Deregulation involves reducing or eliminating government rules and restrictions in industries to promote competition and increase efficiency. This process can lead to lower prices and innovation but may also pose risks such as reduced consumer protections or market instability. Explore the rest of the article to understand how deregulation impacts various sectors and what it means for your interests.

Table of Comparison

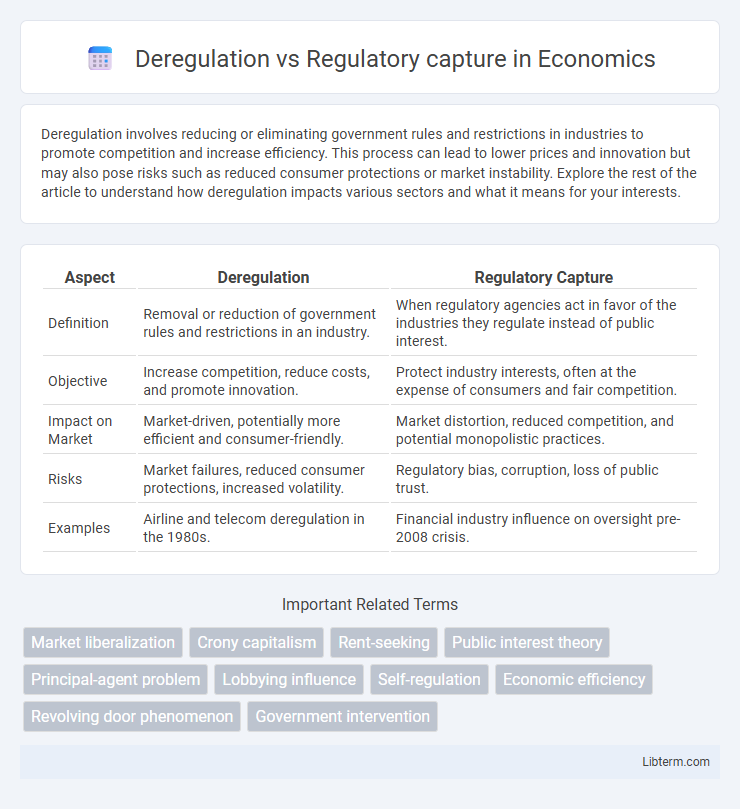

| Aspect | Deregulation | Regulatory Capture |

|---|---|---|

| Definition | Removal or reduction of government rules and restrictions in an industry. | When regulatory agencies act in favor of the industries they regulate instead of public interest. |

| Objective | Increase competition, reduce costs, and promote innovation. | Protect industry interests, often at the expense of consumers and fair competition. |

| Impact on Market | Market-driven, potentially more efficient and consumer-friendly. | Market distortion, reduced competition, and potential monopolistic practices. |

| Risks | Market failures, reduced consumer protections, increased volatility. | Regulatory bias, corruption, loss of public trust. |

| Examples | Airline and telecom deregulation in the 1980s. | Financial industry influence on oversight pre-2008 crisis. |

Introduction to Deregulation and Regulatory Capture

Deregulation involves the removal or reduction of government rules and restrictions in an industry to promote competition and efficiency. Regulatory capture occurs when regulatory agencies are dominated by the very industries they are charged with overseeing, leading to policies that favor industry interests over public welfare. Understanding the balance between deregulation and regulatory capture is crucial for effective policymaking and market regulation.

Defining Deregulation: Concepts and Purpose

Deregulation involves reducing or eliminating government rules and restrictions in industries to increase efficiency, competition, and innovation. The primary purpose of deregulation is to minimize bureaucratic oversight, lower costs, and enhance market dynamics by allowing businesses greater freedom. It contrasts with regulatory capture, where regulatory agencies serve industry interests rather than the public, potentially justifying deregulation to curb such influence.

Understanding Regulatory Capture: Origins and Mechanisms

Regulatory capture occurs when regulatory agencies, established to act in the public interest, become dominated by the industries they are supposed to regulate, leading to policies that favor private interests over public welfare. This phenomenon originates from close interactions between regulators and industry stakeholders, including revolving doors of employment, lobbying, and informational asymmetries that skew decision-making. Key mechanisms include regulatory agencies adopting industry perspectives, regulatory leniency, and reduced enforcement, ultimately undermining effective oversight and market competition.

Historical Examples of Deregulation

Historical examples of deregulation include the Airline Deregulation Act of 1978, which eliminated government control over fares, routes, and market entry in the U.S. airline industry, fostering competition and lower prices. The Telecommunications Act of 1996 aimed to reduce barriers in the telecom sector, encouraging innovation and expanding consumer choices. Deregulation in the financial sector during the 1980s and 1990s, such as the repeal of the Glass-Steagall Act in 1999, contributed to increased market competition but also raised concerns about regulatory capture and systemic risks.

Notable Cases of Regulatory Capture

Notable cases of regulatory capture include the U.S. financial crisis of 2008, where key regulatory bodies like the Securities and Exchange Commission (SEC) were heavily influenced by the financial industry, leading to lax oversight of risky financial products. Another example is the Federal Aviation Administration's (FAA) relationship with major airlines, which has been criticized for prioritizing airline interests over safety concerns. These cases highlight how deregulation efforts can backfire when regulatory agencies become dominated by the industries they are supposed to regulate.

Pros and Cons of Deregulation

Deregulation can spur economic growth by removing restrictive government controls, leading to increased competition, innovation, and lower prices for consumers. However, it may also result in reduced oversight, increasing the risk of market abuses, environmental harm, and financial instability. The balance between fostering free markets and protecting public interests remains a critical challenge in the deregulation debate.

Consequences of Regulatory Capture on Public Policy

Regulatory capture leads to policies that disproportionately favor industry interests over public welfare, resulting in weakened consumer protections and increased risk of market failures. It distorts public policy by allowing regulatory agencies to be influenced or controlled by the industries they are supposed to regulate, undermining accountability and transparency. This often culminates in reduced competition, higher prices, and diminished trust in governmental institutions.

Deregulation vs Regulatory Capture: Key Differences

Deregulation refers to the reduction or elimination of government rules and restrictions in an industry to promote competition and efficiency, while regulatory capture occurs when regulatory agencies are dominated by the industries they are supposed to oversee, leading to biased policies favoring industry interests. Key differences include their impact on market dynamics: deregulation aims to increase competition and reduce government intervention, whereas regulatory capture results in compromised regulations that benefit specific industries at the expense of public interest. Understanding these distinctions is crucial for effective policy-making that balances market freedom with proper oversight.

Preventing Regulatory Capture in Deregulated Industries

Preventing regulatory capture in deregulated industries requires robust transparency measures, independent oversight bodies, and stakeholder engagement to ensure regulatory agencies prioritize public interest over industry influence. Implementing clear conflict-of-interest policies and frequent audits can mitigate undue corporate influence on policymakers. Maintaining competitive market conditions alongside vigilant enforcement of anti-corruption laws strengthens resistance to regulatory capture in sectors like telecommunications, energy, and finance.

Future Trends: Balancing Deregulation and Effective Oversight

Future trends in balancing deregulation and regulatory capture emphasize adaptive frameworks that integrate technological advancements like AI-driven monitoring systems to enhance transparency and accountability. Policymakers increasingly advocate for dynamic regulatory models that mitigate capture risks while fostering innovation, particularly in sectors such as fintech and environmental protection. Emphasizing data-driven oversight mechanisms and stakeholder collaboration promises a more resilient approach to maintaining market integrity without stifling economic growth.

Deregulation Infographic

libterm.com

libterm.com