Fiscal conservatism emphasizes prudent government spending, reducing debt, and minimizing taxation to promote economic stability and growth. It advocates for policies that limit wasteful expenditures while ensuring efficient allocation of resources. Explore the article to understand how fiscal conservatism can impact your financial future.

Table of Comparison

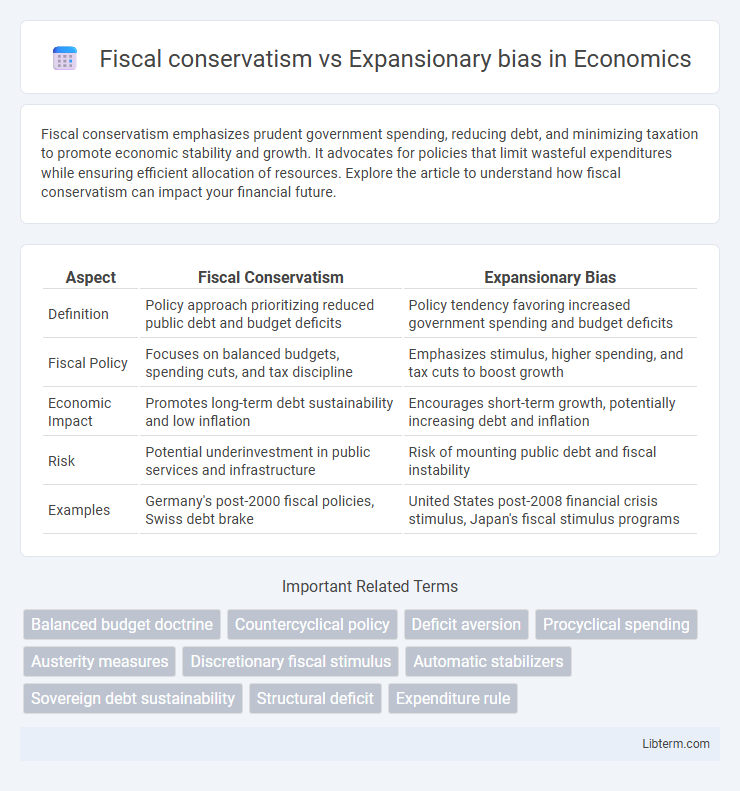

| Aspect | Fiscal Conservatism | Expansionary Bias |

|---|---|---|

| Definition | Policy approach prioritizing reduced public debt and budget deficits | Policy tendency favoring increased government spending and budget deficits |

| Fiscal Policy | Focuses on balanced budgets, spending cuts, and tax discipline | Emphasizes stimulus, higher spending, and tax cuts to boost growth |

| Economic Impact | Promotes long-term debt sustainability and low inflation | Encourages short-term growth, potentially increasing debt and inflation |

| Risk | Potential underinvestment in public services and infrastructure | Risk of mounting public debt and fiscal instability |

| Examples | Germany's post-2000 fiscal policies, Swiss debt brake | United States post-2008 financial crisis stimulus, Japan's fiscal stimulus programs |

Defining Fiscal Conservatism and Expansionary Bias

Fiscal conservatism emphasizes reducing government deficits and debt through prudent spending and balanced budgets, prioritizing long-term economic stability and low inflation. Expansionary bias refers to the tendency of policymakers to favor increased public spending and tax cuts to stimulate short-term economic growth, often leading to persistent budget deficits. Understanding these concepts is crucial for analyzing government fiscal policies and their impact on economic health.

Historical Contexts of Fiscal Policy Approaches

Fiscal conservatism historically emphasizes limited government spending and balanced budgets to maintain economic stability, rooted in the classical gold standard era and post-World War II economic policies. Expansionary bias, often observed in Keynesian-influenced periods such as the Great Depression and post-2008 financial crisis, reflects governments' tendency to increase spending and run deficits to stimulate growth and reduce unemployment. These contrasting approaches shape modern fiscal policy debates by highlighting the tension between long-term debt sustainability and short-term economic stabilization.

