The junior tranche refers to the lowest priority segment of a structured financial product, such as a collateralized debt obligation (CDO) or mortgage-backed security, which absorbs losses first before senior tranches face any risk. It typically offers higher potential returns due to increased risk exposure but is more vulnerable during defaults or economic downturns. To understand how the junior tranche might impact your investment strategy, continue reading the rest of this article.

Table of Comparison

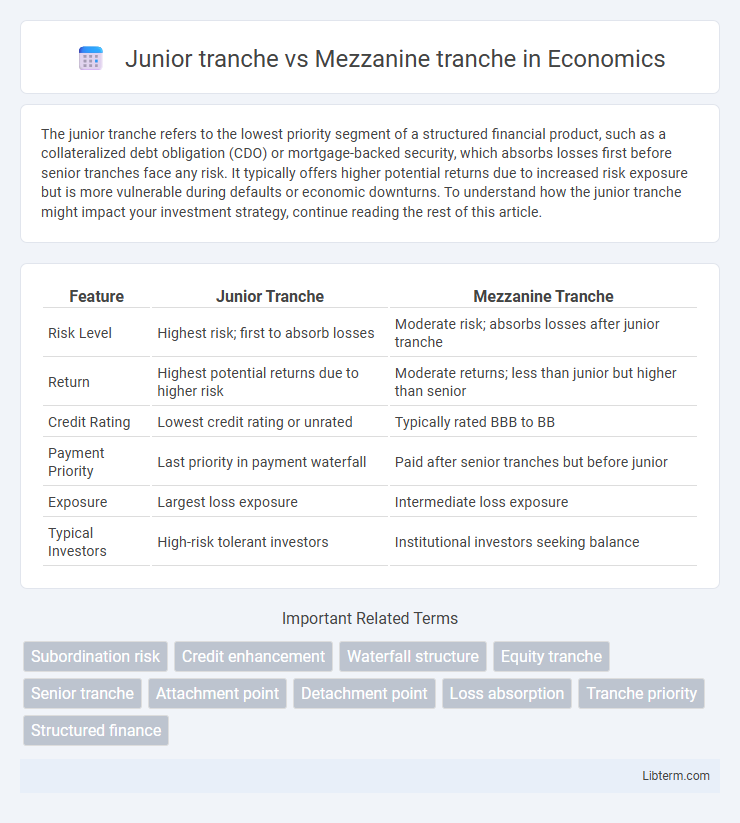

| Feature | Junior Tranche | Mezzanine Tranche |

|---|---|---|

| Risk Level | Highest risk; first to absorb losses | Moderate risk; absorbs losses after junior tranche |

| Return | Highest potential returns due to higher risk | Moderate returns; less than junior but higher than senior |

| Credit Rating | Lowest credit rating or unrated | Typically rated BBB to BB |

| Payment Priority | Last priority in payment waterfall | Paid after senior tranches but before junior |

| Exposure | Largest loss exposure | Intermediate loss exposure |

| Typical Investors | High-risk tolerant investors | Institutional investors seeking balance |

Introduction to Tranches in Structured Finance

Junior tranches represent the lowest priority debt in structured finance, absorbing initial losses and thus carrying higher risk and higher yields compared to mezzanine tranches. Mezzanine tranches occupy a middle position in the capital stack, offering moderate risk and return by absorbing losses only after junior tranches are depleted but before senior tranches are affected. Understanding the risk hierarchy and cash flow priorities of junior and mezzanine tranches is critical for investors assessing structured finance securities like collateralized debt obligations (CDOs) or mortgage-backed securities (MBS).

Defining Junior and Mezzanine Tranches

The junior tranche represents the lowest priority class of debt or securities in a structured finance deal, absorbing initial losses and carrying the highest risk but offering the highest potential returns. The mezzanine tranche lies between the senior and junior tranches, featuring moderate risk and return profiles by absorbing losses only after the junior tranche is depleted but before senior obligations are impacted. Both tranches structure risk and cash flow priorities, aligning with investor risk appetite and return expectations in collateralized debt obligations or mortgage-backed securities.

