Quasi-hyperbolic discounting models how people value immediate rewards disproportionately higher than future ones, leading to inconsistent decision-making over time. This concept explains behaviors like procrastination and impulsive spending by emphasizing present bias in individual preferences. Discover how understanding quasi-hyperbolic discounting can help you make better long-term choices by reading the rest of the article.

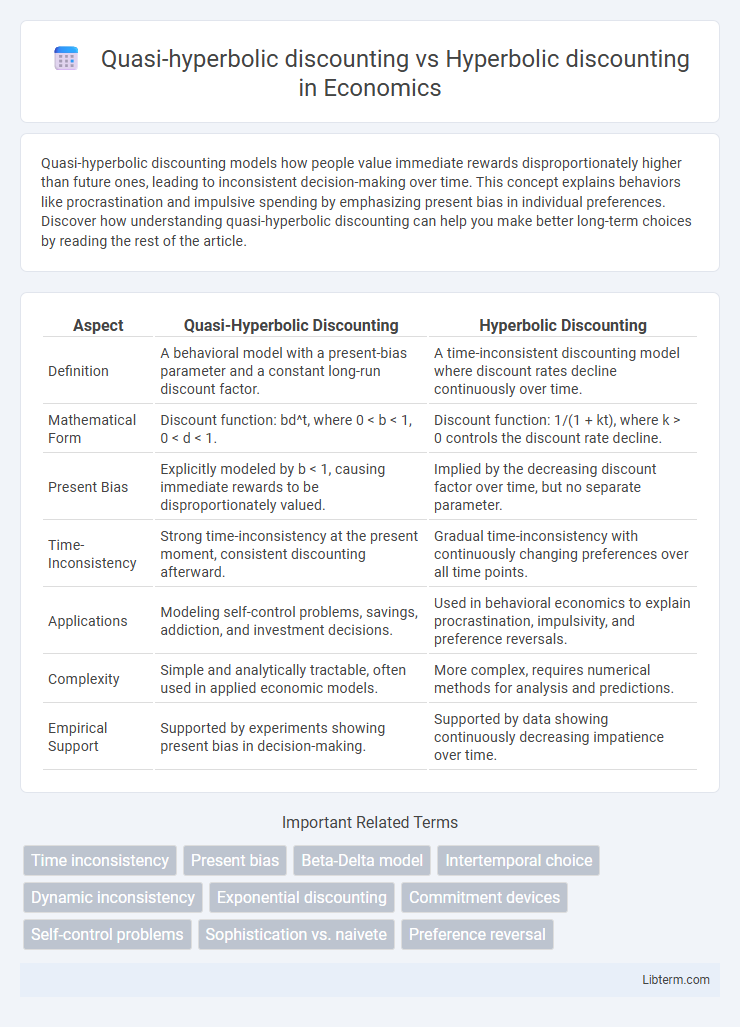

Table of Comparison

| Aspect | Quasi-Hyperbolic Discounting | Hyperbolic Discounting |

|---|---|---|

| Definition | A behavioral model with a present-bias parameter and a constant long-run discount factor. | A time-inconsistent discounting model where discount rates decline continuously over time. |

| Mathematical Form | Discount function: bd^t, where 0 < b < 1, 0 < d < 1. | Discount function: 1/(1 + kt), where k > 0 controls the discount rate decline. |

| Present Bias | Explicitly modeled by b < 1, causing immediate rewards to be disproportionately valued. | Implied by the decreasing discount factor over time, but no separate parameter. |

| Time-Inconsistency | Strong time-inconsistency at the present moment, consistent discounting afterward. | Gradual time-inconsistency with continuously changing preferences over all time points. |

| Applications | Modeling self-control problems, savings, addiction, and investment decisions. | Used in behavioral economics to explain procrastination, impulsivity, and preference reversals. |

| Complexity | Simple and analytically tractable, often used in applied economic models. | More complex, requires numerical methods for analysis and predictions. |

| Empirical Support | Supported by experiments showing present bias in decision-making. | Supported by data showing continuously decreasing impatience over time. |

Introduction to Discounting Models

Quasi-hyperbolic discounting and hyperbolic discounting are behavioral economic models explaining how individuals value future rewards less than immediate ones. Hyperbolic discounting describes a declining discount rate over time, causing preferences to reverse as the delay extends, while quasi-hyperbolic discounting simplifies this with a present-bias parameter and a constant exponential discount rate for future periods. Both models address time-inconsistent preferences but quasi-hyperbolic discounting offers tractability in modeling impatience and self-control issues in economic decision-making.

Understanding Hyperbolic Discounting

Hyperbolic discounting reflects a time-inconsistent preference where individuals disproportionately value immediate rewards over future ones, leading to decreasing discount rates as delay increases. Quasi-hyperbolic discounting simplifies this by modeling a present-bias parameter combined with a constant discount factor for future periods, capturing the initial sharp decline in value more tractably. Understanding hyperbolic discounting is crucial in behavioral economics for explaining procrastination, addiction, and inconsistent decision-making over time.

