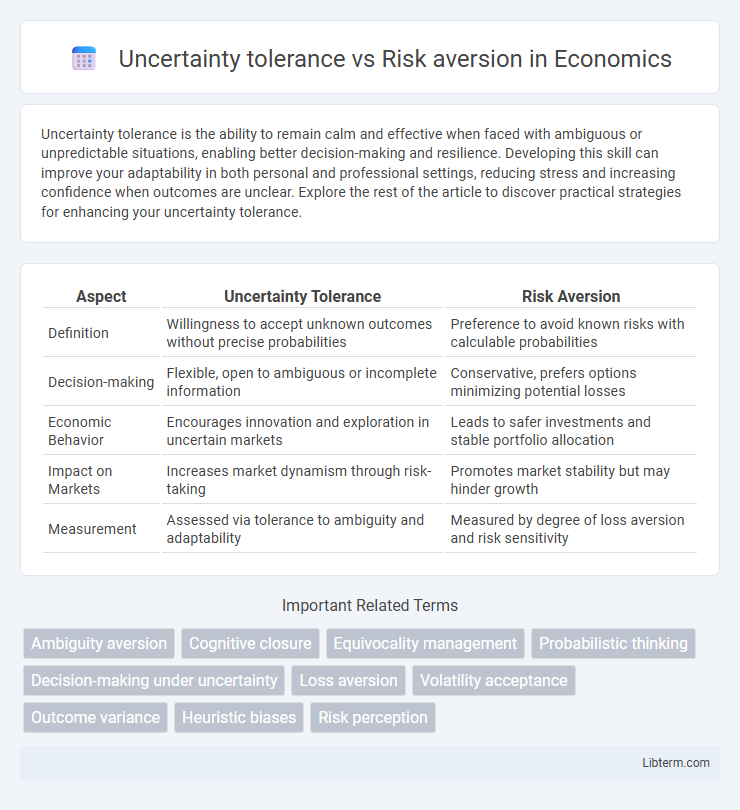

Uncertainty tolerance is the ability to remain calm and effective when faced with ambiguous or unpredictable situations, enabling better decision-making and resilience. Developing this skill can improve your adaptability in both personal and professional settings, reducing stress and increasing confidence when outcomes are unclear. Explore the rest of the article to discover practical strategies for enhancing your uncertainty tolerance.

Table of Comparison

| Aspect | Uncertainty Tolerance | Risk Aversion |

|---|---|---|

| Definition | Willingness to accept unknown outcomes without precise probabilities | Preference to avoid known risks with calculable probabilities |

| Decision-making | Flexible, open to ambiguous or incomplete information | Conservative, prefers options minimizing potential losses |

| Economic Behavior | Encourages innovation and exploration in uncertain markets | Leads to safer investments and stable portfolio allocation |

| Impact on Markets | Increases market dynamism through risk-taking | Promotes market stability but may hinder growth |

| Measurement | Assessed via tolerance to ambiguity and adaptability | Measured by degree of loss aversion and risk sensitivity |

Understanding Uncertainty Tolerance: Definition and Importance

Uncertainty tolerance refers to an individual's capacity to accept and adapt to ambiguous or unpredictable situations without excessive stress or avoidance. High uncertainty tolerance enables better decision-making in complex environments by embracing ambiguity, whereas risk aversion typically involves avoiding potential losses by shunning uncertain outcomes. Developing uncertainty tolerance is crucial for innovation, resilience, and strategic flexibility in dynamic markets and personal growth contexts.

What Is Risk Aversion? Core Concepts Explained

Risk aversion refers to the preference for certainty and the tendency to avoid options with uncertain outcomes, even if those outcomes might offer higher rewards. It is a core concept in behavioral economics and finance, influencing how individuals and investors make choices under uncertainty by prioritizing stability and minimizing potential losses. Understanding risk aversion helps explain decision-making patterns where people prefer guaranteed returns over gambles with potentially greater but uncertain payoffs.