Core Principles of Fiscal Conservatism

Fiscal conservatism centers on maintaining balanced budgets, minimizing government debt, and promoting sustainable economic growth through prudent spending and low taxation. It emphasizes reducing public sector size and avoiding excessive deficits to ensure long-term fiscal stability. The core principle advocates for disciplined government finance policies that prevent expansionary bias, which often leads to higher deficits and inflationary pressures.

Key Drivers Behind Expansionary Bias

Expansionary bias in fiscal policy stems primarily from political incentives encouraging short-term economic growth and voter approval through increased public spending and tax cuts, disregarding long-term fiscal sustainability. Fiscal conservatism advocates for reducing government debt and maintaining balanced budgets, emphasizing spending discipline and structural reforms to avoid accumulation of deficits. Key drivers behind expansionary bias include electoral pressures, information asymmetry between policymakers and voters, and institutional constraints limiting effective fiscal oversight.

Economic Outcomes: Growth, Stability, and Volatility

Fiscal conservatism emphasizes reducing government deficits and debt, promoting long-term economic stability by limiting excessive public spending and avoiding inflationary pressures. Expansionary bias, characterized by persistent government deficits to stimulate growth, often leads to short-term economic growth but increases volatility and risk of fiscal crises. Empirical evidence suggests countries adhering to fiscal conservatism experience more sustainable growth and lower market volatility, whereas economies with expansionary bias face heightened instability and cyclical fluctuations.

Political Motivations and Policy Decisions

Fiscal conservatism emphasizes reducing government debt and deficits by prioritizing balanced budgets and limiting public spending, often appealing to voters concerned about economic stability and long-term growth. Expansionary bias occurs when politicians favor increased government spending and tax cuts to stimulate short-term economic growth, motivated by the desire to gain electoral support through immediate benefits. These political motivations drive policy decisions, with fiscal conservatives advocating for austerity measures while proponents of expansionary bias support deficit-financed stimulus to boost economic activity.

Fiscal Discipline: Benefits and Trade-offs

Fiscal discipline ensures sustainable public finances by controlling deficits and debt levels, enhancing investor confidence and economic stability. While fiscal conservatism fosters long-term growth through prudent budget management, expansionary bias often prioritizes short-term economic stimulus at the risk of higher debt and inflation. Policymakers face trade-offs between maintaining fiscal restraint to avoid financial crises and implementing expansionary policies to support employment and demand during downturns.

Case Studies: Countries Exemplifying Each Approach

Germany exemplifies fiscal conservatism through its disciplined budget management, maintaining low debt-to-GDP ratios and adhering to strict austerity measures during economic downturns. Conversely, Japan demonstrates expansionary bias by prioritizing aggressive fiscal stimulus and persistent budget deficits to spur growth and counter deflationary pressures. These contrasting approaches highlight the impact of fiscal policy choices on economic stability and long-term public debt sustainability across different advanced economies.

Challenges in Balancing Fiscal Policies

Fiscal conservatism emphasizes reducing government deficits and controlling public debt through restrained spending and efficient budget management. Expansionary bias arises from political pressures to increase spending and lower taxes, often leading to persistent budget deficits. Balancing these opposing fiscal approaches requires addressing challenges such as economic growth sustainability, debt stability, and the political feasibility of implementing disciplined fiscal policies.

Future Trends in Fiscal Governance

Fiscal conservatism emphasizes strict budget discipline and reduced government spending to ensure long-term economic stability, while expansionary bias reflects a tendency toward persistent budget deficits driven by short-term political incentives. Future trends in fiscal governance suggest increased reliance on automatic stabilizers and independent fiscal councils to counteract expansionary bias and promote sustainable public finances. Advances in data analytics and real-time monitoring are enhancing transparency and accountability, enabling more effective enforcement of fiscal rules aligned with conservative principles.

Fiscal conservatism Infographic

libterm.com

libterm.com