Insurance provides financial protection against unexpected events, safeguarding your assets and minimizing potential losses. Understanding various insurance types, from health and life to property and auto, helps you choose policies tailored to your specific needs. Explore the rest of the article to learn how insurance can secure your future effectively.

Table of Comparison

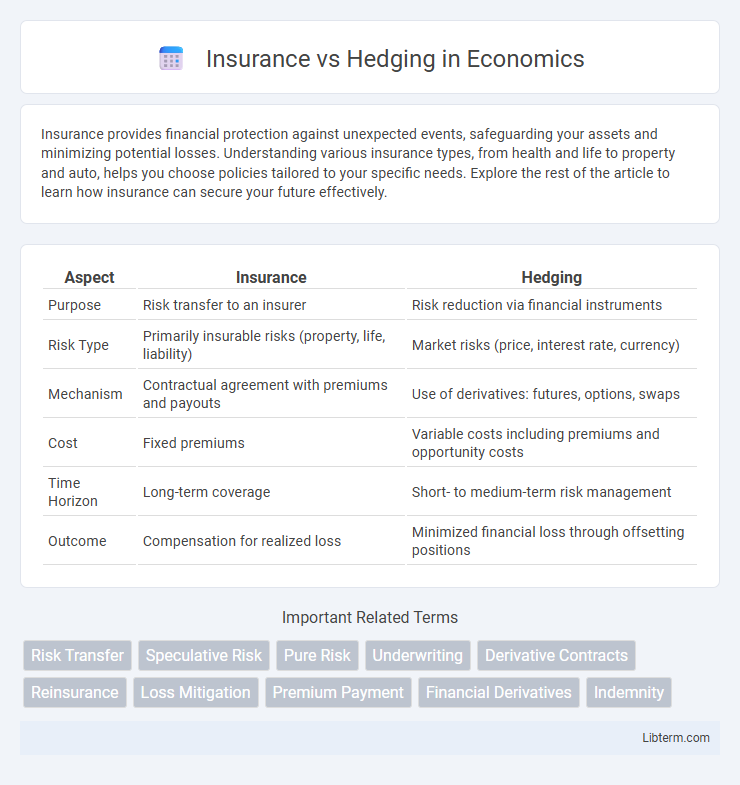

| Aspect | Insurance | Hedging |

|---|---|---|

| Purpose | Risk transfer to an insurer | Risk reduction via financial instruments |

| Risk Type | Primarily insurable risks (property, life, liability) | Market risks (price, interest rate, currency) |

| Mechanism | Contractual agreement with premiums and payouts | Use of derivatives: futures, options, swaps |

| Cost | Fixed premiums | Variable costs including premiums and opportunity costs |

| Time Horizon | Long-term coverage | Short- to medium-term risk management |

| Outcome | Compensation for realized loss | Minimized financial loss through offsetting positions |

Introduction to Insurance and Hedging

Insurance provides financial protection against specific risks by transferring potential losses to an insurer in exchange for premiums, ensuring stability and risk management for individuals and businesses. Hedging involves using financial instruments such as derivatives to offset potential losses in investments or assets, aiming to minimize exposure to price fluctuations. Both strategies are essential in risk management but differ in mechanisms, scope, and application across various industries.

Defining Insurance: Purpose and Scope

Insurance provides financial protection against specific, quantifiable risks by transferring potential loss from an individual or entity to an insurer. Its primary purpose is to mitigate the impact of unforeseen events such as accidents, property damage, or liability through indemnification. Insurance scope typically covers personal, commercial, health, and life risks, creating a contractual safety net for policyholders.

What is Hedging? Key Concepts

Hedging is a financial strategy employed to reduce or eliminate the risk of adverse price movements in assets by taking an offsetting position in a related security or derivative, such as options or futures contracts. Key concepts in hedging include risk mitigation, exposure management, and cost-efficiency, often utilized by investors, corporations, and financial institutions to protect against market volatility and uncertainty. Unlike insurance, which transfers risk to another party for a premium, hedging involves actively managing portfolio risk within the market to preserve asset value.

Main Differences Between Insurance and Hedging

Insurance transfers risk by paying a premium to protect against potential financial loss from specific events, while hedging uses financial instruments like options or futures to mitigate exposure to price fluctuations in assets. Insurance typically involves a contractual guarantee of compensation upon the occurrence of insured events, whereas hedging aims to offset potential losses without eliminating the risk entirely. The cost structure differs as insurance requires fixed premiums, but hedging involves variable costs based on market prices and the complexity of financial derivatives used.

Common Examples: Insurance vs. Hedging in Practice

Insurance commonly covers risks such as health issues, property damage, and life events by transferring potential financial loss to an insurer for a premium. Hedging, often utilized in financial markets, involves strategies like futures contracts and options to mitigate risks related to price fluctuations in commodities, currencies, or securities. Both methods aim to manage risk but differ in mechanism: insurance relies on pooling and indemnification, while hedging uses offsetting positions to limit exposure.

Risk Management Strategies Compared

Insurance and hedging serve as distinct risk management strategies, with insurance transferring risk to an insurer in exchange for premiums, providing financial protection against specific losses. Hedging involves using financial instruments like options, futures, or swaps to offset potential losses in investments or assets, aiming to reduce exposure to market volatility. While insurance typically covers unpredictable events with defined coverage terms, hedging actively manages ongoing financial risks by balancing asset positions within financial markets.

Cost and Benefit Analysis: Insurance vs Hedging

Insurance involves paying a premium to transfer risk to an insurer, providing financial protection against specific losses at a predictable cost. Hedging uses financial instruments like derivatives to offset potential losses in investments, often requiring ongoing costs and market expertise but offering flexibility in managing risk. Cost-benefit analysis favors insurance for predictable, quantifiable risks with fixed premiums, while hedging benefits those seeking dynamic risk management with potential for both gains and losses in volatile markets.

When to Choose Insurance Over Hedging

Choose insurance over hedging when facing risks with high uncertainty and potentially catastrophic financial losses, such as natural disasters or major liability claims. Insurance provides a transfer of risk to a third party with predefined coverage and costs, making it suitable for individual or business risk protection without the complexity of financial markets. Hedging is more appropriate for managing known market risks, especially in financial instruments or commodities, where the risk exposure, cost, and return trade-offs are measurable and can be actively managed.

Regulatory and Compliance Factors

Insurance involves transferring risk to an insurer under regulatory frameworks that mandate licensing, solvency requirements, and consumer protection laws to ensure policyholder security. Hedging, primarily conducted through financial instruments such as derivatives, falls under securities and commodities regulations that require transparency, reporting, and adherence to market conduct rules enforced by bodies like the SEC or CFTC. Compliance in insurance emphasizes contract standards and claim handling, while hedging compliance centers on risk disclosure, position limits, and anti-manipulation provisions to maintain market integrity.

Conclusion: Making the Right Risk Management Choice

Choosing between insurance and hedging depends on the specific nature of the risk and the desired financial outcome. Insurance is ideal for transferring unexpected losses with predictable costs, commonly used for property, health, or liability risks. Hedging suits managing market or financial risks by offsetting potential losses with investment strategies, making it essential for businesses exposed to price volatility or currency fluctuations.

Insurance Infographic

libterm.com

libterm.com