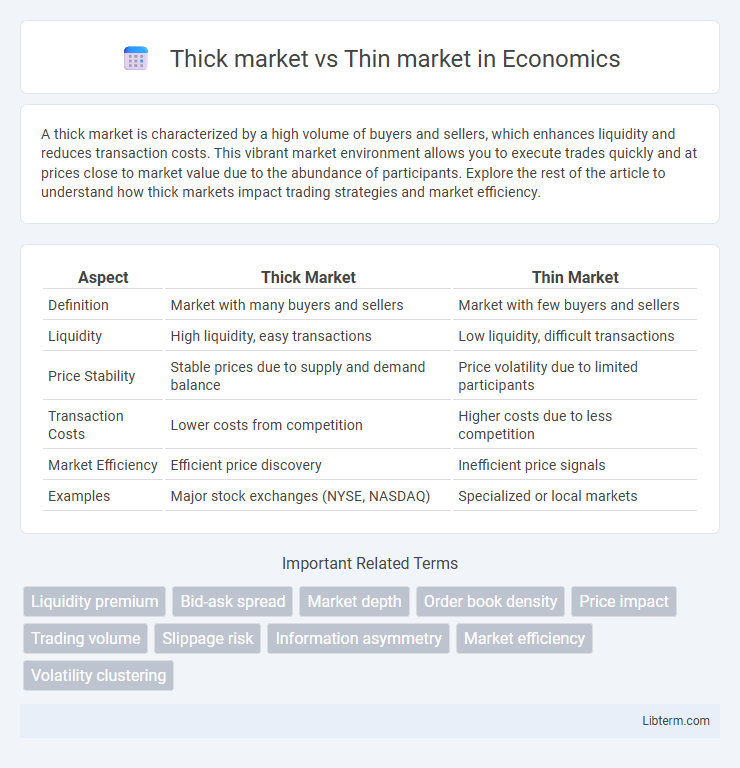

A thick market is characterized by a high volume of buyers and sellers, which enhances liquidity and reduces transaction costs. This vibrant market environment allows you to execute trades quickly and at prices close to market value due to the abundance of participants. Explore the rest of the article to understand how thick markets impact trading strategies and market efficiency.

Table of Comparison

| Aspect | Thick Market | Thin Market |

|---|---|---|

| Definition | Market with many buyers and sellers | Market with few buyers and sellers |

| Liquidity | High liquidity, easy transactions | Low liquidity, difficult transactions |

| Price Stability | Stable prices due to supply and demand balance | Price volatility due to limited participants |

| Transaction Costs | Lower costs from competition | Higher costs due to less competition |

| Market Efficiency | Efficient price discovery | Inefficient price signals |

| Examples | Major stock exchanges (NYSE, NASDAQ) | Specialized or local markets |

Understanding Thick and Thin Markets

Thick markets feature a high volume of buyers and sellers, which enhances liquidity, reduces transaction costs, and leads to more efficient price discovery. Thin markets have fewer participants, causing higher volatility, wider bid-ask spreads, and potential difficulties in executing trades at desired prices. Understanding the differences between thick and thin markets is crucial for investors and traders to tailor strategies based on market depth and liquidity conditions.

Defining Market Thickness

Market thickness refers to the number of buyers and sellers actively participating in a market, directly impacting liquidity and transaction efficiency. A thick market features a large volume of participants and frequent trades, creating tight bid-ask spreads and reducing price volatility. Conversely, a thin market has limited participants and lower trading frequency, resulting in wider spreads and higher price impact for individual transactions.

Key Characteristics of Thick Markets

Thick markets feature a high volume of buyers and sellers, resulting in greater liquidity and tight bid-ask spreads that facilitate efficient price discovery. These markets typically exhibit lower transaction costs and faster execution times due to the abundance of trading activity. The enhanced competition and diversity of participants in thick markets contribute to more accurate and stable market prices.

Key Characteristics of Thin Markets

Thin markets exhibit low trading volumes and limited liquidity, often resulting in wider bid-ask spreads and higher price volatility. Such markets typically have fewer participants, leading to reduced competition and increased difficulty in executing large orders without significant price impact. The scarcity of buyers and sellers can cause price inefficiencies and make thin markets more susceptible to manipulation.

Liquidity Differences Between Thick and Thin Markets

Thick markets exhibit high liquidity with numerous buyers and sellers, resulting in tight bid-ask spreads and efficient price discovery. Thin markets have low liquidity, characterized by fewer participants and wider bid-ask spreads, leading to increased price volatility and higher transaction costs. The liquidity differences significantly impact market depth, trading volume, and the ease with which assets can be bought or sold without affecting prices.

Price Stability and Volatility

Thick markets exhibit high liquidity with numerous buyers and sellers, leading to greater price stability and lower volatility due to efficient matching of orders. Thin markets suffer from low liquidity, where fewer participants cause wider bid-ask spreads and significant price fluctuations, increasing volatility. The presence of thick market conditions typically results in smoother price discovery and reduced risk for traders.

Impact on Buyers and Sellers

In thick markets, abundant buyers and sellers increase liquidity, enabling faster transactions, tighter bid-ask spreads, and more accurate price discovery, benefiting both parties with lower transaction costs and reduced risk. Conversely, thin markets suffer from low participant numbers, causing wider spreads, higher volatility, and difficulty in executing large orders without significantly impacting prices, which poses challenges for sellers trying to find buyers and buyers facing limited options. This disparity affects market efficiency and can lead to increased uncertainty and higher costs for market participants.

Role of Information in Market Thickness

Market thickness significantly depends on the availability and quality of information, which facilitates transactions by reducing uncertainty and search costs. In thick markets, abundant and transparent information attracts numerous buyers and sellers, enabling efficient price discovery and liquidity. Conversely, thin markets suffer from limited information flow, hindering matching efficiency and resulting in higher transaction costs and volatility.

Common Examples of Thick and Thin Markets

Stock exchanges such as the New York Stock Exchange (NYSE) and NASDAQ represent classic examples of thick markets, characterized by high trading volumes, numerous buyers and sellers, and greater liquidity. In contrast, thin markets include specialized real estate sectors in rural areas or niche collectibles markets where fewer participants and lower transaction frequencies result in limited liquidity. Commodity markets for rare items like certain antiques or fine art also exhibit thin market features due to their low trading activity and wider bid-ask spreads.

Strategies for Navigating Thin and Thick Markets

Thick markets feature high liquidity and numerous buyers and sellers, enabling strategies such as rapid trade execution and tight bid-ask spreads. Thin markets have low liquidity and fewer participants, requiring strategies like cautious order placement, patience to avoid price slippage, and leveraging limit orders to secure better prices. Traders optimize outcomes in thin markets by focusing on market depth analysis and timing trades during periods of increased activity.

Thick market Infographic

libterm.com

libterm.com