Structural Position: Junior vs Mezzanine

The junior tranche holds the lowest structural position in a securitization, absorbing losses first and offering higher risk but potentially greater returns. The mezzanine tranche sits above the junior tranche, providing a balance between risk and return with priority over junior losses but subordinate to senior tranches. This structural hierarchy impacts cash flow distribution and risk exposure within the capital stack of asset-backed securities.

Risk Profile Comparison

Junior tranche carries the highest risk in a structured finance deal due to its position at the bottom of the capital stack, absorbing initial losses before mezzanine and senior tranches. Mezzanine tranche holds moderate risk, subordinated to senior tranches but senior to the junior tranche, offering a balance between risk and return. Investors in junior tranches expect higher yields as compensation for greater exposure to default and credit risk compared to mezzanine tranches.

Returns and Yield Differences

Junior tranche typically offers higher returns due to increased risk exposure compared to mezzanine tranche, which has moderate risk and thus moderate yields. Yield differences arise because junior tranche absorbs initial losses, leading investors to demand higher compensation for potential default. Mezzanine tranche balances risk and return by having priority over junior tranche in cash flow distribution while still providing attractive yields above senior tranches.

Loss Absorption Capacity

The Junior tranche possesses the highest loss absorption capacity, absorbing initial losses before any impact on mezzanine or senior tranches, making it the riskiest for investors. Mezzanine tranches absorb losses only after the junior tranche is completely depleted, providing a moderate level of loss protection while offering higher yields than senior tranches. This hierarchical loss absorption structure prioritizes protection levels and influences investor return expectations within structured finance products.

Typical Investors in Each Tranche

Junior tranche investors typically include hedge funds and mezzanine funds seeking higher yields with elevated risk exposure, while mezzanine tranche investors often consist of institutional investors like pension funds and insurance companies aiming for moderate returns with balanced risk. Junior tranches absorb initial losses, attracting investors comfortable with higher default risk, whereas mezzanine tranches provide a middle layer of protection and appeal to those prioritizing a blend of income and capital preservation. Investor profiles differ based on risk tolerance, return expectations, and portfolio diversification strategies aligned with each tranche's credit hierarchy.

Role in Collateralized Debt Obligations (CDOs)

The Junior tranche in Collateralized Debt Obligations (CDOs) acts as the first loss absorber, bearing the highest risk and providing credit enhancement for senior tranches by absorbing defaults before them. The Mezzanine tranche holds a middle-risk position, receiving payments after senior tranches but before the junior tranche, thus offering higher yields than senior debt but lower risk than the junior tranche. Both tranches are crucial in structuring CDOs, balancing risk and return to attract different investor profiles and ensuring the overall credit quality of the CDO.

Impact on Credit Ratings

The junior tranche carries higher risk and typically receives lower credit ratings compared to the mezzanine tranche, which holds a middle position in the capital structure with moderate risk and credit ratings. Rating agencies assign the junior tranche lower ratings due to its subordinate claim on assets and higher likelihood of loss in default scenarios. Mezzanine tranches benefit from partial credit enhancement, resulting in higher credit ratings that reflect their better protection against defaults relative to junior tranches.

Choosing Between Junior and Mezzanine Tranches

Choosing between junior and mezzanine tranches depends on risk tolerance and investment goals; junior tranches offer higher risk and potential returns due to their subordinate payment priority, while mezzanine tranches provide moderate risk with more stable cash flows and higher credit ratings. Investors seeking greater yield may prefer junior tranches for their higher loss exposure but higher spread, whereas conservative investors often select mezzanine tranches for balanced risk-return profiles within structured finance deals. Understanding the tranche's position in the capital structure and the associated credit enhancement levels is crucial for making an informed investment choice.

Junior tranche Infographic

libterm.com

libterm.com