A carbon tax directly sets a price on carbon by levying a fee on the carbon content of fossil fuels, encouraging businesses and individuals to reduce greenhouse gas emissions. This economic incentive promotes cleaner energy alternatives and drives innovation in sustainable technologies, helping to combat climate change effectively. Discover how a carbon tax could impact your community and the environment by reading the full article.

Table of Comparison

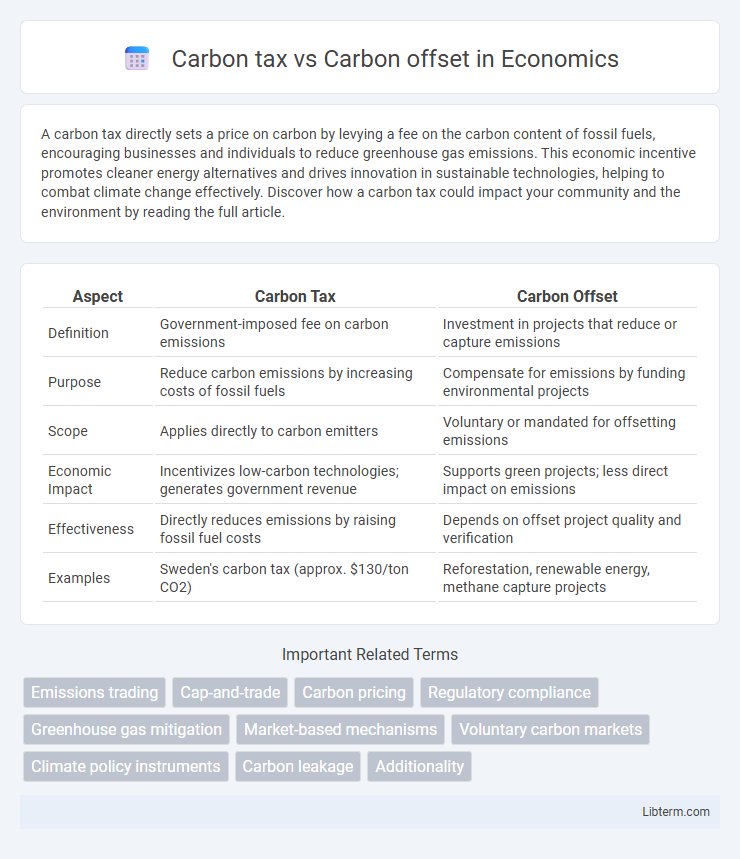

| Aspect | Carbon Tax | Carbon Offset |

|---|---|---|

| Definition | Government-imposed fee on carbon emissions | Investment in projects that reduce or capture emissions |

| Purpose | Reduce carbon emissions by increasing costs of fossil fuels | Compensate for emissions by funding environmental projects |

| Scope | Applies directly to carbon emitters | Voluntary or mandated for offsetting emissions |

| Economic Impact | Incentivizes low-carbon technologies; generates government revenue | Supports green projects; less direct impact on emissions |

| Effectiveness | Directly reduces emissions by raising fossil fuel costs | Depends on offset project quality and verification |

| Examples | Sweden's carbon tax (approx. $130/ton CO2) | Reforestation, renewable energy, methane capture projects |

Understanding Carbon Tax: Definition and Purpose

Carbon tax is a government-imposed fee on the carbon content of fossil fuels designed to reduce greenhouse gas emissions by making carbon-intensive energy sources more expensive. Its primary purpose is to incentivize businesses and individuals to lower their carbon footprint through cleaner energy alternatives and improved efficiency. This market-based approach directly targets the source of emissions, promoting long-term environmental sustainability and compliance with climate targets.

What Are Carbon Offsets? Key Concepts Explained

Carbon offsets represent measurable, verifiable emission reductions from projects like reforestation or renewable energy that compensate for carbon emissions elsewhere. They function by funding initiatives that either remove CO2 from the atmosphere or prevent future emissions, effectively balancing an entity's carbon footprint. Unlike carbon taxes, which impose a direct fee on emissions, carbon offsets provide a flexible, market-based mechanism to achieve carbon neutrality.

