Marginal Value at Risk (MVaR) measures the incremental risk an individual asset contributes to a portfolio's overall Value at Risk, helping investors understand specific exposures during potential losses. Calculating MVaR allows you to identify which assets most significantly impact your portfolio's downside, enabling more precise risk management. Explore the rest of this article to learn how MVaR can optimize your investment strategy and enhance risk assessment.

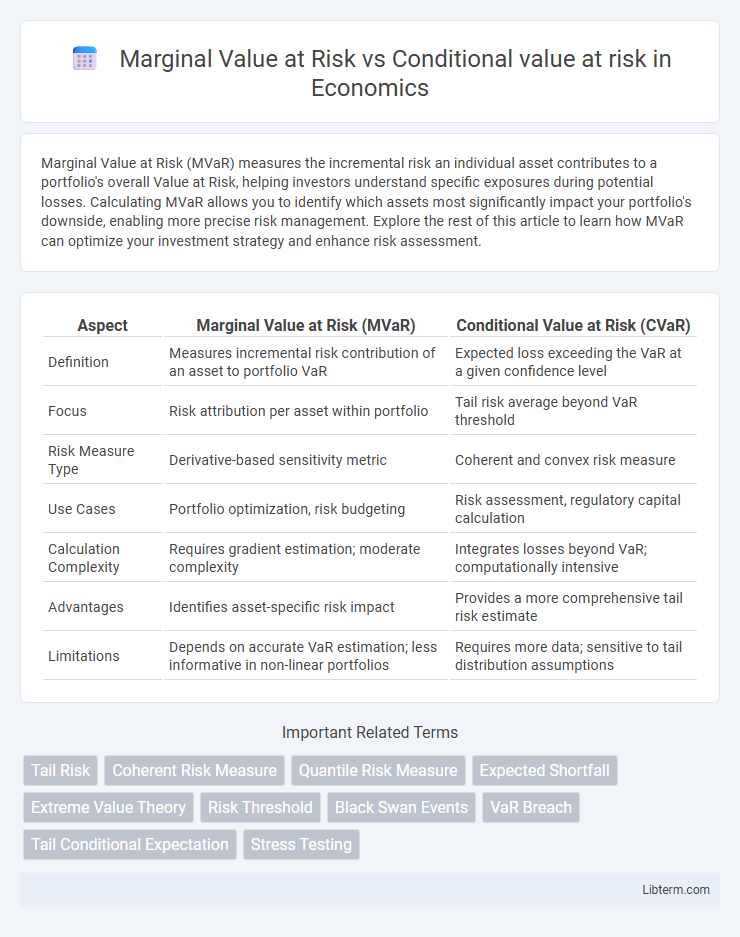

Table of Comparison

| Aspect | Marginal Value at Risk (MVaR) | Conditional Value at Risk (CVaR) |

|---|---|---|

| Definition | Measures incremental risk contribution of an asset to portfolio VaR | Expected loss exceeding the VaR at a given confidence level |

| Focus | Risk attribution per asset within portfolio | Tail risk average beyond VaR threshold |

| Risk Measure Type | Derivative-based sensitivity metric | Coherent and convex risk measure |

| Use Cases | Portfolio optimization, risk budgeting | Risk assessment, regulatory capital calculation |

| Calculation Complexity | Requires gradient estimation; moderate complexity | Integrates losses beyond VaR; computationally intensive |

| Advantages | Identifies asset-specific risk impact | Provides a more comprehensive tail risk estimate |

| Limitations | Depends on accurate VaR estimation; less informative in non-linear portfolios | Requires more data; sensitive to tail distribution assumptions |

Introduction to Risk Measures in Finance

Marginal Value at Risk (MVaR) quantifies the incremental risk contribution of a specific asset within a portfolio, providing insights into how individual positions impact overall financial risk. Conditional Value at Risk (CVaR), also known as Expected Shortfall, measures the average loss exceeding the Value at Risk (VaR) threshold, offering a more comprehensive assessment of tail risk under adverse market conditions. Both MVaR and CVaR are essential risk measures in finance, enhancing portfolio risk management by capturing different dimensions of potential losses beyond traditional VaR metrics.

Defining Marginal Value at Risk (MVaR)

Marginal Value at Risk (MVaR) quantifies the incremental risk contribution of an individual asset or portfolio component to the overall Value at Risk (VaR), measuring how a slight change in that asset's position impacts total portfolio risk. MVaR is derived by calculating the partial derivative of the portfolio VaR with respect to the asset's weight, providing insight into risk allocation and capital optimization. Unlike Conditional Value at Risk (CVaR), which estimates expected losses beyond the VaR threshold, MVaR focuses on marginal contributions, enabling precise sensitivity analysis and risk management decisions at the asset level.

