Traditional reinsurance involves transferring a portion of an insurer's risk to another insurance company, providing financial stability and risk management for primary insurers. It typically includes treaty or facultative agreements that help mitigate losses from large or unexpected claims. Discover how traditional reinsurance can safeguard your business and enhance your understanding by reading the rest of this article.

Table of Comparison

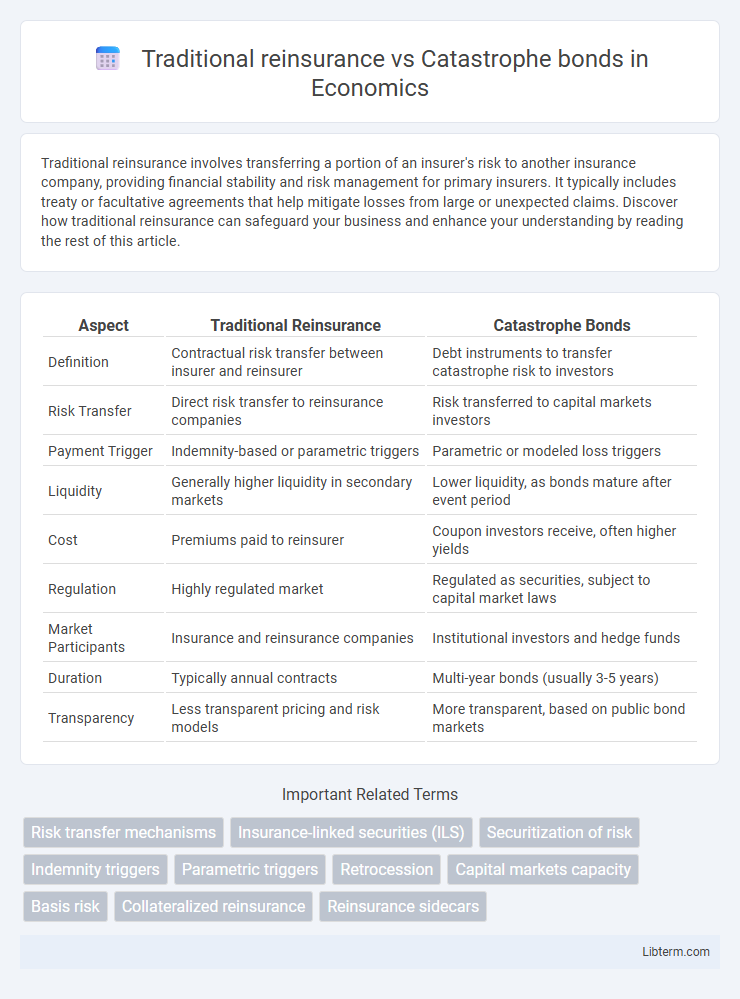

| Aspect | Traditional Reinsurance | Catastrophe Bonds |

|---|---|---|

| Definition | Contractual risk transfer between insurer and reinsurer | Debt instruments to transfer catastrophe risk to investors |

| Risk Transfer | Direct risk transfer to reinsurance companies | Risk transferred to capital markets investors |

| Payment Trigger | Indemnity-based or parametric triggers | Parametric or modeled loss triggers |

| Liquidity | Generally higher liquidity in secondary markets | Lower liquidity, as bonds mature after event period |

| Cost | Premiums paid to reinsurer | Coupon investors receive, often higher yields |

| Regulation | Highly regulated market | Regulated as securities, subject to capital market laws |

| Market Participants | Insurance and reinsurance companies | Institutional investors and hedge funds |

| Duration | Typically annual contracts | Multi-year bonds (usually 3-5 years) |

| Transparency | Less transparent pricing and risk models | More transparent, based on public bond markets |

Understanding Traditional Reinsurance

Traditional reinsurance involves insurance companies transferring portions of their risk portfolios to reinsurers to manage large-scale losses and stabilize financial performance. This conventional risk-sharing mechanism relies on contractual agreements where reinsurers indemnify primary insurers against specific losses, providing capital relief and loss mitigation. Traditional reinsurance typically covers a broad range of risks with flexible terms, distinguishing it from catastrophe bonds that focus on financing extreme, predefined disaster events.

What Are Catastrophe Bonds?

