Personal income reflects the total earnings an individual receives from wages, investments, and other sources, serving as a key indicator of economic well-being. Understanding how personal income fluctuates helps you budget effectively and plan for future financial goals. Explore the rest of this article to learn more about factors influencing personal income and strategies to increase it.

Table of Comparison

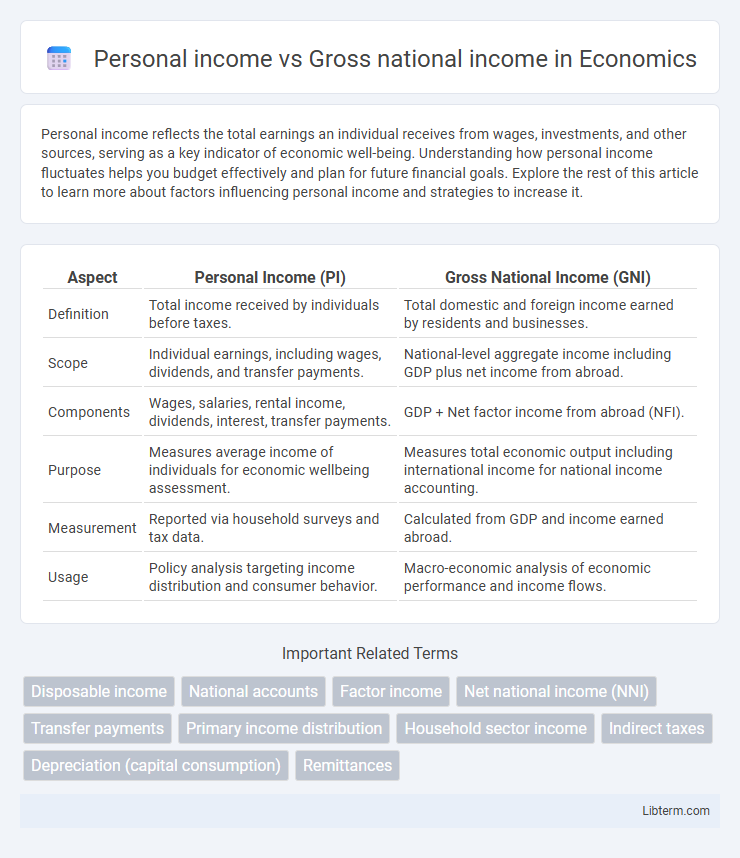

| Aspect | Personal Income (PI) | Gross National Income (GNI) |

|---|---|---|

| Definition | Total income received by individuals before taxes. | Total domestic and foreign income earned by residents and businesses. |

| Scope | Individual earnings, including wages, dividends, and transfer payments. | National-level aggregate income including GDP plus net income from abroad. |

| Components | Wages, salaries, rental income, dividends, interest, transfer payments. | GDP + Net factor income from abroad (NFI). |

| Purpose | Measures average income of individuals for economic wellbeing assessment. | Measures total economic output including international income for national income accounting. |

| Measurement | Reported via household surveys and tax data. | Calculated from GDP and income earned abroad. |

| Usage | Policy analysis targeting income distribution and consumer behavior. | Macro-economic analysis of economic performance and income flows. |

Introduction to Personal Income and Gross National Income

Personal income represents the total earnings received by individuals from all sources, including wages, investments, and transfer payments, reflecting the economic well-being of households. Gross National Income (GNI) measures the total monetary value of goods and services produced by a country's residents, including net income from abroad, providing a comprehensive view of national economic strength. Both metrics play crucial roles in economic analysis by linking individual income levels with broader national economic output.

Defining Personal Income

Personal income refers to the total earnings received by individuals from all sources, including wages, salaries, bonuses, dividends, rental income, and transfer payments such as social security and unemployment benefits. It reflects the actual income available to households before taxes and personal contributions to social insurance programs. Gross national income (GNI) differs by measuring the total domestic and foreign output claimed by residents, combining gross domestic product (GDP) with net income from abroad.

Understanding Gross National Income

Gross National Income (GNI) measures the total income earned by a country's residents and businesses, including income from abroad, reflecting the overall economic strength beyond domestic production. It differs from Personal Income, which accounts for individual earnings such as wages, investments, and transfer payments within the country. Understanding GNI is crucial for assessing the total economic resources available to a nation, informing policy decisions and international comparisons.

Key Differences Between Personal and Gross National Income

Personal income represents the total earnings received by individuals and households from all sources, including wages, investments, and transfer payments. Gross National Income (GNI) measures the total income earned by a country's residents and businesses, including any income earned abroad, reflecting the overall economic strength of the nation. The key differences lie in scope and inclusivity, with personal income focusing on individual earnings while GNI encompasses national economic activity and cross-border income flows.

How Personal Income Is Calculated

Personal income is calculated by summing all income received by individuals, including wages, salaries, rental income, dividends, interest, and government transfer payments such as Social Security and unemployment benefits. It excludes corporate profits and retained earnings, focusing solely on earnings directly available to individuals. Unlike gross national income, which measures the total income earned by a country's residents regardless of location, personal income reflects the actual income accessible to households for consumption and saving.

Components of Gross National Income

Gross National Income (GNI) includes the total domestic and foreign income earned by a country's residents, encompassing wages, rents, interest, and profits from abroad, distinguishing it from Personal Income which only accounts for individual earnings before taxes. Key components of GNI encompass compensation of employees, net property income from abroad, and taxes less subsidies on production and imports, reflecting a broader measure of overall economic benefit. This metric provides a more comprehensive understanding of national economic activity by integrating income flows between a country and the rest of the world.

The Importance of Measuring Personal Income

Measuring personal income is crucial for understanding the financial well-being of individuals and households, which directly impacts consumer spending and economic growth. Personal income reflects earnings from wages, investments, and government transfers, providing a clear picture of disposable income available for goods and services. Unlike gross national income (GNI), which aggregates national output including corporate profits and taxes, personal income focuses on actual funds accessible to people, aiding policymakers in designing effective fiscal and social programs.

Role of Gross National Income in Economic Analysis

Gross National Income (GNI) plays a crucial role in economic analysis by measuring the total domestic and foreign output claimed by residents of a country, reflecting the overall economic strength beyond just national borders. Unlike Personal Income, which focuses on individual earnings, GNI provides a broader perspective on national economic performance, incorporating income from abroad such as remittances and foreign investments. This comprehensive metric aids policymakers and economists in assessing economic growth, income distribution, and the impact of globalization on the national economy.

Implications for Policymakers and Economists

Personal income reflects the total earnings received by individuals, directly influencing consumption patterns and taxation policies, while Gross National Income (GNI) measures the overall economic strength, including income from abroad, guiding decisions on trade, foreign investment, and national welfare programs. Policymakers use personal income data to tailor social safety nets and stimulate domestic demand, whereas GNI offers insights for balancing national accounts and assessing international economic competitiveness. Economists analyze discrepancies between personal income and GNI to identify income distribution issues and formulate strategies for sustainable economic growth.

Conclusion: Choosing the Right Income Measure

Selecting the appropriate income measure depends on the context and purpose of analysis, where personal income captures household earnings and gross national income (GNI) reflects a country's total economic production including net income from abroad. Personal income is ideal for assessing individual or household economic well-being and consumption capacity, while GNI provides a broader perspective on national economic performance and international economic ties. Understanding these distinctions ensures accurate economic assessments and policy decisions tailored to either microeconomic or macroeconomic objectives.

Personal income Infographic

libterm.com

libterm.com