Mechanisms: How Carbon Tax and Offsets Work

A carbon tax imposes a direct fee on the carbon content of fossil fuels, incentivizing businesses and consumers to reduce emissions by making carbon-intensive activities more expensive. Carbon offsets allow individuals or companies to compensate for their emissions by investing in projects that reduce or capture greenhouse gases elsewhere, such as reforestation or renewable energy initiatives. While carbon tax sets a fixed price on emissions, offsets provide flexibility by enabling voluntary or regulated compensation to meet emission reduction targets.

Environmental Impact: Comparing Tax vs Offsets

Carbon tax directly reduces carbon emissions by assigning a price to greenhouse gas output, incentivizing businesses and individuals to lower their carbon footprint through cleaner technologies and energy efficiency. Carbon offsets allow emitters to compensate for emissions by funding projects like reforestation or renewable energy, but their effectiveness depends on the quality and verification of the offset projects. Studies indicate carbon taxes lead to more consistent and measurable emission reductions, while offsets can provide supplementary environmental benefits but risk allowing continued emissions if not rigorously managed.

Economic Implications for Businesses

Carbon tax imposes direct costs on businesses by taxing greenhouse gas emissions, incentivizing companies to reduce their carbon footprint through operational efficiency and cleaner technologies. Carbon offsets allow businesses to compensate for emissions by investing in external projects, offering financial flexibility but potentially limiting immediate emission reductions within the company. Economically, carbon taxes create predictable expenses and encourage innovation, while offsets may reduce compliance costs but can face scrutiny over effectiveness and market volatility.

Policy Effectiveness: Which Delivers Better Results?

Carbon tax directly incentivizes emission reductions by assigning a price per ton of CO2 emitted, driving businesses and consumers to lower their carbon footprint through cost-driven decisions. Carbon offsets provide flexibility by allowing entities to compensate for emissions through investments in renewable energy, reforestation, or other carbon sequestration projects, but often face challenges in verification and permanence. Empirical studies suggest carbon taxes yield more consistent reductions, creating clearer market signals and fostering innovation, while offsets complement but cannot replace direct emission pricing as primary climate policies.

Implementation Challenges and Solutions

Carbon tax implementation faces challenges such as political resistance, accurately pricing carbon emissions, and potential economic impacts on industries and consumers. Carbon offset programs struggle with verifying the authenticity and effectiveness of offset projects, ensuring additionality, and preventing fraud. Solutions include transparent regulatory frameworks, third-party certification standards, and integrating offset schemes with robust monitoring and reporting systems to enhance credibility and effectiveness.

Global Perspectives and Case Studies

Carbon tax imposes a direct price on greenhouse gas emissions, encouraging companies and individuals to reduce their carbon footprint, while carbon offsets allow entities to compensate for emissions by funding environmental projects. In countries like Sweden, carbon taxes have significantly reduced emissions by integrating them into national fiscal policies, whereas in the U.S., voluntary carbon offset programs have driven private sector investment in renewable energy and reforestation. Global case studies reveal that carbon taxes offer predictable emission reductions through regulatory frameworks, whereas carbon offsets provide flexibility but face challenges in verification and impact measurement.

Public Perception and Stakeholder Responses

Public perception of carbon tax often centers on concerns about increased costs and economic impact, prompting mixed reactions from businesses and consumers who worry about financial burdens. Stakeholder responses vary, with environmental groups generally supporting carbon taxes for their direct impact on emissions, while some corporations advocate for carbon offsets as a more flexible, market-based solution. Offsets are viewed favorably by stakeholders seeking immediate sustainability actions but face criticism for potential lack of transparency and effectiveness compared to a tax.

Future Trends: The Path Forward for Carbon Solutions

Carbon tax policies are increasingly being integrated into national climate strategies, driving emissions reductions through direct economic incentives and regulatory frameworks. Carbon offsets are evolving with technology advancements, emphasizing transparency and verification to ensure genuine environmental impact in voluntary and compliance markets. Future trends indicate a hybrid approach combining carbon taxes and offsets will optimize cost-effectiveness and accelerate global decarbonization efforts.

Carbon tax Infographic

libterm.com

libterm.com