Stamp duty is a tax imposed on legal documents, typically involving the purchase of property or shares, and its rates vary depending on the jurisdiction and transaction value. Understanding how stamp duty impacts your overall transaction costs is crucial for effective financial planning and avoiding unexpected expenses. Explore the rest of this article to learn more about stamp duty regulations, exemptions, and strategies to minimize your tax liability.

Table of Comparison

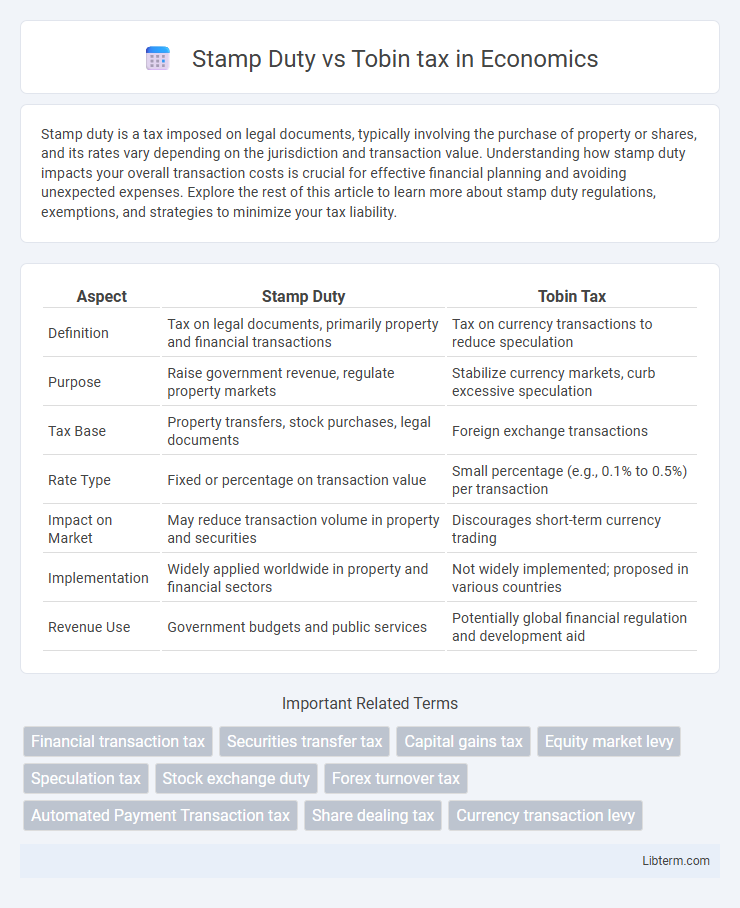

| Aspect | Stamp Duty | Tobin Tax |

|---|---|---|

| Definition | Tax on legal documents, primarily property and financial transactions | Tax on currency transactions to reduce speculation |

| Purpose | Raise government revenue, regulate property markets | Stabilize currency markets, curb excessive speculation |

| Tax Base | Property transfers, stock purchases, legal documents | Foreign exchange transactions |

| Rate Type | Fixed or percentage on transaction value | Small percentage (e.g., 0.1% to 0.5%) per transaction |

| Impact on Market | May reduce transaction volume in property and securities | Discourages short-term currency trading |

| Implementation | Widely applied worldwide in property and financial sectors | Not widely implemented; proposed in various countries |

| Revenue Use | Government budgets and public services | Potentially global financial regulation and development aid |

Introduction to Stamp Duty and Tobin Tax

Stamp Duty is a government-imposed tax on legal documents, primarily affecting the transfer of assets such as real estate and shares. Tobin Tax, proposed by economist James Tobin, targets currency transactions to reduce short-term speculation and volatility in foreign exchange markets. Both taxes serve distinct fiscal and regulatory purposes, influencing financial markets and economic stability.

Defining Stamp Duty: Overview and Key Features

Stamp duty is a government-imposed tax on legal documents, primarily affecting the transfer of assets such as real estate, shares, and securities. It serves as a revenue source and involves a fixed percentage or tiered rate based on the transaction's value, with variations across jurisdictions. Key features include its application at the point of asset transfer, legal recognition requirements, and role in regulatory compliance.

