Traditional bonds offer predictable income through fixed interest payments and are considered lower-risk investments compared to stocks. These securities can help diversify your investment portfolio and protect against market volatility. Explore the rest of the article to learn how traditional bonds can fit into your financial strategy.

Table of Comparison

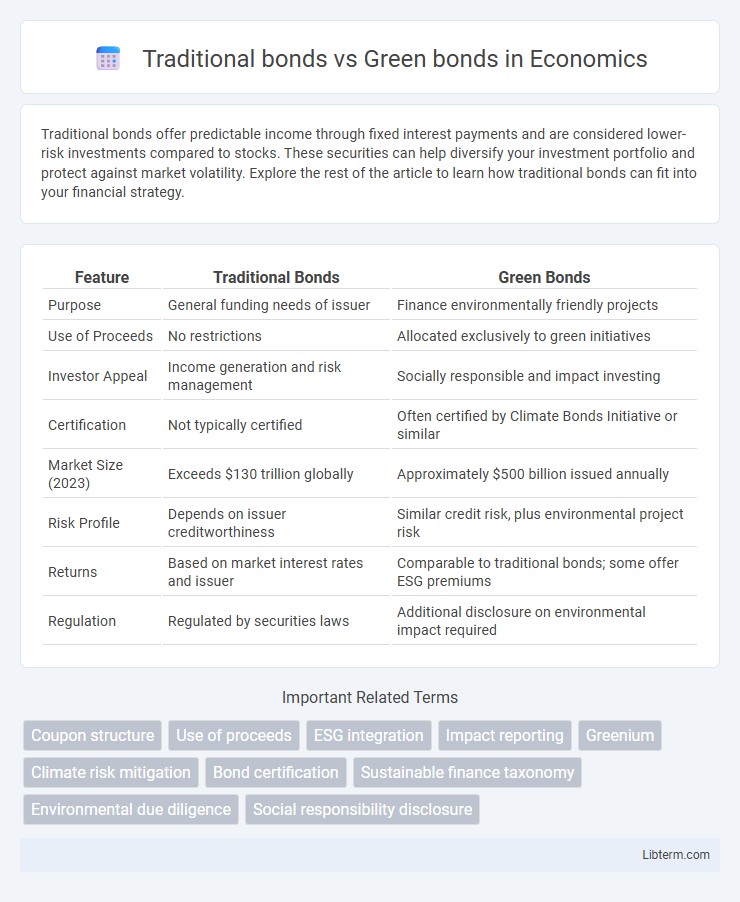

| Feature | Traditional Bonds | Green Bonds |

|---|---|---|

| Purpose | General funding needs of issuer | Finance environmentally friendly projects |

| Use of Proceeds | No restrictions | Allocated exclusively to green initiatives |

| Investor Appeal | Income generation and risk management | Socially responsible and impact investing |

| Certification | Not typically certified | Often certified by Climate Bonds Initiative or similar |

| Market Size (2023) | Exceeds $130 trillion globally | Approximately $500 billion issued annually |

| Risk Profile | Depends on issuer creditworthiness | Similar credit risk, plus environmental project risk |

| Returns | Based on market interest rates and issuer | Comparable to traditional bonds; some offer ESG premiums |

| Regulation | Regulated by securities laws | Additional disclosure on environmental impact required |

Introduction to Bonds: Traditional vs Green

Traditional bonds represent debt securities issued to finance general government or corporate activities, offering fixed interest payments and principal repayment at maturity. Green bonds allocate capital specifically to environmentally sustainable projects, such as renewable energy, clean transportation, or climate change mitigation initiatives. Investors increasingly favor green bonds for aligning portfolios with ESG criteria while maintaining the financial characteristics of conventional bonds.

Key Features of Traditional Bonds

Traditional bonds represent debt securities issued by governments, municipalities, or corporations to raise capital with a fixed interest rate and maturity date, providing predictable income streams to investors. These bonds do not have specific environmental or social criteria attached, allowing funds to be used for general purposes, including refinancing debt, capital expenditures, or operational costs. Traditional bonds typically have varying credit ratings that influence interest rates and perceived risk, with key features including coupon payments, principal repayment at maturity, and market liquidity.

