Excludability refers to the ability to prevent individuals who have not paid for a good or service from accessing it, which is a key concept in economics that affects market efficiency and resource allocation. Goods that are highly excludable, such as private goods, allow sellers to control consumption and pricing, influencing consumer behavior and profitability. Explore the rest of the article to understand how excludability impacts different types of goods and your role in economic decisions.

Table of Comparison

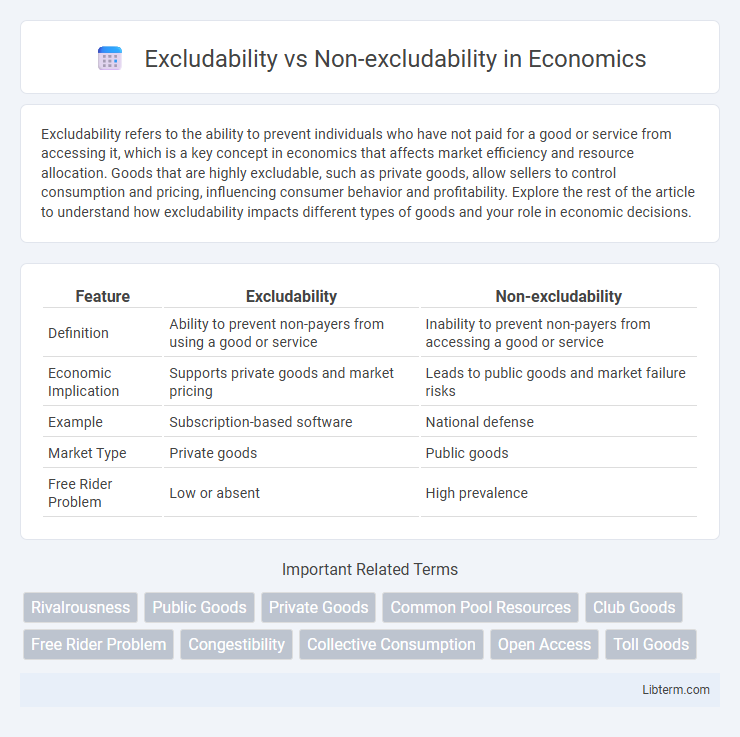

| Feature | Excludability | Non-excludability |

|---|---|---|

| Definition | Ability to prevent non-payers from using a good or service | Inability to prevent non-payers from accessing a good or service |

| Economic Implication | Supports private goods and market pricing | Leads to public goods and market failure risks |

| Example | Subscription-based software | National defense |

| Market Type | Private goods | Public goods |

| Free Rider Problem | Low or absent | High prevalence |

Understanding Excludability: Definition and Key Concepts

Excludability refers to the ability to prevent individuals who do not pay for a good or service from accessing it, which is a fundamental characteristic influencing market dynamics and resource allocation. Key concepts include private goods, which are excludable and rivalrous, meaning consumption by one person limits availability to others, and club goods, which are excludable but non-rivalrous up to a point. Understanding excludability helps in distinguishing goods that can sustain private markets from those requiring public provision or regulation due to their non-excludable nature.

What is Non-excludability? An Overview

Non-excludability refers to a characteristic of goods or services where it is impossible to prevent individuals who have not paid from consuming them. Public goods such as clean air and national defense exemplify non-excludability, creating challenges for private markets to provide these efficiently. This leads to free-rider problems where people benefit without contributing to the cost.

The Economic Significance of Excludability

Excludability determines whether individuals can be prevented from accessing a good or service if they do not pay for it, directly influencing market efficiency and private provision incentives. Goods with high excludability, like private goods, encourage innovation and investment since producers can capture returns by limiting access. Non-excludability, typical of public goods, often leads to free-rider problems and under-provision without government intervention or alternative financing mechanisms.

Real-world Examples of Excludable Goods

Excludable goods are products or services that suppliers can restrict access to, such as subscription-based streaming services like Netflix or private gym memberships, where only paying customers can benefit from the offerings. Other common real-world examples include toll roads, where users pay a fee to access improved infrastructure, and patented pharmaceuticals, which are available only to those who purchase them or have prescriptions. These examples highlight how excludability allows providers to control consumption and generate revenue by limiting usage to those who pay.

Non-excludable Goods: Common Cases and Characteristics

Non-excludable goods, often characterized by their inability to prevent individuals from accessing them, include public goods like clean air, national defense, and street lighting. These goods are susceptible to free-rider problems because consumption by one individual does not reduce availability for others, making exclusion impractical or impossible. The challenge in managing non-excludable goods lies in funding and preserving them, as market mechanisms typically fail to provide efficient incentives for private provision.

Excludability vs Non-excludability: Core Differences

Excludability refers to the ability to prevent individuals who do not pay for a good or service from accessing it, which is a key characteristic influencing market efficiency and resource allocation. Non-excludability occurs when it is impossible or highly costly to restrict access, leading to potential free-rider problems and challenges in funding public goods. The core differences between excludability and non-excludability directly impact how goods are classified as private, public, common resources, or club goods, shaping economic strategies and policy decisions.

The Role of Excludability in Public and Private Goods

Excludability determines whether consumers can be prevented from accessing a good if they do not pay, playing a critical role in distinguishing public goods from private goods. Private goods are excludable because producers can restrict usage to paying customers, driving market efficiency and incentivizing production. Public goods are non-excludable, making it difficult to exclude non-payers and often resulting in free-rider problems and the need for government intervention or collective funding mechanisms.

Challenges Arising from Non-excludable Resources

Non-excludable resources, such as public goods and common-pool resources, face significant challenges including overconsumption and free-rider problems due to the inability to prevent individuals from accessing them without payment. This often results in resource depletion, as seen in the tragedy of the commons where shared resources like fisheries and clean air are overused. Effective management strategies require regulatory frameworks or community governance to sustain these resources and prevent economic inefficiencies.

Excludability, Market Efficiency, and Social Welfare

Excludability refers to the ability to prevent individuals who have not paid from consuming a good or service, which directly impacts market efficiency by facilitating efficient resource allocation and incentivizing production. When excludability is high, markets can effectively price goods, reducing free-rider problems and enhancing social welfare through optimal consumption and investment. Conversely, low excludability often leads to market failure, necessitating government intervention to improve social welfare and correct inefficiencies.

Policy Approaches to Address Non-excludability Issues

Policy approaches to address non-excludability issues include the implementation of public goods provisioning through government funding and regulation, ensuring access without direct charges. Mechanisms such as taxation and subsidies enable the financing of non-excludable goods like national defense and clean air, preventing free-rider problems. Regulatory frameworks and market-based solutions such as tradable permits also help manage and limit overuse while maintaining equitable access.

Excludability Infographic

libterm.com

libterm.com