burdens, high tax rates, and limited access to formal financial services that push businesses to operate outside the formal sector. Labor market rigidities, such as inflexible labor laws and social security contributions, increase incentives for employers and workers to engage in the shadow economy. Weak enforcement of legal frameworks and corruption further exacerbate the growth of informal economic activities by lowering the perceived risks of operating unofficially.

The Role of Government Regulation

Effective government regulation plays a critical role in delineating the shadow economy from the formal sector by enforcing compliance with taxation, labor laws, and business standards. Robust regulatory frameworks incentivize formalization through simplified tax systems and transparent legal processes, reducing the prevalence of informal economic activities. Strong enforcement mechanisms and penalties further discourage unregistered enterprises, promoting economic stability and equitable growth.

Economic Impact of the Shadow Economy

The shadow economy significantly reduces tax revenues, undermining public services and infrastructure financing essential for economic growth. It distorts labor markets by fostering informal employment, which limits social security coverage and worker protections. This parallel market creates unfair competition, discouraging investment in the formal sector and impairing long-term economic development.

Challenges Facing the Formal Sector

The formal sector faces significant challenges such as high taxation, complex regulations, and bureaucratic red tape that incentivize businesses to operate in the shadow economy. Limited access to finance and costly compliance requirements strain small and medium-sized enterprises (SMEs), hindering formalization efforts. These obstacles reduce competitiveness and economic growth, undermining labor protections and government revenue collection.

Employment Patterns in Both Sectors

Employment patterns in the shadow economy often involve informal jobs characterized by a lack of social security, irregular wages, and absence of legal contracts, contrasting sharply with the formal sector's structured employment, which includes legal protections, social benefits, and regulated wages. Workers in the shadow economy typically face job insecurity and limited access to institutional support, while formal sector employees benefit from labor laws, formal contracts, and workplace safety regulations. The prevalence of informal employment is higher in developing countries, where the shadow economy serves as a buffer in times of economic instability, whereas developed economies exhibit a higher proportion of formal sector jobs with standardized employment conditions.

Taxation and Revenue Implications

The shadow economy undermines formal sector taxation by operating outside official tax systems, leading to significant revenue losses for governments. Informal activities evade income, sales, and corporate taxes, reducing the fiscal capacity needed for public services and infrastructure investment. Enhancing tax compliance and integrating informal businesses into the formal economy can improve revenue collection and economic transparency.

Transitioning from Informal to Formal Economy

Transitioning from the shadow economy to the formal sector involves implementing policies that enhance regulatory compliance, provide access to financial services, and reduce bureaucratic barriers for informal businesses. Leveraging digital technologies and offering incentives like tax breaks can facilitate smoother integration into the formal economy. This shift boosts government revenue, improves labor protections, and fosters sustainable economic growth.

Policy Strategies to Address the Shadow Economy

Effective policy strategies to address the shadow economy include enhancing tax compliance through simplified tax systems and digital payment incentives, improving labor market regulations to reduce informal employment, and strengthening law enforcement against illicit activities. Promoting financial inclusion by expanding access to banking services encourages the transition from informal to formal economic participation. Transparent governance and public awareness campaigns further support formalization by building trust in institutions and highlighting the benefits of operating within the formal sector.

Shadow economy Infographic

libterm.com

libterm.com