Bank loans provide essential financing options for individuals and businesses to achieve various financial goals, including purchasing homes, expanding operations, or managing cash flow. Interest rates and repayment terms vary based on your creditworthiness and loan type, influencing the overall cost and feasibility of borrowing. Discover how bank loans can work for you and explore strategies to secure the best terms by reading the full article.

Table of Comparison

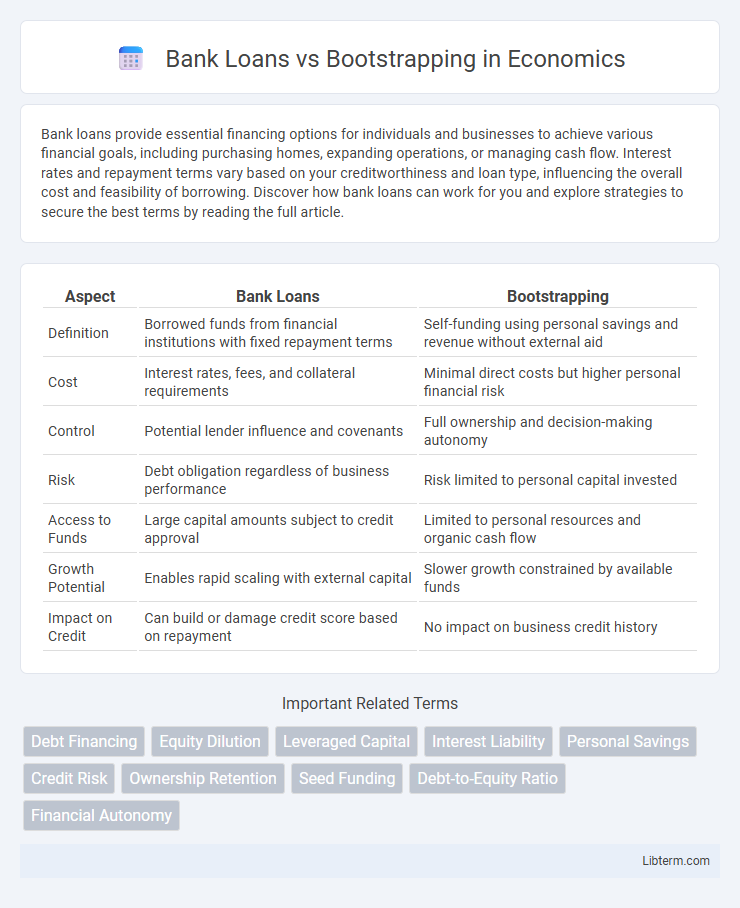

| Aspect | Bank Loans | Bootstrapping |

|---|---|---|

| Definition | Borrowed funds from financial institutions with fixed repayment terms | Self-funding using personal savings and revenue without external aid |

| Cost | Interest rates, fees, and collateral requirements | Minimal direct costs but higher personal financial risk |

| Control | Potential lender influence and covenants | Full ownership and decision-making autonomy |

| Risk | Debt obligation regardless of business performance | Risk limited to personal capital invested |

| Access to Funds | Large capital amounts subject to credit approval | Limited to personal resources and organic cash flow |

| Growth Potential | Enables rapid scaling with external capital | Slower growth constrained by available funds |

| Impact on Credit | Can build or damage credit score based on repayment | No impact on business credit history |

Understanding Bank Loans vs Bootstrapping

Bank loans provide external funding with specified interest rates and repayment schedules, offering immediate capital for business growth but requiring creditworthiness and collateral. Bootstrapping relies on internal resources, such as personal savings or revenue reinvestment, promoting financial discipline and full ownership but often limiting the scale and speed of expansion. Understanding the trade-offs between bank loans and bootstrapping is crucial for strategic decision-making in financing business operations.

Key Differences Between Bank Loans and Bootstrapping

Bank loans require formal approval processes, involve fixed interest rates, and provide substantial capital upfront, enabling rapid business scaling with financial accountability. Bootstrapping relies on personal savings and revenue reinvestment, promoting controlled spending and organic growth without incurring debt or interest expenses. Key differences include the level of external control, risk exposure, and impact on cash flow management in each funding approach.

Pros and Cons of Bank Loans for Business

Bank loans provide businesses with substantial capital and fixed repayment schedules, facilitating planned financial management and enabling significant investments in growth and infrastructure. However, bank loans involve strict eligibility criteria, collateral requirements, and interest obligations, which can strain cash flow and limit flexibility during uncertain business cycles. The long approval process and potential for credit score impact add further risks, making bank loans more suitable for established businesses with stable revenue streams.

Advantages and Disadvantages of Bootstrapping

Bootstrapping offers entrepreneurs full control over their business without incurring debt or interest payments, fostering disciplined financial management and resourcefulness. However, limited capital can restrict growth opportunities, delay market entry, and increase personal financial risk due to reliance on personal savings or revenue. Unlike bank loans, bootstrapping lacks external funding, which may limit scalability but avoids credit checks and complex application processes.

Financial Risks of Bank Loans vs Bootstrapping

Bank loans carry financial risks such as obligatory interest payments and potential collateral loss if business revenues decline, increasing the burden on cash flow management. Bootstrapping minimizes external debt exposure but poses its own risk by limiting capital availability, potentially hindering growth and operational scalability. Evaluating the balance between debt-induced financial strain and self-funding constraints is critical for sustainable business development.

Impact on Business Ownership and Control

Bank loans provide external capital but require businesses to adhere to lender-imposed terms, which can limit operational flexibility without diluting ownership. Bootstrapping relies on personal funds and reinvested earnings, maintaining full ownership and control but potentially restricting the pace of growth due to limited financial resources. Choosing between bank loans and bootstrapping significantly influences business autonomy, decision-making authority, and the ability to scale efficiently.

Flexibility and Scalability: Loan vs Bootstrapping

Bank loans provide structured funding with fixed repayment schedules, limiting flexibility but enabling predictable cash flow management. In contrast, bootstrapping offers greater flexibility as entrepreneurs control expenses and growth pace without external obligations. Scalability is often faster with loans due to immediate capital infusion, whereas bootstrapping may slow expansion but encourages sustainable, organic growth.

Cash Flow Considerations

Bank loans provide a fixed repayment schedule that can strain cash flow, requiring consistent income to meet monthly obligations and interest payments. Bootstrapping relies on reinvested profits and personal savings, offering greater control over cash flow but limiting immediate financial flexibility. Businesses with unpredictable revenue often find bootstrapping reduces the risk of cash shortages compared to the rigid demands of bank loan repayments.

Suitability for Different Business Stages

Bank loans suit established businesses with steady cash flow and credit history, providing significant capital for expansion or operational costs. Bootstrapping is ideal for early-stage startups or entrepreneurs seeking maximum control and low financial risk by using personal savings or revenue reinvestment. Mature companies benefit from bank loans' structured repayment plans, while nascent ventures rely on bootstrapping to validate ideas with minimal external obligations.

Choosing the Right Funding Option for Your Business

Evaluating bank loans and bootstrapping hinges on factors like business scale, cash flow stability, and growth trajectory. Bank loans offer substantial capital with fixed repayment schedules, ideal for businesses needing upfront investment without diluting ownership. Bootstrapping emphasizes organic growth through personal savings or revenue reinvestment, fostering control and financial discipline but potentially limiting rapid expansion opportunities.

Bank Loans Infographic

libterm.com

libterm.com