Key Differences: Uncertainty Tolerance vs Risk Aversion

Uncertainty tolerance refers to an individual's capability to accept and adapt to ambiguous or unpredictable situations without discomfort, while risk aversion involves a preference for avoiding risks and minimizing potential losses. Key differences include emotional response--uncertainty tolerance embraces ambiguity with resilience, whereas risk aversion triggers cautious or defensive behavior. Decision-making under uncertainty relies on flexibility and openness, contrasting with the conservative, loss-avoidant strategies characteristic of risk-averse individuals.

Psychological Foundations Behind Uncertainty and Risk

Uncertainty tolerance reflects an individual's psychological capacity to endure ambiguous or unpredictable situations without distress, grounded in cognitive flexibility and emotional regulation mechanisms. Risk aversion stems from evolutionary survival instincts, where the brain prioritizes avoiding potential losses over acquiring equivalent gains, linked to the activity of the amygdala and prefrontal cortex. These foundational psychological processes influence decision-making styles, with uncertainty tolerance enabling adaptive responses to novel environments and risk aversion promoting caution in threat assessment.

Decision-Making: How Uncertainty Tolerance Influences Choices

Uncertainty tolerance enhances decision-making by enabling individuals to embrace ambiguous situations and consider a wider range of potential outcomes, fostering innovation and adaptive strategies. In contrast, risk aversion often leads to conservative choices that prioritize minimizing potential losses over pursuing uncertain gains, potentially limiting growth and opportunity. Research in behavioral economics and psychology demonstrates that higher uncertainty tolerance correlates with increased resilience and flexibility in complex problem-solving scenarios.

Effects of Risk Aversion on Personal and Professional Life

Risk aversion significantly impacts decision-making by causing individuals to avoid uncertain situations, leading to missed opportunities for growth and innovation in both personal and professional environments. In the workplace, high risk aversion can stifle creativity, limit career advancement, and reduce adaptability to change, while in personal life, it may result in overly cautious behavior that restricts experiences and personal development. Understanding the balance between risk tolerance and aversion is crucial for optimizing outcomes and fostering resilience in uncertain conditions.

Measuring Uncertainty Tolerance and Risk Aversion

Measuring uncertainty tolerance involves assessing an individual's ability to handle ambiguous or unknown situations, often through psychometric scales such as the Intolerance of Uncertainty Scale (IUS) or the Uncertainty Response Scale (URS). Risk aversion is typically measured via behavioral experiments and economic models, like the Holt-Laury risk aversion task or the lottery choice paradigm, which quantify preferences for guaranteed outcomes over probabilistic gains. Combining self-report measures with behavioral assessments provides comprehensive insight into how individuals balance uncertainty tolerance and risk aversion in decision-making contexts.

Uncertainty Tolerance in Leadership and Innovation

Uncertainty tolerance in leadership drives adaptive decision-making and fosters innovation by embracing ambiguous situations without relying on complete information. Leaders with high uncertainty tolerance encourage experimentation and creative problem-solving, which accelerates organizational resilience and competitive advantage. This trait contrasts with risk aversion, which often limits bold initiatives and inhibits breakthrough innovations.

Strategies to Develop a Balanced Approach to Risk

Developing a balanced approach to risk involves integrating uncertainty tolerance with risk aversion by employing strategies such as scenario planning, which anticipates various outcomes without excessive fear of ambiguity. Emphasizing incremental decision-making helps individuals and organizations manage potential losses while gradually increasing exposure to uncertain situations. Utilizing data-driven analysis combined with intuitive judgment fosters resilience and adaptable risk-taking, essential for navigating complex environments effectively.

Real-World Examples: Successes Fueled by Uncertainty Tolerance vs Cautious Risk Aversion

Tesla's rise showcases uncertainty tolerance driving innovation in electric vehicles and renewable energy, capturing market share despite regulatory and technological risks. Conversely, traditional automakers exhibit risk aversion, favoring incremental improvements over bold shifts, which sometimes results in missed opportunities. Amazon's early investment in cloud computing reflects embracing uncertainty, while risk-averse competitors hesitated, allowing Amazon Web Services to dominate the market.

Uncertainty tolerance Infographic

libterm.com

libterm.com