Exploring Conditional Value at Risk (CVaR)

Conditional Value at Risk (CVaR) measures the expected loss exceeding the Value at Risk (VaR) at a given confidence level, providing a more comprehensive risk assessment in extreme market conditions. Unlike Marginal Value at Risk, which evaluates the incremental risk contribution of individual assets, CVaR captures tail risk by averaging potential losses beyond the VaR threshold. Financial institutions use CVaR to optimize portfolios and implement robust risk management strategies that address losses in the worst-case scenarios.

Mathematical Formulation of MVaR

Marginal Value at Risk (MVaR) is mathematically defined as the partial derivative of the portfolio's Value at Risk (VaR) with respect to the position size of a single asset, representing the incremental risk contribution of that asset. This formulation differentiates MVaR from Conditional Value at Risk (CVaR), which measures the expected loss given that the loss exceeds the VaR threshold and involves an integral over the tail distribution. The MVaR provides sensitivity measures essential for risk decomposition and optimization, computed as MVaR_i = VaR_a(X) / w_i, where w_i denotes the weight of asset i in the portfolio and VaR_a(X) is the VaR at confidence level a.

Mathematical Formulation of CVaR

Conditional Value at Risk (CVaR) is mathematically formulated as the expected loss exceeding the Value at Risk (VaR) at a given confidence level a, defined by CVaR_a(X) = E[X | X >= VaR_a(X)]. Unlike Marginal Value at Risk, which measures the incremental contribution of a single position to the overall portfolio risk as the partial derivative of VaR, CVaR provides a coherent and convex risk measure by averaging tail losses beyond the VaR threshold. The integral representation of CVaR involves the optimization problem CVaR_a(X) = min_{e R} { e + (1/(1-a)) E[max(X - e, 0)] }, highlighting its sensitivity to extreme losses in risk management applications.

Key Differences: MVaR vs CVaR

Marginal Value at Risk (MVaR) measures the incremental risk contribution of an individual asset or position to the overall portfolio VaR, highlighting sensitivity to changes in exposure. Conditional Value at Risk (CVaR), also known as Expected Shortfall, calculates the average loss beyond the VaR threshold, providing a more comprehensive assessment of tail risk. The key difference lies in MVaR's focus on marginal risk impact within the portfolio, whereas CVaR emphasizes the expected magnitude of extreme losses in adverse market conditions.

Practical Applications of Marginal Value at Risk

Marginal Value at Risk (MVaR) measures the incremental risk contribution of a single asset or position to the overall portfolio's Value at Risk, providing precise insights for portfolio risk management and optimization. It is widely applied in practical scenarios such as stress testing, risk budgeting, and capital allocation to identify risk drivers and improve risk-adjusted returns. Conditional Value at Risk (CVaR) complements MVaR by capturing tail risk beyond the VaR threshold, but MVaR's granularity enables more effective risk control in dynamic portfolio strategies.

Practical Uses of Conditional Value at Risk

Conditional Value at Risk (CVaR) is widely used in portfolio optimization and risk management due to its ability to capture the expected losses beyond the Value at Risk (VaR) threshold, providing a more comprehensive risk assessment. Unlike Marginal Value at Risk, CVaR accounts for tail risks and extreme losses, making it essential for stress testing and scenario analysis in financial institutions. Practical applications of CVaR include improving capital allocation, enhancing regulatory compliance, and optimizing asset allocation by minimizing the potential for catastrophic losses.

Limitations and Considerations for Each Method

Marginal Value at Risk (MVaR) offers insights into the incremental risk contribution of individual assets within a portfolio but may underestimate tail risk due to its reliance on linear approximations and assumes normality in loss distributions. Conditional Value at Risk (CVaR), while providing a more comprehensive measure of extreme tail risk by averaging losses beyond the VaR threshold, can be computationally intensive and sensitive to the chosen confidence level, potentially leading to estimation errors in small sample sizes. Both methods require careful consideration of distributional assumptions, data quality, and model limitations to ensure robust risk management decisions.

Choosing the Right Risk Measure for Portfolio Management

Marginal Value at Risk (MVaR) quantifies the incremental risk contribution of each asset within a portfolio, aiding in pinpointing risk sources for optimized asset allocation. Conditional Value at Risk (CVaR), also known as Expected Shortfall, captures the average loss beyond the VaR threshold, providing a more comprehensive risk assessment under extreme market conditions. Portfolio managers select CVaR over VaR and MVaR when seeking to manage tail risk and ensure robust downside protection in volatile markets, while MVaR informs detailed risk budgeting and asset-specific adjustments.

Marginal Value at Risk Infographic

libterm.com

libterm.com