Understanding Tobin Tax: Concept and Application

The Tobin tax is a proposed levy on short-term currency transactions aimed at reducing market volatility and speculation by imposing a small tax on foreign exchange trades. Named after economist James Tobin, this tax targets financial market stability, discouraging rapid capital flows that can destabilize economies. Unlike Stamp Duty, which applies to a broader range of financial instruments and property transactions, the Tobin tax specifically addresses currency exchange markets to promote long-term investment and economic stability.

Historical Background of Stamp Duty

Stamp Duty, originating in 17th-century England with the Stamp Act of 1694, was initially introduced to raise revenue for war expenses by taxing legal documents and financial transactions. It evolved as a widespread method for governments to generate fiscal income through the affixation of physical stamps on papers, contracts, and property transfers. In comparison, the Tobin tax, proposed in the 1970s by economist James Tobin, targets speculative currency exchange transactions to curb short-term financial volatility.

Evolution and Purpose of the Tobin Tax

The Tobin tax, proposed by economist James Tobin in the 1970s, evolved as a financial transaction tax aimed at curbing excessive currency speculation and promoting market stability. Unlike traditional stamp duties, which primarily generate government revenue from legal documents and property transactions, the Tobin tax targets short-term currency trades to reduce volatility in foreign exchange markets. Its purpose centers on discouraging rapid, speculative trading while fostering long-term investment and economic stability.

Key Differences Between Stamp Duty and Tobin Tax

Stamp Duty is a tax imposed on legal documents, primarily during the transfer of assets such as property or shares, whereas Tobin Tax targets currency transactions to curb excessive speculation. Stamp Duty is generally fixed or percentage-based on the transaction value within domestic markets, while Tobin Tax applies globally on foreign exchange trades with a small rate designed to reduce market volatility. The primary purpose of Stamp Duty is revenue generation for governments, whereas Tobin Tax aims at financial market stabilization and discouraging short-term currency trading.

Economic Impact of Stamp Duty

Stamp Duty generates substantial government revenue by taxing the transfer of assets like real estate and shares, influencing market liquidity and transaction volumes. Its economic impact includes potential dampening of short-term speculative trading, which can stabilize markets but also reduce overall transaction frequency. Unlike the Tobin tax, which primarily targets currency transactions to curb speculative volatility, Stamp Duty's broader application affects investment behavior and housing market dynamics.

Financial Market Effects of Tobin Tax

The Tobin tax targets financial market transactions, aiming to reduce excessive short-term currency speculation by imposing a small levy on spot currency conversions, which can stabilize exchange rates and decrease market volatility. Unlike stamp duty, primarily applied to equity transactions and legal documents, the Tobin tax directly influences forex and derivative markets, potentially lowering liquidity but encouraging long-term investments. Empirical studies indicate that implementing a Tobin tax can lead to more predictable financial markets by discouraging rapid speculative trading while maintaining overall market efficiency.

Global Adoption: Where Are These Taxes Applied?

Stamp duty is predominantly applied in countries like the United Kingdom, Hong Kong, and India, primarily targeting the transfer of property and securities to generate substantial government revenue. Tobin tax, originally proposed to curb currency speculation, has seen limited adoption but is implemented in several countries including France and Italy, focusing on taxing foreign exchange transactions. Global adoption of stamp duty is more widespread and established compared to the Tobin tax, which remains largely experimental and debated within international financial regulations.

Pros and Cons: Stamp Duty vs Tobin Tax

Stamp Duty generates significant government revenue through fixed fees on property transactions, offering predictable income but potentially discouraging real estate market activity. Tobin Tax targets currency transactions to reduce speculative trading, helping stabilize exchange rates, though it may decrease market liquidity and increase costs for genuine investors. While Stamp Duty is simpler to administer and enforce, Tobin Tax faces challenges in global coordination and risks driving trading volume to untaxed jurisdictions.

Stamp Duty Infographic

libterm.com

libterm.com