Catastrophe bonds are risk-linked securities that transfer natural disaster risks from insurers to investors, allowing insurers to manage their exposure to major catastrophic events like hurricanes and earthquakes. Unlike traditional reinsurance, which involves direct contracts between insurers and reinsurers, catastrophe bonds provide capital market investors with the opportunity to absorb losses in exchange for attractive yields if no triggering event occurs. These bonds are typically structured with specific trigger mechanisms such as parametric or indemnity triggers, enabling rapid payout to the insurer when predefined disaster parameters are met.

Key Structural Differences

Traditional reinsurance involves contractual agreements where insurers transfer risk to reinsurers, typically covering a broad range of losses with negotiated premiums and claim settlements. Catastrophe bonds are capital market instruments that provide disaster risk financing by transferring risk to investors through fixed-term securities, offering predefined payouts triggered by specific catastrophic events. Unlike reinsurance's flexible indemnity-based coverage, catastrophe bonds rely on parametric or index-based triggers, providing faster payouts but limited to predefined event parameters.

Risk Transfer Mechanisms Compared

Traditional reinsurance involves transferring risk from insurers to reinsurers through contractual agreements that cover specific losses, providing predictable indemnity payments after events. Catastrophe bonds (cat bonds) transfer risk to capital markets by issuing securities that pay bondholders only if predefined catastrophic events occur, often providing quicker access to capital with limited counterparty risk. Both mechanisms serve to mitigate insurer exposure but differ significantly in capital source, payout triggers, and risk diversification efficiency.

Costs and Pricing Considerations

Traditional reinsurance involves negotiated premiums based on historical loss data and underwriting assessments, often resulting in higher fixed costs and commissions for cedents. Catastrophe bonds transfer risk to capital markets, pricing exposure through risk modeling and investor yield demands, which can introduce greater pricing volatility but potentially lower overall costs. Both mechanisms require careful evaluation of cost-effectiveness relative to coverage scope, loss triggers, and capital efficiency.

Claims Process and Payout Triggers

Traditional reinsurance claims process involves a detailed assessment and verification of losses by the reinsurer, often requiring extensive documentation and negotiations before payouts are made, which can delay settlements. Catastrophe bonds use predefined parametric triggers based on measurable events like earthquake magnitude or hurricane wind speed, enabling faster automatic payouts without the need for loss adjustment. This parametric approach reduces claim disputes and accelerates funds disbursement compared to the indemnity-based methodology of traditional reinsurance.

Investor Perspective: Reinsurance vs Cat Bonds

From an investor perspective, traditional reinsurance offers steady, contract-based returns tied to underwriting profits, while catastrophe bonds provide exposure to high-yield, event-driven returns with risk linked to specific natural disasters. Investors benefit from reinsurance's established market liquidity and long-term contracts, contrasting with cat bonds' fixed maturity and less frequent issuance. Cat bonds appeal to investors seeking portfolio diversification and uncorrelated risks, whereas reinsurance investments depend heavily on insurer performance and claims management.

Market Trends and Growth Opportunities

Traditional reinsurance dominates the risk transfer market, with global premiums exceeding $300 billion in 2023, driven by increasing climate-related disasters. Catastrophe bonds are expanding rapidly, with issuance surpassing $15 billion in 2023, offering investors diversified risk exposure and insurers alternative capital sources. Market trends highlight growing interest in parametric triggers and blockchain integration, presenting significant growth opportunities in transparency and claim automation.

Regulatory and Legal Frameworks

Traditional reinsurance operates under well-established regulatory frameworks that require compliance with solvency margins, capital adequacy, and detailed reporting standards to protect policyholders and maintain market stability. Catastrophe bonds, classified as insurance-linked securities, are subject to securities regulations and often face complex legal scrutiny regarding investor protection, disclosure requirements, and jurisdictional enforcement. The differing regulatory landscapes impact risk transfer efficiency, transparency, and the capacity of insurers and capital markets to absorb large-scale disaster losses.

Choosing the Right Solution for Risk Management

Traditional reinsurance provides insurers with financial protection by transferring risk to a reinsurer through contractual agreements, offering established, customizable coverage options for various perils. Catastrophe bonds, as insurance-linked securities, transfer specific disaster risks to capital market investors, enabling insurers to offload large, infrequent losses while accessing alternative capital sources. Selecting the right risk management solution depends on factors such as risk appetite, capital requirements, cost considerations, and the desired speed of claim settlement in high-impact loss scenarios.

Traditional reinsurance Infographic

libterm.com

libterm.com