What is Quasi-Hyperbolic Discounting?

Quasi-hyperbolic discounting is a behavioral economic model that captures individuals' preference for immediate rewards more sharply than traditional exponential discounting, reflecting present bias with a simplified two-parameter function. Unlike hyperbolic discounting, which employs a continuous declining discount rate over time, quasi-hyperbolic discounting introduces a distinct present-bias factor (beta) alongside a long-term discount factor (delta), making it easier to model immediate impulsivity and future patience. This approach is widely used in economics and psychology to explain time-inconsistent behaviors such as procrastination and impulsive spending.

Mathematical Foundations of Hyperbolic and Quasi-Hyperbolic Models

Hyperbolic discounting is mathematically represented by a discount function \( D(t) = \frac{1}{1 + kt} \), where \( k \) is a positive constant reflecting the degree of present bias, creating a decreasing discount rate over time. Quasi-hyperbolic discounting simplifies this by introducing a parameter \( \beta \) (0 < \( \beta \) <= 1) along with a standard exponential discount factor \( \delta \), expressed as \( D(t) = 1 \) for \( t=0 \) and \( D(t) = \beta \delta^t \) for \( t > 0 \), capturing immediate gratification effects while maintaining exponential decay for future periods. These mathematical frameworks allow economists and psychologists to model time-inconsistent preferences and dynamic decision-making behaviors with varying levels of complexity and empirical fit.

Key Differences Between Hyperbolic and Quasi-Hyperbolic Discounting

Hyperbolic discounting models gradual declines in future value, capturing decreasing impatience over time, whereas quasi-hyperbolic discounting uses a simplified two-parameter framework with an immediate drop in value followed by exponential decay. Key differences include hyperbolic discounting's continuous time preference curve versus the quasi-hyperbolic model's sharp present-bias factor combined with a standard discount rate for future periods. Quasi-hyperbolic discounting often allows easier mathematical tractability and behavioral interpretation, making it popular in behavioral economics for modeling time-inconsistent preferences.

Behavioral Implications in Decision Making

Quasi-hyperbolic discounting models present a distinct behavioral implication by incorporating a present-bias factor, which leads to stronger preference reversals compared to traditional hyperbolic discounting. This model better captures impulsive decisions in intertemporal choice by emphasizing immediate rewards disproportionately, explaining procrastination and self-control failures more accurately. Hyperbolic discounting, while reflecting declining impatience over time, tends to underestimate the pronounced short-term bias affecting choices in domains like finance, health, and addiction.

Empirical Evidence: Which Model Fits Real-World Behaviors?

Empirical evidence indicates that quasi-hyperbolic discounting, characterized by a present-bias parameter and a constant discount rate, more accurately models short-term impulsivity and preference reversals seen in real-world decision-making than traditional hyperbolic discounting. Studies in behavioral economics and psychology demonstrate that quasi-hyperbolic discounting explains abrupt changes in preferences better due to its distinct b-d formulation, capturing immediate gratification tendencies. Experimental data from intertemporal choice tasks highlight the model's superior fit for predicting actual human behavior regarding delayed rewards compared to the smoother, continuously declining discount factor in hyperbolic discounting.

Applications in Economics and Psychology

Quasi-hyperbolic discounting models time-inconsistent preferences by incorporating present-bias with a simpler functional form, making it widely applied in behavioral economics for explaining savings behavior and procrastination. Hyperbolic discounting captures decreasing impatience over time more accurately, influencing psychological studies on self-control, addiction, and intertemporal choice. Both frameworks inform economic policies and interventions that address commitment devices and impulse control challenges.

Critiques and Limitations of Each Model

Quasi-hyperbolic discounting faces criticism for oversimplifying dynamic preferences by employing a single present-bias parameter, which may fail to capture the nuanced variations in actual human time-inconsistency. Hyperbolic discounting, although more flexible with its continuously declining discount rate, often suffers from difficulties in empirical estimation and may overpredict impulsive behavior, limiting its practical application in long-term forecasting. Both models struggle to fully account for contextual factors influencing decision-making, such as emotional states or environmental cues, highlighting the need for more comprehensive frameworks in behavioral economics.

Conclusion: Choosing the Right Discounting Framework

Selecting the appropriate discounting framework depends on modeling preferences for time-inconsistent behavior and computational simplicity. Quasi-hyperbolic discounting provides a tractable approach by incorporating a present-bias parameter alongside exponential decay, making it suitable for capturing immediate temptation effects. Hyperbolic discounting offers a more flexible, empirically accurate representation of decreasing impatience over time but involves greater mathematical complexity and often demands numerical methods for precise analysis.

Quasi-hyperbolic discounting Infographic

libterm.com

libterm.com