Defining Green Bonds: Purpose and Principles

Green bonds are debt securities specifically issued to finance projects with environmental benefits, such as renewable energy, pollution reduction, and sustainable agriculture. Unlike traditional bonds that fund general corporate or governmental activities, green bonds adhere to strict principles, including transparency, disclosure, and use of proceeds earmarked for eco-friendly initiatives. The Green Bond Principles, established by the International Capital Market Association, provide guidelines ensuring that funds raised contribute to measurable environmental impact.

Market Growth and Trends

The market for green bonds has experienced rapid growth, reaching over $500 billion in global issuances by 2023, driven by increasing investor demand for sustainable finance solutions. Traditional bonds continue to dominate the fixed-income landscape with a market size exceeding $130 trillion, but green bonds are capturing a larger share due to heightened environmental regulations and corporate ESG commitments. Emerging trends highlight the integration of green bonds within broader sustainability-linked instruments, signaling a shift towards more impact-focused investment strategies across global capital markets.

Regulatory Frameworks and Standards

Traditional bonds operate under well-established regulatory frameworks governed by securities laws such as the SEC in the United States, emphasizing issuer disclosure and investor protection. Green bonds adhere to specific standards like the Green Bond Principles (GBP) and Climate Bonds Standard, which require detailed reporting on environmental impact and project eligibility to ensure transparency and accountability. Regulatory bodies are increasingly integrating these standards into financial regulations to promote sustainable finance and align with global climate goals.

Environmental Impact and Sustainability

Traditional bonds primarily fund a broad range of projects without specific environmental criteria, often supporting sectors that may contribute to pollution or resource depletion. Green bonds are exclusively issued to finance environmentally sustainable projects such as renewable energy, clean transportation, and conservation efforts, directly enhancing environmental impact and promoting sustainability. The growing market demand for green bonds reflects increasing investor commitment to reducing carbon footprints and supporting the transition to a low-carbon economy.

Risk and Return Comparison

Traditional bonds typically offer stable returns with moderate risk, reflecting their backing by established government or corporate issuers and predictable cash flows. Green bonds, issued specifically to finance environmentally beneficial projects, may carry slightly higher risk due to project-specific uncertainties but often attract investors seeking sustainable investments, potentially resulting in competitive or lower yield spreads. Both bond types' risk and return profiles depend on issuer creditworthiness, market conditions, and regulatory support for sustainability initiatives.

Investor Profiles and Preferences

Traditional bonds attract conservative investors seeking stable returns and predictable income streams from established sectors like government and corporate debt. Green bonds appeal to socially responsible investors prioritizing environmental impact, funding projects in renewable energy, clean transportation, and sustainable infrastructure. The investor preference shifts toward green bonds reflect growing demand for aligning portfolios with ESG (Environmental, Social, Governance) criteria and long-term sustainability goals.

Challenges and Criticisms

Traditional bonds face challenges related to contributing to environmental degradation and lack of transparency in sustainability efforts, limiting their appeal among socially conscious investors. Green bonds often encounter criticisms regarding greenwashing, where issuers exaggerate or misrepresent the environmental benefits, and the absence of standardized certification leading to inconsistent impact reporting. Both face regulatory and market uncertainty, but green bonds must additionally address the complexity of verifying genuine environmental outcomes.

Future Outlook for Bonds

Traditional bonds continue to be a cornerstone of global fixed-income markets, offering predictable returns and established risk profiles. Green bonds rapidly gain traction as investors prioritize environmental, social, and governance (ESG) criteria, with issuance expected to exceed $1 trillion annually by 2025. The future outlook highlights an increasing blend of sustainability-linked features in traditional bond frameworks, signaling a shift toward more responsible investment strategies.

Traditional bonds Infographic

libterm.com

libterm.com